news

EFCC: How bank wrote off N8bn loan for Saraki

Bank directors are beneficiaries

Bank directors are beneficiaries

Ex-bank MD, Akingbola, on trial over N179bn fraud

A witness of the Economic and Financial Crimes Commission (EFCC), Abdulraheem Jimoh, yesterday narrated before a Federal High Court in Lagos how loans running into billions of naira advanced to the Senate President, Dr. Bukola Saraki and others by the defunct Intercontinental Bank Plc., led to the prosecution of the bank’s former Managing Director, Dr. Erastus Akingbola. The witness made the narration while testifying in the on-going trial of the former bank chief over alleged N179 billion fraud. He testified that he was aware of some other companies owned by Dr. Saraki which were also indebted to Intercontinental Bank, but whose loans were written off. He listed some of the Senate President’s companies whose loans were written off as: Joy Petroleum Limited, with loan of N3.932 billion; Linkers Limited with N3.6 billion loan; Skye View Property with written off loan of N200.8 million and Dice Trade Limited with N1.832 billion. Saraki and his companies had N7.915 billion total loans written off by the Intercontinental Bank.

Jimoh, who was the Chief Inspector in Intercontinental Bank and presently working with the Access Bank Plc., told Justice Mojisola Olatoregun that some of the loans indebted to the defunct bank were eventually written off by Akingbola’s successor, Lai Alabi, in the interest of the ‘powers that be”. He added that some of the companies indebted to the defunct bank were owned by a former Managing Director of Access Bank Plc., Mr. Aigboje Aig- Imoukhuede and his successor, Mr. Herbert Wigwe. According to the witness, Aig-Imoukhuede and Wigwe are directors of some of the companies the then Managing Director of Intercontinental Bank, Mr. Lai Alabi, wrote off their loans.

The witness named one of the companies as United Alliance Company Limited with non-performing loans of N4.5 billion, N4.27 billion and N10.97 billion respectively. The witness testified further that he was aware that Intercontinental Bank was merged with Access Bank, adding that before Access Bank took over Intercontinental Bank, Intercontinental Bank was larger and bigger than Access Bank in asset capital base. He testified that as at the time of taking over Intercontinental Bank, he was aware it had branches and subsidiaries internationally, including Ghana and the United Kingdom. He said further that at the material time, Aig- Imoukhuede and Wigwe were MD and Deputy MD respectively at Access Bank.

The witness, however, denied suggestions by Akingbola’s lawyer, Chief Wole Olanipekun (SAN) that some people at the top made Lai Alabi the Managing Director of Intercontinental Bank for the purpose of writing off their loans in the bank. Further hearing in the trial continues today. Akingbola was, on 13th March, 2019, re-arraigned by the EFCC before Justice Olatoregun over charges related to fraud and abuse of office. The last arraignment on a 22-count charge was the third time since 2010 that the former bank chief will be arraigned on the alleged offence. Akingbola was first arraigned sometimes at the Federal High Court in 2010 on a 26-count bordering on the alleged offence. About two years later, the charge was struck out by Justice Charles Archibong for want of diligent prosecution.

However, on 20th February, 2015, the Court of Appeal, Lagos Division overturned the Federal High Court’s decision striking out the charges against Akingbola. Dissatisfied, Akingbola lodged an appeal at the Supreme Court asking that the ruling be overturned. However, the apex court, in a judgement delivered on 18th May, 2018, ordered him to return to the Federal High Court to answer to the charges slammed on him by the Economic and Financial Crimes Commission (EFCC). Justice Sidi Bage, who read the lead judgement of the apex court, held that the appeal is lacking in merit. He ordered that the case file be remitted to the Federal High Court for expeditious trial.

He was subsequently docked before Justice Olatoregun on a 26-count charge of alleged fraud. In the latest charge marked, FHC/L/443C/2009, Akingbola was alleged to have, between November 2007 and July 2008, created a misleading appearance of active trading in the shares of Intercontinental Bank Plc. on the Nigerian Stock Exchange by being connected with the utilization of an aggregate sum of N179,385,000,000 of the bank’s funds for the purchase of Intercontinental Bank Plc.’s shares and thereby committed an offence contrary to Section 105 (1) (a) of the Investment and Securities Act 2007 and punishable under Section 115 (a) of the same Act.

The EFCC also accused Akingbola of recklessly granting credit facilities of N8 billion each to five firms without adequate security in violation of Section 15(1) (a)(i) of the Failed Banks (Recovery of Debts) and Financial Malpractices in Banks Act, Cap F2, Laws of the Federation of the Federal Republic of Nigeria, 2004, and punishable under Section 16(1)(a) of the same Act. The five firms involved are: Soo-Kok Holding Limited; Tofa General Enterprises; Cinca Nigeria Limited; Harmony Trust and Investment Limited and Stanzus Investment Limited. The anti-graft agency also alleged that Akingbola took £1.3 million from Intercontinental Bank Plc.’s GBP NOSTRO account at Deutsche Bank, London, and remitted same into the bank account of Fuglers Solicitors with the Royal Bank of Scotland Plc., London.

news

Opeifa Defends Rail Reforms, Unveils Nationwide Expansion Roadmap

Opeifa maintained that derailments are not peculiar to Nigeria, noting that such incidents occur across advanced rail systems globally.

Opeifa maintained that derailments are not peculiar to Nigeria, noting that such incidents occur across advanced rail systems globally.

“Derailments are regular occurrences in the rail sector worldwide. In February alone, there were incidents in countries like Britain and others. Around the same time we experienced one, there were multiple derailments across the world,” he said.

He disclosed that in 2025, Nigeria recorded three major derailments:

• August 26 at Asham in Kaduna State

• November 1 at Abraka on the Warri–Itakpe line

• November 8 at Agbor on the same corridor

He said the NRC responded swiftly, restoring services within 24 hours in one case, while others were resolved within 21 and 28 days respectively.

Opeifa stressed that derailments can result from factors such as weather conditions, signal glitches, human error, speeding, or aging infrastructure, but noted that in Nigeria’s recent cases, there were no fatalities.

“These incidents are preventable and efforts are ongoing to minimize them. However, they should not be seen as major setbacks to the overall progress of the railway system,” he said.

On Allegations of Mismanagement

Addressing allegations of financial mismanagement within the corporation, Opeifa declined detailed comments, citing ongoing legal processes.

“When a matter is in court, it is sub judice. Allegations of corruption or mismanagement should be handled by the appropriate authorities,” he stated.

He reiterated that his priority is to reposition the NRC in line with global best practices and ensure efficient rail services for Nigerians.

Expansion, Upgrades and National Connectivity

The NRC boss said efforts are underway to restore damaged coaches and upgrade infrastructure using local engineers and technicians.

“We are bringing back the lines and retrofitting coaches. The Warri–Itakpe line is operational. The Abuja–Kaduna line is running, and we are increasing trips from two to three,” he said.

On long-term plans, Opeifa disclosed that the NRC roadmap envisions rail connectivity across major cities nationwide, subject to funding and phased execution.

He dismissed claims of abandoned projects, explaining that rail developments are capital-intensive and implemented in phases based on available resources.

He cited progress on the Lagos–Ibadan corridor—part of the larger Lagos–Kano project—as well as ongoing work on the Kano–Maradi line linking key northern cities.

Lagos–South-East, Port Connections in View

Opeifa also highlighted plans to expand connectivity between southern ports and inland cities. These include proposed links from Warri to Abuja and from Lekki Deep Sea Port to Kajola, Benin, Onitsha, and Aba, enabling both passenger and cargo movement.

Toward Modern Signaling and Faster Trains

On modernization, he said Nigeria is gradually upgrading from older narrow-gauge systems to standard-gauge infrastructure with improved signaling technology.

He noted that metro rail projects in Kaduna, Kano, and Lagos are being developed with higher signaling standards, positioning the country for faster and more efficient train services in the coming years.

“We are not yet at the highest global level, but we are moving steadily upward,” Opeifa said.

news

Ticket Reform Boosts Confidence in Lagos–Ibadan Rail Service, Says Opeifa

A quiet transformation is reshaping the daily commute between Nigeria’s commercial hub and the historic city of Ibadan. Passengers on the Lagos–Ibadan standard gauge corridor say services have become more efficient and predictable following a clampdown on ticket racketeering led by Kayode Opeifa

A quiet transformation is reshaping the daily commute between Nigeria’s commercial hub and the historic city of Ibadan. Passengers on the Lagos–Ibadan standard gauge corridor say services have become more efficient and predictable following a clampdown on ticket racketeering led by Kayode Opeifa

The renewed confidence in the rail line linking Lagos and is influencing residential and employment decisions among middle-income earners who once considered daily intercity commuting unrealistic.

“It is now possible to live in Ibadan and work in Lagos without the daily anxiety of securing a ticket,” said Adewale Bamidele, a financial analyst who travels three times a week. “Before, you needed connections. Now, you book, you board, you arrive.”

A Line Once Hindered by Middlemen

The Lagos–Ibadan railway, inaugurated as a flagship infrastructure project under the administration of former President Buhari was designed to ease pressure on the congested Lagos–Ibadan Expressway and deepen economic integration across the South-West.

However, in its early phases, passengers frequently complained of informal ticket rackets. Allegations included bulk-buying by intermediaries and artificial scarcity that forced travellers to pay inflated prices for seats on high-demand trains.

Industry observers say such practices undermined the railway’s credibility as a mass transit solution. “Transport systems thrive on predictability and fairness,” said a transport economist “Once access is perceived as compromised, commuters revert to road transport despite the risks and delays.”

Enforcement and Digitisation

Since assuming oversight responsibilities within the sector, Opeifa has reportedly intensified internal monitoring and strengthened digital ticketing protocols. Railway officials, speaking on condition of anonymity, said stricter verification processes and disciplinary measures against errant staff have curtailed unauthorised ticket sales.

Although the Nigerian Railway Corporation has not released detailed enforcement data, anecdotal evidence from regular commuters points to shorter queues, smoother boarding procedures and fewer last-minute cancellations.

For professionals with flexible work schedules, the improvement has been significant. The average journey time of about two to three hours—depending on the service type—now compares favourably with unpredictable road travel, which can take considerably longer during peak traffic.

Changing Urban Dynamics

Property agents in Ibadan report a modest rise in enquiries from Lagos-based workers seeking more affordable housing. Rents in many parts of Ibadan remain significantly lower than comparable neighbourhoods in Lagos, offering relief to households grappling with inflationary pressures.

“Rail reliability changes everything,” said Funke Adebayo, a real estate consultant in Ibadan. “When people trust the timetable, they are more willing to relocate.”

Economists caution, however, that long-term success will depend on consistent maintenance, adequate security along the corridor and transparent ticketing systems. Any return to informal practices could quickly erode recent gains.

The Lagos–Ibadan corridor is widely regarded as a litmus test for Nigeria’s broader rail ambitions. With additional standard gauge projects planned or underway nationwide, policymakers face mounting pressure to ensure that infrastructure investments translate into reliable public service delivery.

For now, passengers remain cautiously optimistic.

“It feels more organised,” Bamidele said while disembarking at Mobolaji Johnson Station in Lagos. “If this standard is sustained, rail can genuinely compete with road transport.”

Nigeria agree, the real challenge lies not just in laying tracks, but in sustaining public trust.

news

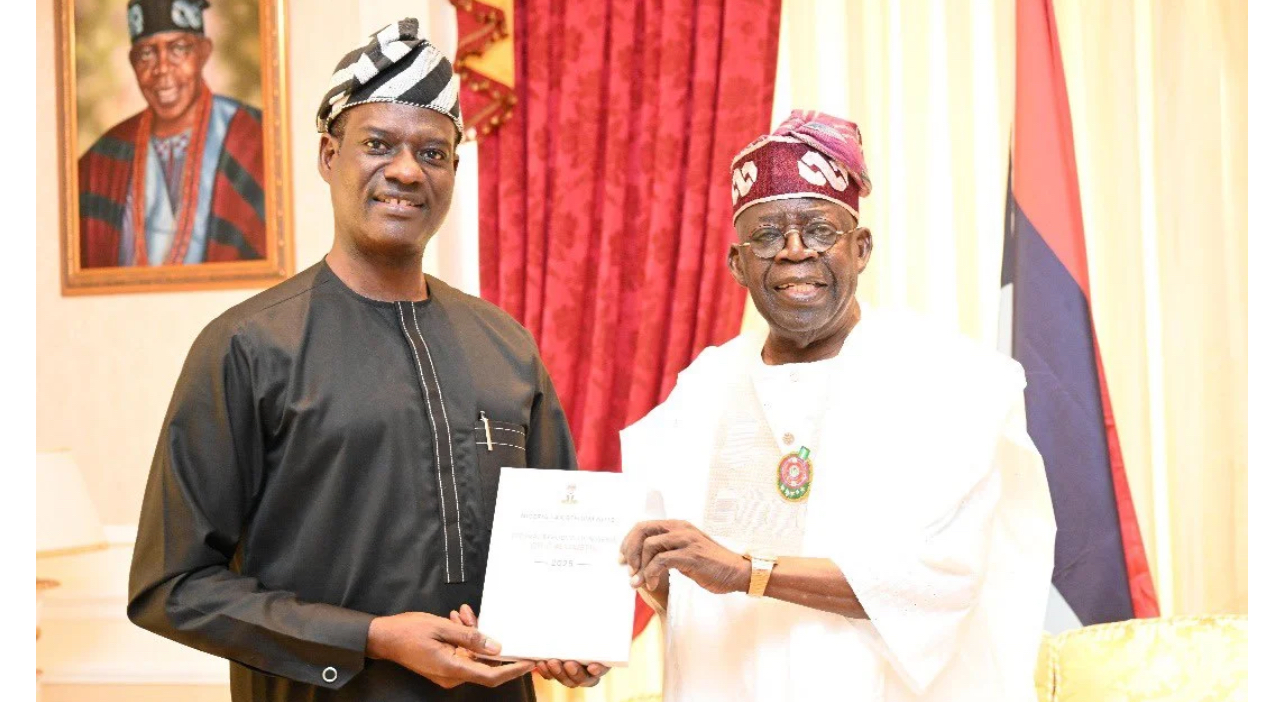

Breaking : Finance Ministry Shake-Up: Tinubu Nominates Oyedele, Says Onanuga

President Bola Tinubu has nominated the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Dr. Taiwo Oyedele, as the Minister of State for Finance.

Oyedele replaces Dr. Doris Anite-Uzoka, who has been redeployed to the Ministry of Budget and National Planning as Minister of State, her third portfolio in the administration.

The President on Tuesday conveyed Oyedele’s nomination to the Senate for confirmation in a letter to the Senate President, Godswill Akpabio, according to a statement by his Special Adviser on Information and Strategy, Bayo Onanuga, on Tuesday.

Until Tinubu nominated him as a minister, Oyedele from Ikaram, Akoko, Ondo State, was the chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, which overhauled Nigeria’s tax system.

The 50-year-old is an economist, accountant, and public policy expert who led the comprehensive overhaul of Nigeria’s tax system through the Presidential Committee on Fiscal Policy and Tax Reforms.

The committee, inaugurated in August 2023, delivered four executive bills that consolidated over 60 taxes into fewer than 10 statutes and introduced significant reforms, including zero income tax for Nigerians earning N800,000 annually or less.

The Tax Reform Acts, which became effective on January 1, 2026, also exempted small businesses with turnover below N50m from company income tax, capital gains tax, and development levy.

Other provisions include a 50 per cent tax deduction for companies hiring new workers for three years, a 50 per cent deduction for wage increases to the lowest-paid employees, and a five-year corporate tax holiday for agricultural enterprises.

Oyedele attended Yaba College of Technology, where he obtained a Higher National Diploma in Accountancy and Finance, before proceeding to Oxford Brookes University for a BSc in Applied Accounting.

He also completed executive education programmes at the London School of Economics, Yale University, the Gordon Institute of Business Science, and the Harvard Kennedy School.

Oyedele spent 22 years at PricewaterhouseCoopers, joining in 2001 and rising to become the Fiscal Policy Partner and Africa Tax Leader before his appointment to head the tax reform committee.

He is currently a professor at Babcock University in Ogun State and a visiting scholar at the Lagos Business School.

As Minister of State for Finance, Oyedele is expected to oversee the implementation of the tax reforms he championed, particularly as the government seeks to improve revenue generation and deepen economic reforms.

Anite-Uzoka, who is being redeployed to the Ministry of Budget and National Planning, previously served as Minister of State for Industry, Trade and Investment before her appointment as Minister of State for Finance.

The Senate is expected to screen and confirm Oyedele’s nomination in the coming weeks, following which he will be sworn in to assume his ministerial duties.

The Finance Ministry, currently led by Wale Edun as substantive minister, oversees fiscal policy, revenue mobilisation, debt management, and economic planning.

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle6 years ago

lifestyle6 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health6 years ago

health6 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health6 years ago

health6 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment1 year ago

entertainment1 year agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news10 months ago

news10 months agoBREAKING: Tinubu swears in new NNPCL Board