news

Economy Reform : All exchange rate segmentation is “abolished with immediate effect,” Says CBN Director

…Market-driven currency regime excites financial experts

…Market-driven currency regime excites financial experts

The Central Bank of Nigeria (CBN) yesterday unified all exchange rates within the economy into the Investors and Exporters (I&E) window.

In a circular to authorised dealers signed by CBN Director, Financial Markets, Angela Sere-Ejembi, the regulator said all exchange rate segmentation is “abolished with immediate effect”.

The CBN said all segments of the foreign exchange market are now collapsed into the I&E window.

It added that applications for medicals, school fees, Business Travel Allowance/Personal Travel Allowance and SMEs would continue to be processed through the I&E window.

Experts spoken to by our correspondence welcomed the development, saying it will remove corruption, increase Forex inflow and boost economic development.

The apex bank action is in line with the directive by President Bola Ahmed Tinubu in his inauguration day speech, which was yet to be carried out by suspended CBN Governor Godwin Emefiele before he was edged out of office last week.

Emefiele is currently under probe for his conduct during his nine years in office.

Under Emefiele, the CBN resisted the pressure from World Bank and the International Monetary Fund (IMF) that the naira should be floated to determine its real value and eliminate the corruption embedded in the multiple exchange rates regime.

In the circular, the CBN also said that the operational changes to the foreign exchange market include the re-introduction of the “Willing Buyer, Willing Seller” model at the I&E Window.

“Operations in this window shall be guided by the extant circular on the establishment of the window, dated 21 April 2017 and referenced FMD/DIR/CIR/GEN/08/007.

“All eligible transactions are permitted to access foreign exchange at this window,” it stated.

According to the circular, all operational rates for all government-related transactions shall be the weighted average rate of the preceding day’s executed transactions at the I&E window, calculated to two decimal places.

“Proscription of trading limits on oversold FX positions with permission to hedge short positions with OTC futures limits on overbought positions shall be zero.

“Re-introduction of order-based two-way quotes, with bid-ask spread of N1. All transactions shall be cleared by a Central Counter Party (CCP).

“Re-introduction of Order Book to ensure transparency of orders and seamless execution of trades.

“The operational hours of trades shall be from 9 am to 4 pm, Nigeria time,” the circular said.

Also, there is a cessation of the RT200 Rebate Scheme and the Naira4Dollar Remittance Scheme, with effect from 30 June 2023.

Market-driven naira value excites financial experts

The Finance and economic experts, who welcomed the floating of the Naira are the President, the Association of Capital Market Academics, Prof. Uche Uwaleke; Chief Executive Officer, Centre for the Promotion of Private Enterprise [CPPE], Mr Muda Yusuf; Fiscal Policy Partner and Africa Tax Leader, PwC, Taiwo Oyedele; Chief Economist, PwC Nigeria, Andrew Neven; Managing Director, Arthur Steven Asset Management, Mr Olatunde Amolegbe; and President, Association of Bureaux De Change Operators of Nigeria (ABCON), Alhaji Aminu Gwadabe.

Others are Senior Credit Research Analyst, REDD Intelligence, Mark Bohlund; former Executive Director, Keystone Bank, Richard Obire; Director General, Manufacturers Association of Nigeria (MAN), Mr Segun Ajayi-Kadiri; Financial analysts, Renaissance Capital, Charles Robertson; and Managing Director, SD & D Capital Management Limited, Mr Gbolade Idakolo.

Uwaleke, who said that the unification of exchange rates would lead to “ a more transparent forex market,” however, advised the CBN to implement the policy ”in a way that it would not cause massive distortions in the general price level.”

He said: “The unification of exchange rates should not be a one-step process but should be implemented over a period of time however short it may be. Empirical evidence suggests that reforms are more successful when they are sequenced and implemented in phases. This is against the backdrop of the oil subsidy removal which, taken together, can result in galloping inflation and rising poverty levels. So, while fiscal and monetary policy reforms are welcome, absolute care should be taken to strike the right balance and minimise their unintended consequences.”

Yusuf said the policy would facilitate the mopping up of naira liquidity in the economy in the short to medium term.

That, according to him, will impact positively on inflation outlook and deepen the autonomous foreign exchange market through the liberalisation of inflows from export proceeds, diaspora remittances, multinational oil companies, diplomatic missions, etc.

He added that “the erstwhile foreign exchange policy regime was for all practical purposes, a fixed exchange rate regime that created distortions and negative outcomes.”

Yusuf said the distortions included “widening the gap between the official, other multiple windows and parallel market exchange rates, collapse of liquidity in the foreign exchange market and high demand for forex .”

He added: “It is important to reiterate that this is not a devaluation policy, it is a normalisation of the foreign exchange policy regime and an adjustment of rate to reflect the fundamentals of demand and supply. It would be dynamic, and the naira will appreciate or depreciate depending on the fundamentals.”

The expert advised the CBN to ”position itself for periodic intervention in the forex market, as and when necessary.”

Oyedele said the decision was a positive move that should bring more benefits than pains to the economy.

He outlined that with the market-driven rate, the aggregate demand for forex across markets should reduce as round-tripping incentive is removed, noting that avenues for corruption such as people who fake foreign travels just to get forex at discounted rates would be.

“Also, Nigeria’s sovereign credit rating should improve if this is complemented with the right fiscal and monetary policies thereby attracting more forex inflows and lowering the cost of borrowing,” Oyedele said.

In a 10-point impact analysis, Oyedele explained that while the decision expectedly would have some negative implications, the overall impact would be positive for the economy, government revenue and the capital market.

Neven expressed support for the policy as it would remove uncertainties and ensure transparency in the forex market.

“We had stated in a report to the CBN that as long as we don’t have a unified exchange rate, and there is a lack of transparency, nobody will invest in Nigeria. We will continue to have insufficient investment and growth and consequently remain poor. What we said years ago came to pass.

”During the (Muhammadu) Buhari Administration, the average growth rate was 1.5 per cent and the population growth was 2.7 per cent. So, it is a necessary condition to get enough investment into the country when we have a unified exchange rate.

“A situation where you have multiple exchange rates, where you don’t know how to have access to foreign exchange or at what price, simply is unworkable. Any system where you have to go to the CBN in order to access foreign exchange or get approval simply isn’t going to work. That is what has been proved over the last decade.

“I think the reaction to President Tinubu’s inauguration statement was very positive, and this latest statement is very positive. We view these as a necessary step toward economic recovery in Nigeria. We’re very much in favour of the unification of the exchange rate,” Neven said.

Ajayi-Kadiri said it was a “positive development and an indication of a far-sighted strategic choice”.

He said the policy, among other range of fiscal measures to promote domestic manufacturing, was borne out of a deep reflection on the current inclement manufacturing environment and the need to stop the drift into inglorious de-industrialization of the Nigerian economy.

The MAN chief, however, said in addition to pursuing the unification of the exchange rate, the CBN should be prevailed upon to take effective action to give priority to the allocations of forex to the productive sector, particularly to manufacturers to import raw materials, spares, and machinery that are not locally available.

Also, Amolegbe said the market-driven rate was another painful reform that needed to be done noting that the multiple exchange rate regime was not doing the economy any good.

“Not only did the former multiple exchange rate system discourage the inflow of much-needed foreign investments, but it also encouraged massive corruption. Harmonizing the rates should lead to better price discovery and hopefully lead to more transparent commerce. That is why the markets responded to it positively,” Amolegbe, a former president of the Chartered Institute of Stockbrokers (CIS) said.

Gwadabe said the removal of the rate cap would allow a true market clearance rate which has been the agitation of several stakeholders in the economy.

He said the move will harness and increase various sources of supply of dollars into the economy like foreign portfolio investment, foreign direct investment, diaspora remittances, and export proceeds, among others.

“The new directive, in my opinion, is to checkmate various illegal economic behaviours like rent-seeking, currency substitution, forex holding positions and frivolous demand in the market,” Gwadabe said.

Obire said eradicating multiple exchange rates would bring about increased dollar supply, and exchange rate stability.

Also, Bohlund said the unification would help the federal government to better balance its books as it is still highly dependent on dollar-linked oil revenue while spending is in naira.

While Robertson said that “Nigeria has become investable again, adding that attracting foreign money is wise when local savings are in short supply.”

Idakolo said the floating of the naira would lead to a free market system that allows market forces to determine the rate.

“This would allow availability to determine the rate and eliminate hoarding,” Idakolo said.

He added that the development “would also encourage foreign direct investment into the economy as restrictions limiting free flow has been lifted. In the long run, as the economy becomes stronger, the naira would begin to appreciate against the Dollar and the economic activities would now determine the strength of our currency going forward.”

news

BREAKING: Tinubu Names Tunji Disu Acting Inspector General After Egbetokun’s Exit

President Bola Tinubu has accepted the resignation of the Inspector-General of Police, Kayode Egbetokun, and approved the appointment of Tunji Disu as Acting Inspector-General of Police with immediate effect.

Our correspondent had earlier reported that Egbetokun tendered his resignation letter on Tuesday, citing pressing family considerations.

Appointed in June 2023, Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

In a statement issued on Tuesday by his Special Adviser on Information and Strategy, Bayo Onanuga, the President received the letter earlier on Tuesday and expressed appreciation for his service to the nation.

He also commended Egbetokun’s “decades of distinguished service to the Nigeria Police Force and the nation,” acknowledging his “dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.”

“In view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance, President Tinubu has approved the appointment of Assistant Inspector-General of Police Tunji Disu to serve as Acting Inspector-General of Police with immediate effect.

“The President is confident that AIG Disu’s experience, operational depth, and demonstrated leadership capacity will provide steady and focused direction for the Nigeria Police Force during this critical period,” the statement read.

It added that in compliance with the provisions of the Police Act 2020, the President will soon convene a meeting of the Nigeria Police Council to formally consider Disu’s appointment as substantive Inspector-General of Police, after which his name will be forwarded to the Senate for confirmation.

The President reaffirmed his administration’s commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

news

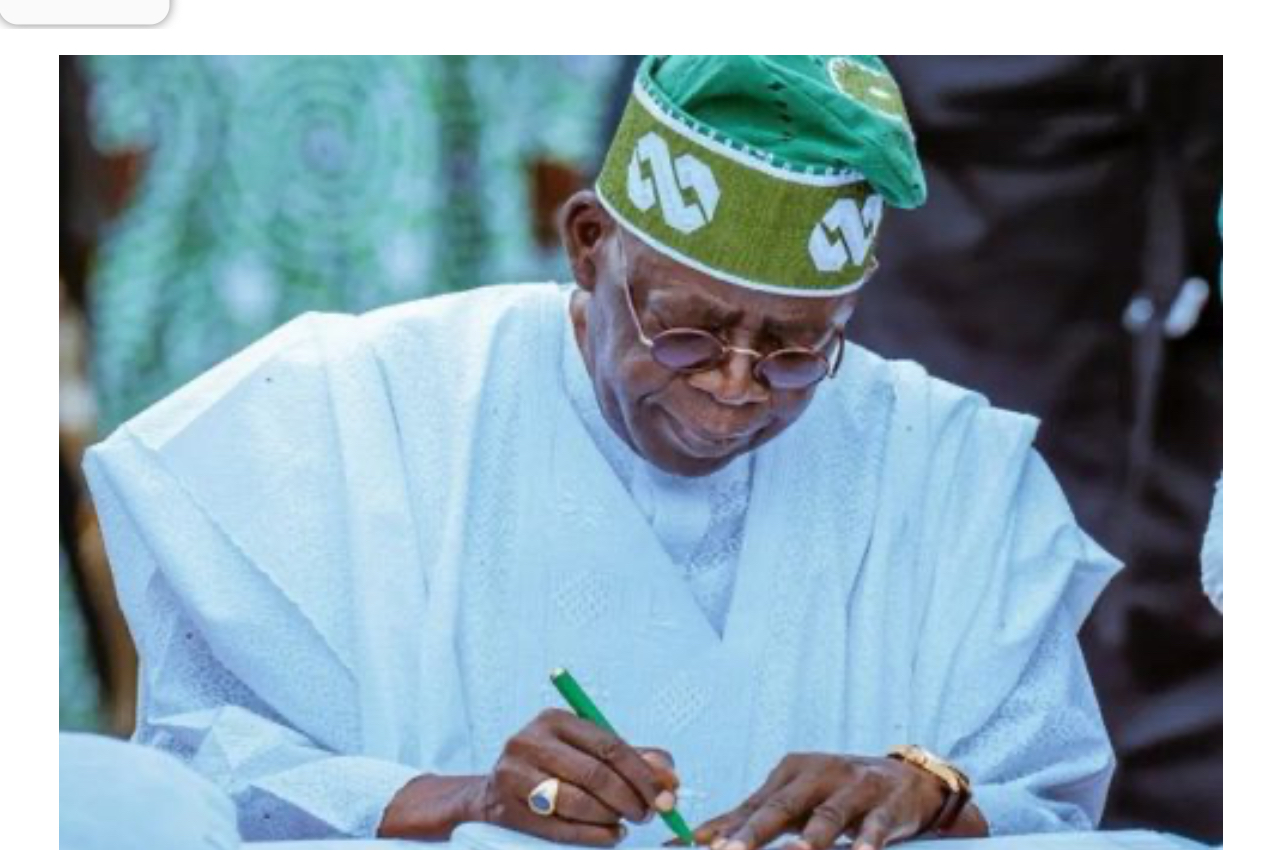

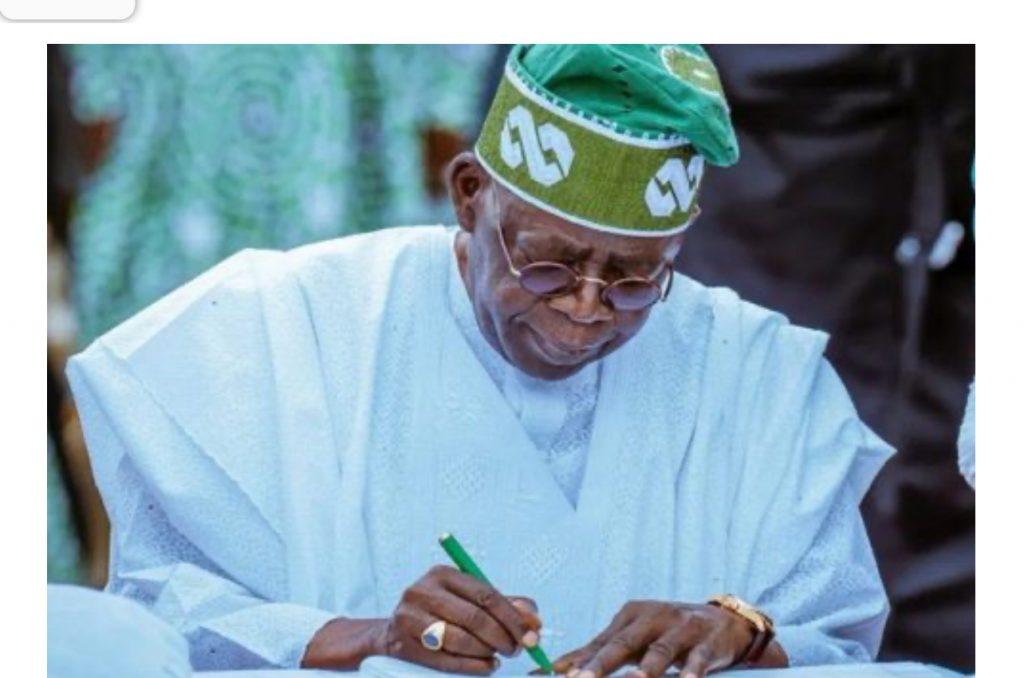

Breaking : Nigeria Gets New Electoral Act as Tinubu Signs 2026 Reform Bill

President Bola Tinubu has signed the Electoral Act 2026 (Amendment) into law, days after the Independent National Electoral Commission (INEC) released the timetable for the 2027 general elections.

The signing ceremony took place at the State House, Abuja, at about 5:00pm on Wednesday, with principal officers of the National Assembly in attendance.

The National Assembly had on Tuesday passed the Electoral Act 2026 (Amendment) Bill.

The latest amendment comes amid intense public debate over the electronic transmission of election results in real time.

Last week, protests erupted at the National Assembly complex as civil society organisations and opposition figures mounted pressure on lawmakers to mandate live transmission of results from polling units directly to INEC’s central server.

The protesters argued that real-time transmission would reduce result manipulation and strengthen public confidence in the electoral process.

However, the ruling All Progressives Congress (APC) and some stakeholders have raised concerns about the technical feasibility of live transmission, particularly in communities with weak telecommunications infrastructure. They have argued for a phased or hybrid approach that would allow manual collation where electronic systems fail.

news

EFCC Extends El-Rufai’s Stay in Custody Amid ₦432bn Probe

Former Kaduna State Governor, Nasir El-Rufai, on Tuesday spent the second night in the custody of the Economic and Financial Crimes Commission, as his lawyer, A.U Mustapha (SAN), pushes for his release on bail.

There are, however, indications that the commission may seek a remand order to extend his stay in custody to enable him to respond to questions posed by investigators handling his matter.

The former governor arrived at the EFCC headquarters in Abuja on Monday around 10 a.m. for questioning in connection with an alleged N432bn corruption probe. He was, however, detained at the commission, where investigators continued to grill him.

An official of the commission who pleaded anonymity said the anti-graft agency was considering obtaining a remand order after the expiration of the hours allowed by law to enable investigators conclude questioning him.

“Forget the speculations being peddled on social media that he has been released. He has not. El-Rufai is still with us and will be spending another night in custody.

“He is very much with us and will remain so because the investigators are considering getting a remand order after the expiration of the 48 hours allowed by law.

“The investigators need some time with him to answer questions arising from his eight years as governor in Kaduna State,” the source said.

Speaking in a telephone conversation with The PUNCH on Tuesday, El-Rufai’s counsel, Mustapha, confirmed that the former governor remained with the anti-graft agency, while insisting that his client had fully cooperated with investigators.

He described his client as a responsible citizen who is not a flight risk if granted bail.

Mustapha said, “Well, as a responsible citizen, he was invited and, true to his word, he honoured the invitation.

“As we speak, he is still with the EFCC. He is cooperating to the best of his capacity, and we hope that the EFCC, given its integrity, will be kind enough to admit him to bail because he is presumed innocent, and I am sure if he is granted bail, he will not jump bail.

“He is a responsible citizen, and everybody knows him. He came to Nigeria on his own volition. He wrote a letter that he was going to honour the EFCC invitation, and he kept his word as a man of integrity. We’re hopeful that very soon he will be granted bail.”

When asked about the specific allegations against his client, Mustapha declined to offer details.

“You’re asking the right question from the wrong person. That question can only be answered by the EFCC and not by me. I would just be speculating, and lawyers don’t do that.”

Pressed further on whether he witnessed parts of the interrogation and what it was about, Mustapha responded, “That would be prejudicial. It’s a confidential matter and not meant for public consumption.”

The EFCC’s interrogation is linked to the report of an ad hoc committee of the Kaduna State House of Assembly set up in 2024 to probe finances, loans, and contracts awarded between 2015 and 2023 during El-Rufai’s administration.

EFCC extends El-Rufai detention, Plateau indigenes killed, other top stories

Rep backs real-time electronic transmission of election results

The committee, chaired by Henry Zacharia, had alleged that several loans obtained during the period were not utilised for their intended purposes.

While presenting the report, the Speaker, Yusuf Dahiru Leman, claimed that about N423bn was allegedly siphoned under the former governor’s administration.

The committee recommended the investigation and prosecution of El-Rufai and some former cabinet members over alleged abuse of office, diversion of public funds, money laundering, contract awards without due process, and reckless borrowing.

The Assembly subsequently forwarded petitions to the EFCC and the Independent Corrupt Practices and Other Related Offences Commission.

El-Rufai has denied the allegations, describing the probe as politically motivated, and insisted that loans obtained during his tenure were properly appropriated and used for infrastructure, education, healthcare, and security.

On Monday, an EFCC source said the commission had been investigating the matter for about a year, noting that suspects are usually invited after investigations have reached an advanced stage.

“The commission has been investigating him for about a year now. As a commission, we don’t just rush to invite suspects. Persons accused are always the last; that is, after we might have done our investigation to an advanced stage.

“We are investigating him on the allegations against him by the Kaduna State Assembly,” the source said.

Meanwhile, in a separate development, the Department of State Services has filed criminal charges against El-Rufai before the Federal High Court in Abuja over alleged unlawful interception of the phone communications of the National Security Adviser, Nuhu Ribadu.

The three-count charge, marked FHC/ABJ/CR/99/2026, was filed under the Cybercrimes (Prohibition, Prevention, etc.) Amendment Act, 2024, and the Nigerian Communications Act, 2003.

According to the charge sheet, El-Rufai allegedly admitted during a February 13, 2026, appearance on Arise TV’s Prime Time Programme that he and unnamed associates unlawfully intercepted Ribadu’s communications.

Count One alleged that El-Rufai “did admit during the interview that you and your cohorts unlawfully intercepted the phone communications of the National Security Adviser, Nuhu Ribadu,” an offence said to be punishable under Section 12(1) of the Cybercrimes Amendment Act.

Count Two accused him of acknowledging knowledge of an individual involved in the alleged interception without reporting it to security agencies, while Count Three alleged that he and others still at large used technical equipment that compromised public safety and national security.

The prosecution further claimed that the alleged act, reportedly admitted during the television interview, caused “reasonable apprehension of insecurity among Nigerians.”

He is yet to be arraigned.

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle6 years ago

lifestyle6 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health6 years ago

health6 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health6 years ago

health6 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment1 year ago

entertainment1 year agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news9 months ago

news9 months agoBREAKING: Tinubu swears in new NNPCL Board