brand

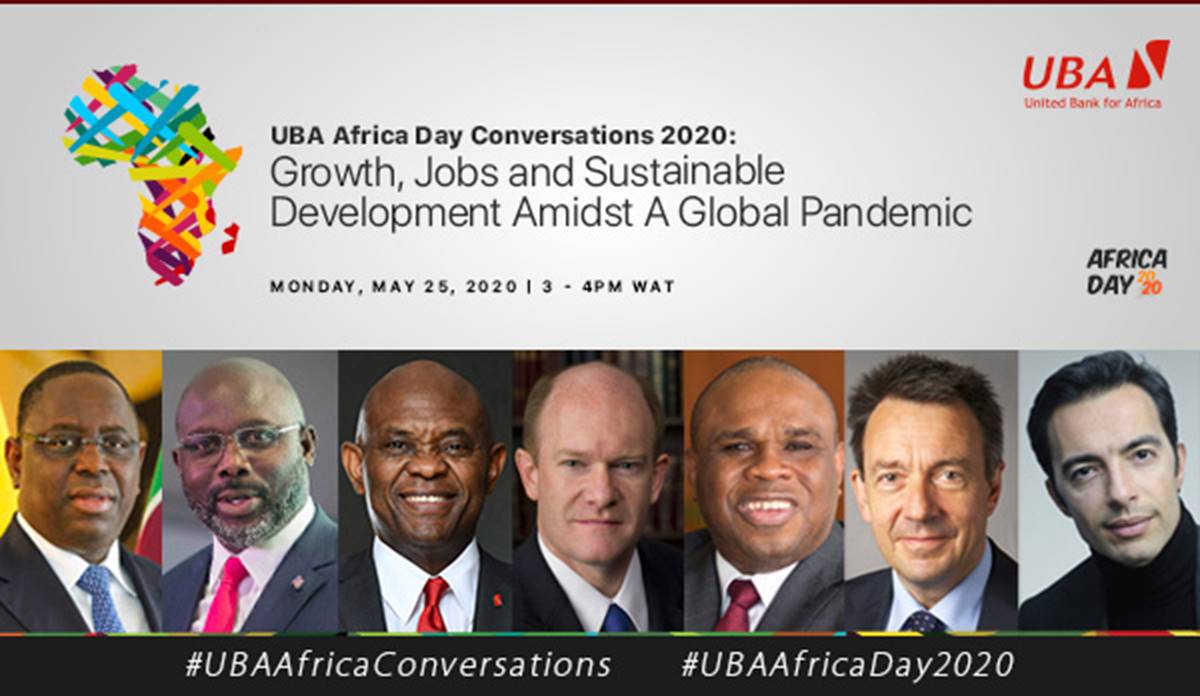

Develop Homegrown Solutions, Human Capacity and Invest in Agriculture to Rebuild Africa; Experts say at UBA Africa Day Conversations

·

……Prioritise SMEs Development

· …… Advocate Partnerships between Private Sector and Government

African thought leaders and great minds have noted that the development of homegrown solutions and adequate investment in human capacity building and agricultural expansion are key steps that will help to rebuild Africa and put the continent on a stronger footing post Covid-19.

Analysing the theme ‘Domestic Policies, Regional Development and a Global Agenda: SDGs and African Development at Crossroads; the speakers collectively gave this submission during the second panel session of the 2020 edition of United Bank for Africa (UBA) African Day Conversations.

The virtual session, which was moderated by Veteran Journalist and Media Consultant, Eugenia Abu, was made up of thought leaders from across Africa, including the Regional CEO, UBA West Africa, Abiola Bawuah (Ghana); Senior Program Coordinator, Regional Network of Agricultural Policy Research Institutes, Dr Nalishebo Meebelo (Zambia); Leadership Coach and Chairman, Go Ahead Africa Ltd, Roland Kwemain (Cameroon); Founder and Executive Director, Social Change Factory, Sobel Aziz Ngom (Senegal); Special Assistant to the President Muhammadu Buhari on Digital and New Media, Tolu Ogunlesi (Nigeria); and Social Entrepreneur and Founder, LEAP Africa, Ndidi Nwuneli (Nigeria).

Abiola Bauwah who emphasised how Africa should rely less on foreign donors, said, “There are five areas we should work on more for us to reach the SDG goals; the private sector; rapid industrialization; institutions and the rule of law; develop our human capital; remove the barriers across Africa. We should institute Africapitalism which is an economic philosophy that says that the human and capital resources of Africa are the only ways in which we can develop Africa.”

Nalishebo Meebelo noted that there’s a lot that young people can do along the value chain of manufacturing, transporting, technology and marketing, adding that, “Government cannot do it alone, they need to work with other stakeholders. Cut and paste solutions do not work for us here in Africa, we need to have our own homegrown solutions to fight this pandemic.”

Eugenia Abu, who focused on the huge role that women and youth must play in rebuilding the continent, said that Africa had to work together to provide solutions to its numerous challenges. “Women, entrepreneurial champions, young people and collaborations between African countries are very key to developing Africa,” she stated.

Ndidi Nwuneli who was saddened that the agricultural sector remained hugely untapped, emphasised the need for a change of mindset where people usually equated agriculture to poverty. “This is a $1 trillion industry and we are neglecting it; therefore my charge to you is that we invest in the agricultural sector, prioritize it, leverage it, transform our educational system to prepare our young people for this sector, change the mindset and trade with each other,” she explained.

Sobel Aziz Ngom pointed out the need for the youth to take charge in Africa. “It is time to not just serve young people, but to trust them to lead. The challenge that we have at the domestic and continental level is making the change in our structure and in the political system that give the place to young people to be 100% engaged,” Ngom stated.

In his own submission, Tolu Ogunlesi, said, “All over the countries young people are seizing opportunities, and we need to start thinking about how to make sure that this is not just for the age of COVID but for now and beyond COVID-19. Even if the pandemic was to disappear today, I hope that the lessons we’re learning, we’re not going to forget them and go back to where we used to be.”

For Roland Kwemain, more institutions need to tow the line of UBA in events such as UBA Africa Conversations. “If 100 multinationals in Africa were doing that UBA is doing, we would go far because CSR is an amazing leverage not just for the brand but also for supporting people & women in terms of activities. The truth is that we need partnership between the government, corporates and the civil society,” he said.

The United Bank for Africa is a leading pan-African financial institution offering banking services to more than twenty million customers globally. With footprint in 20 African countries and presence globally in the United Kingdom, the USA and France, UBA is connecting people and businesses across Africa through retail, commercial and corporate banking, innovative cross border payments and remittances, trade finance and ancillary banking services.

brand

ZENITH BANK SET TO HOST 2026 INTERNATIONAL WOMEN’S DAY SEMINAR IN LAGOS

Zenith Bank Plc will commemorate the 2026 International Women’s Day with a renewed call to purposeful action and leadership. As part of preparations to celebrate this significant occasion, the Bank is set to hold its annual International Women’s Day Seminar on Monday, March 9, 2026, at The Civic Centre, Victoria Island, Lagos.Aligned with the global theme ‘Give to Gain” which underscores the principle that sustainable progress is achieved when individuals and institutions invest intentionally in women, Zenith Bank’s 2026 IWD seminar is themed “Take It, You Own It.” The theme reflects the Bank’s belief that while institutions must give through enabling environments and equitable systems, women must also step forward to claim space, own their value, and lead with confidence. It is both an affirmation and a challenge: embrace opportunity, empower yourself and others, and take ownership of your growth journey.Building on the success of previous seminars, including the 2025 edition themed “Winning On All Fronts”, Zenith Bank’s 2026 programme is designed to deepen meaningful engagement around women’s empowerment, leadership, and sustainable impact. Over the years, the Bank’s International Women’s Day initiatives have brought together women leaders, professionals, entrepreneurs, and emerging talents for dynamic dialogue, inspiration, and shared learning around gender equity, professional growth, and inclusive opportunity.More than a commemorative gathering, the 2026 seminar is designed as a convergence of influence, insight, and inspiration, bringing together accomplished women and progressive leaders across business, governance, creative industries, technology, and social impact.Speaking ahead of the Seminar, the Group Managing Director/CEO, Dame Dr. Adaora Umeoji, OON, who will deliver the welcome address, said “The International Women’s Day is a reminder that progress requires intentionality. ‘Give to Gain’ speaks to the responsibility institutions have to create real opportunities, while our theme ‘Take It, You Own It’ challenges women to step forward boldly and lead. At Zenith Bank, we are deliberate about building environments where women are supported to grow, thrive, and shape outcomes, not only within our institution but across the communities and industries we serve.”The seminar will include segments focused on leadership insight, professional empowerment, wellbeing, and collaboration, offering attendees opportunities to engage deeply with thought leadership and practical strategies for advancing equity. With a carefully curated programme spanning keynote addresses, panel conversations, Q&A sessions, and creative interludes, Zenith Bank’s 2026 International Women’s Day Seminar promises to be a catalyst for meaningful action.Through its alignment with “Give to Gain” and its bold seminar theme, “Take It, You Own It,” Zenith Bank reaffirms its belief that when institutions give intentionally and women lead confidently, entire ecosystems rise. As conversations around inclusion continue to shape the future of business and society, the Bank remains resolute in its mission to foster platforms where women’s potential is recognised, amplified, and fully owned.

brand

Fidelity Bank Advances Financial Inclusion in Kebbi as Community Celebrates New Branch Launch

L-R: District Head, Kyangakwai, Alhaji Suleiman Musa; Former Speaker, Kebbi State House of Assembly, Mr Isma’ila Abdulmumuni Kamba; District Head, Kamba (Sarkin Shikon Kamba), Mamuda Zarummai; Council Secretary, Dandi Local Government, Kebbi State, Alhaji Abdulkadir Muhammad; and Regional Bank Head, North-West Zone 2, Fidelity Bank Plc, Mr Muhammad Lawal-Ahijo; at the official commissioning of the new Fidelity Bank Plc branch in Kamba, Dandi Local Government Area, Kebbi State recently.

Residents of Kamba in Dandi Local Government Area of Kebbi State have welcomed the opening of a new branch of Fidelity Bank Plc, describing it as a major milestone that will ease long-standing financial and logistics challenges faced by farmers, small-scale traders and individuals in the community.

The Chairman of Dandi Local Government Council, Dr. Mansur Isah-Kamba, described the branch as a welcome relief after years of limited access to formal banking services. Represented by the Council Secretary, Alhaji Abdulkadir Muhammad, Isah-Kamba noted that residents – including over 83 traditional rulers on the local government payroll—previously travelled long distances to Birnin Kebbi for routine banking transactions.

“With the opening of this branch in our locality, the stress, cost and time associated with banking outside the community will be significantly reduced,” he said. He also commended Fidelity Bank for its foresight and commitment to supporting farmers and small and medium-scale enterprises (SMEs).

On his part, the Sarkin Shikon of Kamba, Alhaji Mahmoud Zarumai-Fana, described farming as the primary occupation in the area will help improve commercial activities.

“Our people are predominantly farmers. Access to financial services will help them improve productivity and livelihoods. Farmers need support such as pumping machines, fertilisers, and pesticides, and proximity to banking services will make it easier to save, access loans, and participate in agricultural intervention programmes,” he said.

Speaking at the official inauguration ceremony, Regional Bank Head, North‑West Region, Fidelity Bank Plc, Mr. Muhammad Lawal‑Ahijo, highlighted the bank’s commitment to expanding financial access and supporting economic growth across Nigeria.

“Our decision to establish this branch is rooted in our belief that every community deserves access to reliable financial services that enable people to grow, businesses to thrive, and local economies to prosper. Kamba is a thriving agricultural community, and the decision to open a branch here is a strategic investment in the future of its farmers, traders, and households. While the infrastructure is for the bank, this branch belongs to the community. We encourage residents to take ownership by fully utilising the services available.” Lawal-Ahijo said.

He further noted the bank’s overall dedication to empowering informal sector workers and small and medium-scale enterprises (SMEs), adding, “Our goal is to bring banking closer to the people and support farmers, SMEs and households with accessible financial services that drive sustainable growth.”

In his remarks, a member of the Kebbi State House of Assembly representing Dandi Constituency, Dr. Abubakar Suleiman-Fana, said the new branch marked a significant step toward strengthening financial inclusion in rural communities.

“This is a milestone for our constituency. Financial inclusion is critical to rural development, and farmers, traders, and youths must take advantage of this opportunity to grow their businesses and improve their economic well-being,” he said.

Residents also expressed delight about the impact the new branch will have on their daily lives. A petty trader, Mrs. Hassana Abubakar, said she previously had to close her shop whenever she travelled to Birnin Kebbi for banking transactions.

“Now I can do my banking here without losing a whole day’s business. This will help my shop grow,” she said.

The opening of the Fidelity Bank branch in Kamba underscores the bank’s ongoing commitment to advancing financial inclusion, supporting rural economies and empowering farmers and small businesses across Nigeria.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 10 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is a recipient of multiple local and international Awards, including the 2024 Excellence in Digital Transformation & MSME Banking Award by BusinessDay Banks and Financial Institutions (BAFI) Awards; the 2024 Most Innovative Mobile Banking Application award for its Fidelity Mobile App by Global Business Outlook, and the 2024 Most Innovative Investment Banking Service Provider award by Global Brands Magazine.

Additionally, the Bank was recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence and as the Export Financing Bank of the Year by the BusinessDay Banks and Financial Institutions (BAFI) Awards.

brand

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing 73790#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle6 years ago

lifestyle6 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health6 years ago

health6 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health6 years ago

health6 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment1 year ago

entertainment1 year agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news10 months ago

news10 months agoBREAKING: Tinubu swears in new NNPCL Board