news

Update : PARIS FUND REFUND: COURT RULES IN FAVOUR OF LINAS INTERNATIONAL LIMITED, OTHERS

A Federal High Court sitting in Abuja has ruled in favour of Linas International Limited and 235 others against the Federal Government of Nigeria in the Paris Fund Refund.

A Federal High Court sitting in Abuja has ruled in favour of Linas International Limited and 235 others against the Federal Government of Nigeria in the Paris Fund Refund.

In a suit with no FHC/ABJ/130/2013, Justice J.T Tsoho ruled in favour of Linas International and others (plaintiffs) against the Federal Government of Nigeria, The Attorney General of the Federation, The Minister of Finance and the Accontant General of the Federation (defendants)

Below are unedited details of the ruling

IN THE FEDERAL HIGH COURT

IN THE ABUJA JUDICIAL DIVISION

HOLDEN AT ABUJA

ON WEDNESDAY, THE 1ST DAY OF DECEMBER, 2021

BEFORE THE HON. JUSTICE J.T. TSOHO

CHIEF JUDGE

BETWEEN:

LINAS INTERNATIONAL LIMITED & 235 ORS….PLAINTIFFS/RESPONDENTS

AND THE FEDERAL GOVERNMENT OF NIGERIA DEFENDANTS/RESPONDENTS

THE ATTORNEY GENERAL OF THE FEDERATION THHONOURABLE MINISTER OF FINANCE

THE ACCOUNTANT GENERAL OF THE FEDERATION

RE: THE INCORPORATED TRUSTEE OF THE NIGERIA GOVERNORS’ FORUM INTERESTED PARTY/APPLICANT

(Suing for and on behalf of the 36 States of the Federation)

RULING

The interested Party/Applicant sought the leave of this Court to appeal against the judgment of Hon. Justice A.F.A Ademola (Rtd.) by a Motion on Notice dated 12/4/2021 but filed on 15/6/2021 brought pursuant to Section 6, 36, 162, and 243(1) of the CFRN 1999 (As Amended), Sections 13(2) and 32 of the Federal High Court (Civil Procedure) Rules, 2019 and under the inherent jurisdiction of this Court.

However, the 3rd Defendant/Respondent (Hon. Minister of Finance) filed a Notice of Preliminary Objection challenging the competence of the Motion on Notice filed by the Interested Party/Applicant. Since the NPO shall be first disposed of.

It is necessary to follow the time honored principle of law to the effect that when an issue of jurisdiction of a Court to entertain a case is raised, the law requires that it should be considered and determined first before any further steps are taken by the Court in the proceedings due to its not only intrinsic but extrinsic nature to such proceedings. The reason for this position is that it is prudent and expedient to determine the issue of its jurisdiction first in order to avoid what might turn out to be exercise in futility in conducting proceedings or taking steps in the case, if it eventually turned out that it lacks the requisite jurisdiction to adjudicate over the case. See B.A.S.F. Nig. Ltd. V. Faith Ent. Ltd. (2010) 4 NWLR (1133) 704: Comm. for L.G. v. Ezemwokwe (1991) 3 NWLR (181) 615: A. G., Lagos State v. Dosunmu (1989) 3 NWLR (111)552: Nokoprise Int Co. Ltd. v. Dobest Trad. Corp. (1997) 9 NWLR (520) 334. This position of the law on the need for Court to determine the question/issue of its jurisdiction to entertain a case expeditiously and first, simply means that the issues raised by the parties in the case on the merit.

By Notice of Preliminary Objection dated and filed 22/9/2021, the 3rd Defendant is challenging the competence of the Interested Party/Applicant’s application on the following ground.

That the judgment in this Suit sought to be appealed against by the Interested Party/Applicant/Respondent has been fully executed pursuant to a Garnishee Order Absolute made by this Honourable Court on 29/6/2016. Per Hon. Justice A.F.A Ademola which is Exhibit NGF 2 attached to the Affidavit of the Interested Party/Applicant and payments of the judgment debts effected by the Federal Government of Nigeria to the various beneficiaries.

The 3rd Defendant sought Relief in the following terms:

An Order dismissing this application for being incompetent and for constituting an abuse of the process of this Court.

Also the 3rd Defendant/Respondent filed a Written Address on 22/9/2021 and formulated a single issue for determination thus:

Whether the Motion on Notice filed by the Interested Party/Applicant is not incompetent in view of the fact that the Judgment in Suit No: FHC/ABJ/CS/130/2021 (sic) between Linas International Limited & Ors vs. The Government of Nigeria & 3 Ors sought to be appealed against has been fully executed pursuant to a Garnishee Order Absolute made by this Government of payments effected by the Federal Government of Nigeria to the various beneficiaries of the Judgment sum including the 774 Local Government Councils.

The 3rd Defendant submitted that the Interested Party’s application is incompetent considering the garnishee Order Absolute delivered on 29/6/2016 by Hon. Justice Ademola in Suit No: FCH/ABJ/CS/130/2013 between Linas International Limited & 3 Ors The Federal Government of Nigeria & 3 Ors The 3rd Defendant submitted further that once Garnishee Order Nisi is made respecting money due to a judgment debtor in possession of the Garnishee, such funds or money is deemed to have been attached for the satisfaction of the judgment debt for order Absolute to be made. Reference made to Exhibit NGF 2 in the Interested Party’s Motion on Notice. The 3rd Defendant cited Sections 83 to 86 of the SCP Act and the cases of Zenith Bank Plc v. Chief Arthur John & 2 Ors (2016) All FWLR (Pt. 827) p. 633 at 654 paras A-F and Union Bank of Nigeria Plc v. Boney Marcus Industries Limited (2005) All FWLR (Pt. 278) p. 1037.

According to the 3rd Defendant, the essence of Order for stay of execution is to maintain status quo before the order to prevent the successful party from invoking the powers of the Court. That since the judgment in this Suit which the Interested Party is seeking to stay execution has been fully executed, the purpose of granting a stay of execution pending determination of appeal is defeated. Cited INEC v. Mbonu (2018) LPELR-44018(CA). The 3rd Defendant urged the Court to hold that the Interested Party is a total stranger to this action which has been fully executed and is also out of time to appeal by several years. That it is more so, as the application was brought without first obtaining leave for extension of time to appeal as Interested Party. The 3rd Defendant therefore urged the Court to dismiss the application of the Interested Party.

In reply to the objection, the Interested Party/Application argued that the NPO is an unsigned process and that even if it is signed, the signed, the said process is incompetent Referred to Order 26 Rules 24 of FCH Rules, 2019. He argued further that a NPO cannot be a response to Motion on Notice and that what ought to have been filled should have been a Counter Affidavit or a Reply on Points of Law Cited Eyitayo v. Kazeem (2020) LPELR-50630 ap. 7 paras B-D. He urged the Court to strike out the incompetent process.

A threshold issue to be first resolved under the Notice of Preliminary Objection is whether the Notice of Preliminary Objection is unsigned and that even signed, it is an incompetent process. I have perused the 3rd Court’s Main File and confirm that it is signed and the Court’s record binds it and the parties. That being the position, I hold the humble opinion that it is a competent process, despite not being a counter affidavit. This is the particularly having regard to the 3rd Defendant/Respondent’s perception of the Applicant’s Motion as being an abuse of process. In that context, a drastic, though inappropriate reaction could be tolerated. Thus, for the purpose of this application, the Notice of Preliminary Objection is considered competent.

In determining whether or not this Court has the jurisdiction to grant the prayers sought by the applicants, I have carefully perused the ground, affidavit and exhibits attached in support of the application for leave and the counter affidavit and exhibits attached in opposition to the application for leave to appeal and for stay of execution and or injunction. From the facts contained in the affidavit it is not in dispute that the judgment of Honorable Justice A.F.A. Ademola of the Federal High Court, Abuja Division, was delivered on 3rd December, 2013 in this Suit, that is, Suit No: FCH/ABJ/CS/130/2013: Linas International Limited & Ors v. The Federal Government of Nigeria & 3 Ors.

It is also not in dispute that the Interested Party/Applicant filed this application on 15th June 2021: being outside the 90 days allowed for, an appeal against the final decision of this Court. In PROYO V. MAKAFI (2018) 1 NWLR 1 NWLR (Pt 1599) 91, the Supreme Court stated:

“There is no doubt that the respondents were not part of the proceedings at the trial Court, hence they sought to appeal as respondent had, inter alia, sought an order of the Court below extending time for them within which to seek leave to appeal against the judgment of the trial Federal High Court of 29/6/2016 Coram: Abang.J. Thereafter, their Notice of Appeal was filed on 02/11/2016 at the Court below”.

Ordinarily, an application for leave to appeal as an interested party has been held not to have time limit In Re: Madaki (1996) 7 NWLR (Pt. 459) 153 this Court, per Uwals, CJN opined that.

“neither the Constitution nor the Court of Appeal Act or the Court of Appeal rules prescribe any period within which an interested part may bring application for leave to appeal.” And once granted leave to appeal, he can now formally file the processes. If already out of time then the trinity prayers as others who were originally part of the proceedings. See: Chief Cyprian Chukwu & Anor V. INEC & Ors (2014) 10 NWLR (Pt. 1415) 385. In the instant case, there was no need to have asked for extension of time to seek leave to appeal as interested parties”.

From the above decision, where time to appeal had elapsed before the applicant became aware of the decision appealed against as in the case at hand, it stands to reasoned that this court has lost the power to grant such leave. This is so because it is trite law that the Federal High Court can neither extend the time within which to file a notice of appeal nor grant extension of time to apply for leave to appeal. Only the Court of Appeal has the jurisdictional competence so to do.

Under the doctrine of stare decisis, this court is bound to follow the decision of the Supreme Court on this issue. I am therefore bound to apply the decision of the Supreme Court in POROYO V. MAKARFI (supra). Accordingly, I hold that this court lacks the jurisdiction to grant the reliefs sought on the motion paper. Therefore the motion dated 12th April, 2021 but filed on 12th June 2021 is liable to be struck out for being incompetent. In effect, the Notice of Preliminary Objection filed by the 3rd Defendant/Respondent against the Motion on Notice of the Interested Party/Applicant is sustained.

An Order of this Honorable Court granting the interested Party/Applicant leave to Appeal the Judgment of Honorable Justice A.F.A Ademola of the Federal High Court, Abuja Division, delivered on 3rd December, 2013 in this Suit, that is Suit NO:

FCH/ABJ/CS/130/2013 between Linas International Limited & Ors vs The Federal Government of Nigeria & 3 Ors as an interested party.

An Order of this Honorable Court staying execution of and/or injunction restraining the Respondents, their servants, agents and /or further enforcing the judgment in this Suit that is, Suit No: FCH/ABJ/CS/130/2013 delivered by Honorable Justice A.F. A. Ademola of the Federal High Court, Abuja Division, on 3rd December,2013 by way of Garnishee proceedings, writ of execution or by any other means howsoever.

The application is premised upon the following grounds:

By an Originating Summons dated 11th June, 2013, the 1st to 236th Plaintiffs/Respondents commenced and action against the 1st to 4th Defendants/Respondents inviting the Court amongst others, to make declaration on whether it was constitutional for the 1st Defendants/Respondent to utilize moneys from the Federation Account for debts servicing by way of first line charges between June 1995 and London Club Debt buy in 1992 and 2002: and London Club exit payment 2006, without the authorization of other tiers of Government.

The 1st to 236th Plaintiffs/Respondents sought for refund of USD$2,624,812,616.76 to the LGAs and Federation and additional USD$563,266,88.20 due to the LGAs and Area Councils, thus bringing the amount claimed to USD$3,188,079,505,96. The Plaintiffs/Respondents also sought a further order mandating the 1st Defendant/Respondent to pay to the 1st Plaintiff/Respondent through its attorneys, 20% of the said sum as consultancy fees.

The judgment of Honorable Justice A.F.A Ademola of the Federal High Court, Abuja Division, delivered on 3rd December, 2013 (SIC) granted all the reliefs sought including the payment of 20% of the judgment sum to the 1st Plaintiff/Respondent Linas International Limited.

The State Governors who are beneficiaries of the Federation Account under the provision of the Section 162(3) of the Constitution and Trustee of Funds due to the Local Government from the Federation Account by the provision of Sections 7, 162(5), (6), (7) and (8) of the CFRN and Section 3 of the Allocation of Revenue (Federation Account, etc) Act were not joined as parties to the Suit.

The Plaintiffs/Respondents invited the Court to resolve questions on fiscal provisions contained in Section 162(1), (3), (5), Subsection 5 particularly provides that the amount due to the Local Government Councils.

The Interested Party/Applicant is the umbrella body of democratically elected Governors of all States in Federation of Nigeria and Chief Executive Officers of the36 States with the funding thereof. The Interested Party/Applicant has commenced this action for and on behalf of the 36 States of the Federation and on their authority.

The State Governments as Trustees of the funds due to the Local Governments within their Territory are prejudicially affected by the judgment of Honorable Justice A.F.A Ademola, particularly the award of 20% of the judgment sum due to Local Governments within their territories to the 1st Plaintiff/Respondent for alleged “consultancy service”

The Federal Government through the Debt Management Office has recently finalized plans to charge allocations due to the Local Governments for several years to come of liquidating the judgment sum in favor of the 1st Plaintiff/Respondent.

The Interested Party/Applicant’s application is predicated on a proposed notice of appeal and grounds of appeal raising Constitutional and Jurisdiction issues which constitute special and exceptional circumstances upon which this application should be granted.

It is necessary in the interest of justice and the economic stabililty of States to stay enforcement of the judgment and restrain parties from taking any steps to give effect to, activate and/or enforce the judgment pending the determination of the appeal which implicate a determination of Constitutional and Jurisdictional questions raised in this appeal.

It is in the interest of justice to grant this application.

The Motion is supported by a 23 paragraph Affidavit deposed to on 15/6/2021 by Asishana B Okauru, a Director General of the Nigeria Governors Forum (NGF) with the consent and authority of the Interested Party/Applicant. Accompanying the application are documents marked as Exhibits NGF1-NGF5. There is also a Written Address dated 17/9/2021

In opposition to the Motion, the Plaintiffs filed a Counter Affidavit of 26 paragraphs deposed to on 13/9/2021 by Ewer

A. Aliemeke. There are documents attached to the Counter Affidavit and marked as Exhibits A-C and also a Written dated 6/9/2021

In the Written Address in support of the Motion on Notice, the Interested Party/Applicant formulated 2 issues for determination as follows:

Whether the Applicant has fulfilled the requirement of law for leave to appeal as interested party, to wit – shown sufficient Interest in the proceedings and judgment of trial Court.

Whether the Applicant has shown special and exceptional circumstances and established strong and arguable grounds of appeal to warrant the grant of an injunction on the enforcement of the judgment of the trial Court pending appeal.

The Plaintiffs in their address accompanying the Counter Affidavit formulated 4 issues for determination:

Whether the Applicant’s application for leave to appeal as an Interested Party ought not to be struck out for being Incompetent.

Whether the Applicant can be granted leave to appeal the decision in the circumstances of this matter.

Whether the Applicant is a person interested in the decision of the Court in Suit No: FHC/ABJ/CS/130/2013 to be granted leave to appeal as an Interested Party

Whether the Honourable Court can grant an Order of Stay of Execution pending appeal in the circumstances of this case.

On issue 1, the interested Party/Applicant submitted as trite that there is no time limit within which the Court can entertain or grant an application for leave to appeal as an interested party Cited Bi-Courtney Ltd v. A-G-F; (2019) 10 NWLR (Pt 1679) 112 and Poroye&Ors v. Makarfi&Ors (2017) LPELR-42738 (SC) among others. The Applicant also cited Section 243(1) of the Constitution and paragraphs 5-22 of the Affidavit in support, The Applicant urged the Court to hold that he has shown interest. For the definition of interested Party, the Applicant cited Assams&Ors v. Ararume&Ors (2015) LPELR – 40828, Par Chima Cantus Nweze, JSC pp,27-28 paras D-F, The Applicant argued that the Originating Summons at the trial Court invited this Court to interpret Section 162 of the CFRN, 1999 (As Amended) to determine the rights of the Federal, Local and Governments in respect of Federation Account Referred to A-G Bendel State v. A-G Federaion (1983) LPWKE-3153(SC).

He then urged the Court to consider the interests of the States which are affected by the judgment of the trial Court and urged the Court to hold.

On issue 2, the Applicant referred to Ndaba Nig. Ltd & Anor v. UBN Plc &Ors (2007) LPELR-8316(CA) for the conditions the Court considers in granting injunction to restrain a successful party from enjoying the fruits of his judgment. For the special circumstances under which an Order of injunction pending appeal may be made, the Applicant also cited SPDC (Nig.) Ltd v. Amadi&Ors (2011) LPELR-3204(SC). It is argued that should this application be refused, the Federal Government, 1st Defendant/Respondent would proceed to make deductions on allocations due to the Local Governments of the Federation and pay same to the plaintiffs in satisfaction of the judgement sum. That the Respondents will not suffer any inconvenience by the grant or refusal of this application. The Applicant made reference to the Proposed Notice of Appeal which contained jurisdictional and constitutional issues on the judgement of the trial Court which is an exceptional circumstances necessitating the grant of injunction pending determination of the proceed appeal. They urged the court to grant the reliefs sought in this application.

The Respondents in argument of their issue 1, contented that a person who was not a party but is affected by the decision of the trial Court must apply to the same Court for leave to appeal to the court of Appeal within the same time prescribed for appealing or after the expiration of that time. Apply to the Court of Appeal for extension of time to seek leave to appeal. The Respondents conceded that there is no time limit to bringing an application to appeal as an interested party and once the time expired and for the application to be competent, it must contain trinity prayers for extension of time within which to seek leave to appeal, leave to appeal and extension of time to appeal. That the application must be made to the court of appeal and that failure to comply renders the application incompetent and liable to be struck out. Cited among others are the cases of Owena Bank Nigeria Plc v. N.S.E. Ltd (1997) 8 NWLR (Pt. 515)pp. 13 paras D-F; 17 paras F-G; 20 paras F-G and Bello v. INEC (2010) 8 NWLR (PT. 1196) p. 342 at 388 paras A-C.

According to them, there isno dispute that the decision sought to be appealed by the interested party was delivered on 3/12/2013 and that the time within which to appeal against the judgment has since expired on then must apply to the court of appeal, as the federal high court would not have jurisdiction to entertain the application. They urged the court to so hold.

On issue 2. It is submitted that appealed is a complaint against a decision of the court and the only person entitled to appeal is aperson aggrieved who has suffered a legal grievance who has suffered a legal grievance. Referred to Essienv. Eskot(2020) 11NWLR (pt.1734) 177 at pp. 199-200 Paras h-c. it is submitted further the decision of the trial court, then he does ot have a right of appeal against the decision of the court. Referred to Ntungv. Llongkwang(2021) 8 NWLR (pt. 1779) 431 at 493 para B. for the options available to the person who is not a party to an action but whose interest was directly in issue, the respondents cited bello v. INEC (Supra). The respondents argued that it is not in dispute that states of the federation have been receiving payments of the judgment sums in suit no: FHC/ABJ/CS/130/2013 reference made to paragraph 11 of the applicant’s affidavit and exhibit B hey also made reference to exhibit C o show that the current applicant’s counsel acted for the 2nd to 236th respondents in this case in favour of the same judgment they urged the court to resolve this issue against the applicant.

On issue 3, the Plaintiffs/Respondents highlighted the provision of Section 243(a) of the Constitution on the right to appeal According to them, Courts have interpreted the term “person having an interest in the matter” to be synonymous with a person aggrieved or a man against whom a decision has been pronounced which has wrongfully deprived him of something or wrongfully affected his title to something Citied P.P.A v. INEC (2012) 13 NWLR (Pt. 1317) 215 at 247 paras E-G: Ede v, Nwidenyi In Re: Ugadu (1988) 1 NWLR (Pt 93) 189 at 199 paras A-B Per Karibi, Whyte JSC, The Plaintiffs stated that the complaint of the Applicant is on the interpretation of Section 162 (5) of the Constitution relating to the award of 20% of the total judgement sum in Suit No: FHC/ABJ/CS/130/2013 due to the local governments within the states in the federation to the 1st Plaintiff/Judgement Creditor/Respondent as consultancy fees That the percentage not being a party privy thereto.

They submitted that assuming without conceding that any person can challenge the agreed consultancy percentage other than the parties to the contract, it is the interest of the state of the federation that can be affected by the decision of the court and not the Applicant. Reference made to paragraph 2 of the Applicant’s Affidavit and the cases of A-G, Adamawa State v. A-G-F; (2005) 18 NWLR (Pt.958) 581 at 623 paras E-F; 654paras H-A and Nigeria Engineering Works Ltd v. Denap Ltd (2001) 18 NWLR (Pt. 746) 726 at 749 paras F-H among others. The Plaintiffs also cited Section 195 of the Constitution.

They urged the Court to consider the Applicant as a busy body and meddlesome interloper who usurps the duties of Attorney General of the States within the Federation.

On issue 4, the Plaintiffs/Respondents contented that this Court has no jurisdiction to grant stay of execution in the circumstance, as execution in the judgement of Hon Justice Ademola has been completed vide the grant of Order Absolute. The Plaintiffs contended further as trite that a Garnishee Order Absolute means that a judgement is a completed act and such, an Order for stay can neither be Ordered nor carried out when judgment has already been executed Citied Zenith Bank Plc v. John (2015) 7 NWLR (Pt. 1458) 393 at 423-424 paras C-C and 424 paras A-C Per Odilli, JSC, and Exhibit NGF 2.

They urged the Court to hold that the Prayer for stay of execution has been overtaken by the events of grant Garnishee Order Absolute which was upheld by the court of Appeal. Referred to Exhibit A. They finally urged the court to resolve all issues in their favour.

On his part, Ezechukwu, SAN for the 236th Defendant completely associated himself with the submissions made nyNjikonye , SAN. He further pointed out that the cases of Comptroller General NCS & Anor v. Minaj Holdings Ltd (2017) LPELR -40355(CA) pp. 17-19 paras D-Cnd Bi Courtney Ltd v. A-G-F; (2019) 10 NWLR (Pt. 1679) 112 at 129- 137 ere cited out of context, because the facts of those cases are identical with the present matter and that the Supreme Court held that a compromised judgement cannot be contested by the parties involved.

KelesoshoEsq, for the 1st and 2nd Defendants an also holding the brief of YahayaAbubakar for the 4th Respondent also aligned with the submission made by Learned Counsel for the 1st to 236th Respondents. In addition, he emphasized that the proper Applicants in this application should be the Attorney- General of the respective States and that the Applicant lack the locus standi and to dismiss the application for the lacking in merit.

In reply on points of law, pertaining to the arguments of the Plaintiffs in issue 1, that there is a time limit for a person to appeal relying on Section 234(1) (a) of the Constitution, the Applicant referred to the Supreme Court case of B Courtney Ltd v. A-G-F;(2019) 10 NWLR (Pt. 1679) 112 at 128-137 and Chukwu v. INEC (2014) 10 NWLR (Pt. 1415) 385 at 439 para C, per Kekere- Ekun, JSC. On the argument of the Plaintiffs in issues 2 and 3 that the Applicant ought not to be granted leave to exercise its Constitutional right of appeal against the interested party, the Applicant responded that a party who seeks to exercise his right of appeal should not be shut out unless there are compelling reasons to do so. Referred to Mohammed v. Olawunmi (1993) 4 NWLR (Pt. 287) 254 at 279-280 and Vandighl v. Hale (2014) LPELR-24196 pp.47-48 paras B-D (CA).

Pertaining to the argument of the Plaintiffs in their issue 4, whether the Court can grant stay of execution pending appeal, it is contended that an Applicant for leave to appeal is an Appellant and is entitled to enjoy all the remedies available for preservation of the res. The Applicant submitted that the fact that a judgment has been partially or fully executed does not stop a right of appeal by anyone desiring to appeal against such a judgement. Citied Kalu v. Odili (1992) LPELR-1653 pp. 91-92 paras E-B (SC); Comptroller General, Nigeria Customs Service &Ors v. Minaj Holdings Ltd, (2017) LPELR-43055 pp. 17-19 paras D-C (CA) and FIRS v. Governing Councils of the Industrial Training Fund & Anor (2018) LPELR-46857 pp. 9-12 paras D-A.

On the argument of the 1st -4th Respondents that the Applicant lacks locus standi, the Applicant referred to paragraph 4 of their Affidavit, to show that they actually have a locus standi.

I will now consider the issues formulated by the parties, in case I am wrong in holding vide the Notice of Preliminary Objection that this Court lacks the jurisdiction to grant the prayers on the motion paper.

RESOLUTION OF ISSUES SUBMITTED BY THE INTERESTED PARTY APPLICANT

Whether the Applicant has fulfilled the requirement of law for leave to appeal as interested party, to wit-shown sufficient interest in the proceedings and judgment of trial court.

The Applicant in this action approached this court for leave to appeal against the judgement of my Learned Brother, Honorable Justice A.F.A Ademola J. (as he then was) in Suit No. FHC/ABJ/CS/130/13 delivered on 03/12/2013 and upheld by the judgement of the Court of Appeal in Appeal No.CA/A/521/2016 CENTRAL BANK OF NIGERIA V. LINAS INTERNATIONAL LIMITED & ORS.

The primary question to be answered is who is a person interested? The Supreme Court in ASSAMS V ARAUME (2016) 1 N.W.L,R. (Pt. 1473) 368 at 396 (Paras, C-H) SC referring to its decision in Odedo v. Oguebego (2015) 13 NWLR (PT. 1476) 229 @ 271, stated thus:

“When the drafts person of the 1999 Constitution (as amended) Speaks of “person having and interest”, in the second clause of Section 243 (1) (a) (Supra, he uses the phrase as synonymous with the person aggrieved” that is a person against whom a decision has been pronounced which has wrongfully deprived him or her of something or wrongfullyrefused him or her of something. Such a person includes a person who has a genuine grievance because an order has been made which prejudicially affects his interest.”

It follows from the above definition that to qualify as a person 9interested, one must be a person aggrieved with a genuine grievance: not just any grievance against which a decision has been pronounced the definition knowledge and on his behalf by others and who because he does not like the judgment applies for leave to appeal against it. See the case of GWANDO V. MAIDOYA (1990) 4 NWLR (Pt. 147) 805. The interested party/applicant in this application has not shown by affidavit evidence that it was not aware or did not know of the pendency of the suit in this court as to warrant the indulgence sought. He has to explain the reason for delay in appealing the decision within time. It is not sufficient to state that the applicant was not made a party. What was the reason for waiting for over 7 years before coming to a decision to appeal? This has not been explained in the affidavit in support of the application.

Application for leave to appeal, being an equitable remedy is never granted for the asking. The court must be satisfied that there is a justifiable reason which prevented the applicant from exercising its constitutional right of appeal before the prayers can be granted. The only interest shown in the Governors forum is a registered political pressure group for Nigerian governors within the Nigerian polity. I do not see how the judgment arising from enforceable contract between the judgment creditor and judgment debtor and the garnishee has affected the applicant who is not a party to the contract. The applicant is neither a state nor a local government. I therefore resolve this issue against the applicant and hold that the interested party/applicant did not fulfil the requirement for leave to appeal.

Whether the applicant has shown special and exceptional circumstances and established strong and arguable grounds of appeal to warrant the grant of an injunction on the enforcement of the judgment of the trial court pending appeal.

It is observed that this issue is at variance with prayer B on the motion paper. Whilst prayer B on the motion paper is for stay of execution and/or injunction. Without stating that it is injunction pending appeal. Issue 2 formulated for determination by the applicant is for injunction pending appeal. The court of appeal Lagos division considered this issue in NATIONAL PENSION COMMISSION V. FIRST GUARANTEE PENSION LTD & ANOR (2013) LPELR-20824(CA) and stated as follows:

“as Onnoghen, JSC held in Aboseldehyde laboratories plc V union merchant Bank Ltd and Anor (2013) LPELRSC.276/2003: for a court to declare whether or not to grant an injunction pending appeal, it has, as of legal necessity to go into a consideration of the competing legal rights of the parties to the protection of the injunctive relief. It is a duty placed on an applicant seeking injunction pending appeal to establish by evidence in affidavit(s) the legal right he seeks to protect by the order which of necessity makes it mandatory for the court to go into the facts to determine whether such entitlement has been established.” PER NWEZE, J.S.C (Pp. 43-44, Paras. E.A)

From the affidavit in support of the application. There is nowhere the applicant deposed that it hs legal right which it seeks to protect or that further to say that this constitutive requirement for the grant of an injunction pending appeal is closely related to the issue of disclosing special circumstances invariably it has to be considered that in an application for an injunction or stay of executing the applicant has the burden to show that the balance of convenience he would suffer by the refusal of the application is more than that which the respondent would suffer if it is granted see Ukechkwu V. Iwugo (1989) 2 NWLR (pt101)29, Total(nig.) Plc V. Efakire (1998) 5 NWLR(Pt.549) 307. Approvingly, endorsed in SPDC nig ltd V. Amadi (Supra)

The rationale of all binding authorities n this point is that in an application for injunction pending appeal, the balance of convenience is a relevant consideration and such application would not be granted where compensation would not suffice and/or where the applicant cannot compensate the respondent in the damages to be suffered. See Nwaganga V. Military Governor of Imo state (1987) 3 NWLR (pt 59) 185: Oyo. Governor of Oyo state (1993) 1 NWLR (pt.303) 437.

The onus is on the party applying for a stay of execution to satisfy the court that in the peculiar circumstance of his case. A refusal of a stay would be unjust and inequitable from decided cases, the court will grant an application for stay of execution in the following circumstances:

There must be a pending appeal and the pending appeal must be valid in law. Where there is no pending appeal in a matter, an application for stay of execution will not be granted as the application is incompetent.

Where a judgment is declaratory and executor, a court will grant a stay of execution. The applicant in such circumstance ought to apply for an injunction pending appeal.

Where the judgment being sought to be stayed has already been carried out or executed. And order of stay would not ordinarily lie or made since there will be nothing to be stayed

A prayer for stay of execution cannot be for an indefinite period or large but must be made “pending the determination of the appeal filed by the applicant”

The 1st-236 Plaintiffs/judgment creditors/respondents stated in paragraph 23 of their counter affidavit that the judgment has been executed. But in therefore deemed admitted. From all the foregoing. Issue two formulated by the applicant is resolved against the applicant and prayer two on the motion paper is refused

What then is the fat of the 4 issues for determination formulated in the address of plaintiffs/respondents filed with their counter affidavit. Viz:

Whether the applicant’s application for leave to appeal as an interested party ought not to be struck out for being incompetent.

Whether the applicant can be granted leave to appeal the decision in the circumstance of this matter.

Whether the applicant is a person interested in the decision of the court in suit No: FHC/ABJ/CS/130/2013 to be granted leave to appeal as an interested party:

Whether the honourable court can grant an order of stay of execution pending appeal in the appeal in the circumstances of this case these issues and/or questions as posed by the respondents having earlier been pronounced upon inter alia, now seem of superfluous merit the pronouncements are hereby adopted as appropriate.

As a consequence of the foregoing findings, the application of the interested party/applicant fails in it’s entirely and accordingly dismissed.

news

Opeifa Defends Rail Reforms, Unveils Nationwide Expansion Roadmap

Opeifa maintained that derailments are not peculiar to Nigeria, noting that such incidents occur across advanced rail systems globally.

Opeifa maintained that derailments are not peculiar to Nigeria, noting that such incidents occur across advanced rail systems globally.

“Derailments are regular occurrences in the rail sector worldwide. In February alone, there were incidents in countries like Britain and others. Around the same time we experienced one, there were multiple derailments across the world,” he said.

He disclosed that in 2025, Nigeria recorded three major derailments:

• August 26 at Asham in Kaduna State

• November 1 at Abraka on the Warri–Itakpe line

• November 8 at Agbor on the same corridor

He said the NRC responded swiftly, restoring services within 24 hours in one case, while others were resolved within 21 and 28 days respectively.

Opeifa stressed that derailments can result from factors such as weather conditions, signal glitches, human error, speeding, or aging infrastructure, but noted that in Nigeria’s recent cases, there were no fatalities.

“These incidents are preventable and efforts are ongoing to minimize them. However, they should not be seen as major setbacks to the overall progress of the railway system,” he said.

On Allegations of Mismanagement

Addressing allegations of financial mismanagement within the corporation, Opeifa declined detailed comments, citing ongoing legal processes.

“When a matter is in court, it is sub judice. Allegations of corruption or mismanagement should be handled by the appropriate authorities,” he stated.

He reiterated that his priority is to reposition the NRC in line with global best practices and ensure efficient rail services for Nigerians.

Expansion, Upgrades and National Connectivity

The NRC boss said efforts are underway to restore damaged coaches and upgrade infrastructure using local engineers and technicians.

“We are bringing back the lines and retrofitting coaches. The Warri–Itakpe line is operational. The Abuja–Kaduna line is running, and we are increasing trips from two to three,” he said.

On long-term plans, Opeifa disclosed that the NRC roadmap envisions rail connectivity across major cities nationwide, subject to funding and phased execution.

He dismissed claims of abandoned projects, explaining that rail developments are capital-intensive and implemented in phases based on available resources.

He cited progress on the Lagos–Ibadan corridor—part of the larger Lagos–Kano project—as well as ongoing work on the Kano–Maradi line linking key northern cities.

Lagos–South-East, Port Connections in View

Opeifa also highlighted plans to expand connectivity between southern ports and inland cities. These include proposed links from Warri to Abuja and from Lekki Deep Sea Port to Kajola, Benin, Onitsha, and Aba, enabling both passenger and cargo movement.

Toward Modern Signaling and Faster Trains

On modernization, he said Nigeria is gradually upgrading from older narrow-gauge systems to standard-gauge infrastructure with improved signaling technology.

He noted that metro rail projects in Kaduna, Kano, and Lagos are being developed with higher signaling standards, positioning the country for faster and more efficient train services in the coming years.

“We are not yet at the highest global level, but we are moving steadily upward,” Opeifa said.

news

Ticket Reform Boosts Confidence in Lagos–Ibadan Rail Service, Says Opeifa

A quiet transformation is reshaping the daily commute between Nigeria’s commercial hub and the historic city of Ibadan. Passengers on the Lagos–Ibadan standard gauge corridor say services have become more efficient and predictable following a clampdown on ticket racketeering led by Kayode Opeifa

A quiet transformation is reshaping the daily commute between Nigeria’s commercial hub and the historic city of Ibadan. Passengers on the Lagos–Ibadan standard gauge corridor say services have become more efficient and predictable following a clampdown on ticket racketeering led by Kayode Opeifa

The renewed confidence in the rail line linking Lagos and is influencing residential and employment decisions among middle-income earners who once considered daily intercity commuting unrealistic.

“It is now possible to live in Ibadan and work in Lagos without the daily anxiety of securing a ticket,” said Adewale Bamidele, a financial analyst who travels three times a week. “Before, you needed connections. Now, you book, you board, you arrive.”

A Line Once Hindered by Middlemen

The Lagos–Ibadan railway, inaugurated as a flagship infrastructure project under the administration of former President Buhari was designed to ease pressure on the congested Lagos–Ibadan Expressway and deepen economic integration across the South-West.

However, in its early phases, passengers frequently complained of informal ticket rackets. Allegations included bulk-buying by intermediaries and artificial scarcity that forced travellers to pay inflated prices for seats on high-demand trains.

Industry observers say such practices undermined the railway’s credibility as a mass transit solution. “Transport systems thrive on predictability and fairness,” said a transport economist “Once access is perceived as compromised, commuters revert to road transport despite the risks and delays.”

Enforcement and Digitisation

Since assuming oversight responsibilities within the sector, Opeifa has reportedly intensified internal monitoring and strengthened digital ticketing protocols. Railway officials, speaking on condition of anonymity, said stricter verification processes and disciplinary measures against errant staff have curtailed unauthorised ticket sales.

Although the Nigerian Railway Corporation has not released detailed enforcement data, anecdotal evidence from regular commuters points to shorter queues, smoother boarding procedures and fewer last-minute cancellations.

For professionals with flexible work schedules, the improvement has been significant. The average journey time of about two to three hours—depending on the service type—now compares favourably with unpredictable road travel, which can take considerably longer during peak traffic.

Changing Urban Dynamics

Property agents in Ibadan report a modest rise in enquiries from Lagos-based workers seeking more affordable housing. Rents in many parts of Ibadan remain significantly lower than comparable neighbourhoods in Lagos, offering relief to households grappling with inflationary pressures.

“Rail reliability changes everything,” said Funke Adebayo, a real estate consultant in Ibadan. “When people trust the timetable, they are more willing to relocate.”

Economists caution, however, that long-term success will depend on consistent maintenance, adequate security along the corridor and transparent ticketing systems. Any return to informal practices could quickly erode recent gains.

The Lagos–Ibadan corridor is widely regarded as a litmus test for Nigeria’s broader rail ambitions. With additional standard gauge projects planned or underway nationwide, policymakers face mounting pressure to ensure that infrastructure investments translate into reliable public service delivery.

For now, passengers remain cautiously optimistic.

“It feels more organised,” Bamidele said while disembarking at Mobolaji Johnson Station in Lagos. “If this standard is sustained, rail can genuinely compete with road transport.”

Nigeria agree, the real challenge lies not just in laying tracks, but in sustaining public trust.

news

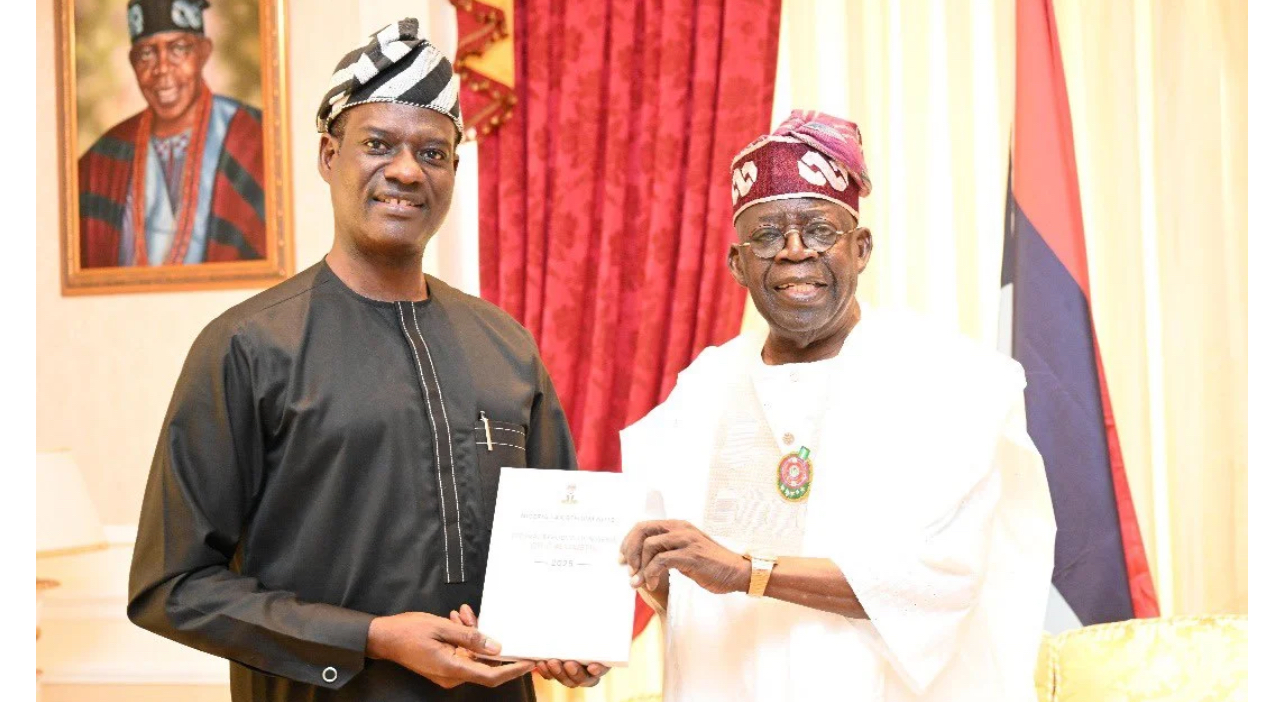

Breaking : Finance Ministry Shake-Up: Tinubu Nominates Oyedele, Says Onanuga

President Bola Tinubu has nominated the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Dr. Taiwo Oyedele, as the Minister of State for Finance.

Oyedele replaces Dr. Doris Anite-Uzoka, who has been redeployed to the Ministry of Budget and National Planning as Minister of State, her third portfolio in the administration.

The President on Tuesday conveyed Oyedele’s nomination to the Senate for confirmation in a letter to the Senate President, Godswill Akpabio, according to a statement by his Special Adviser on Information and Strategy, Bayo Onanuga, on Tuesday.

Until Tinubu nominated him as a minister, Oyedele from Ikaram, Akoko, Ondo State, was the chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, which overhauled Nigeria’s tax system.

The 50-year-old is an economist, accountant, and public policy expert who led the comprehensive overhaul of Nigeria’s tax system through the Presidential Committee on Fiscal Policy and Tax Reforms.

The committee, inaugurated in August 2023, delivered four executive bills that consolidated over 60 taxes into fewer than 10 statutes and introduced significant reforms, including zero income tax for Nigerians earning N800,000 annually or less.

The Tax Reform Acts, which became effective on January 1, 2026, also exempted small businesses with turnover below N50m from company income tax, capital gains tax, and development levy.

Other provisions include a 50 per cent tax deduction for companies hiring new workers for three years, a 50 per cent deduction for wage increases to the lowest-paid employees, and a five-year corporate tax holiday for agricultural enterprises.

Oyedele attended Yaba College of Technology, where he obtained a Higher National Diploma in Accountancy and Finance, before proceeding to Oxford Brookes University for a BSc in Applied Accounting.

He also completed executive education programmes at the London School of Economics, Yale University, the Gordon Institute of Business Science, and the Harvard Kennedy School.

Oyedele spent 22 years at PricewaterhouseCoopers, joining in 2001 and rising to become the Fiscal Policy Partner and Africa Tax Leader before his appointment to head the tax reform committee.

He is currently a professor at Babcock University in Ogun State and a visiting scholar at the Lagos Business School.

As Minister of State for Finance, Oyedele is expected to oversee the implementation of the tax reforms he championed, particularly as the government seeks to improve revenue generation and deepen economic reforms.

Anite-Uzoka, who is being redeployed to the Ministry of Budget and National Planning, previously served as Minister of State for Industry, Trade and Investment before her appointment as Minister of State for Finance.

The Senate is expected to screen and confirm Oyedele’s nomination in the coming weeks, following which he will be sworn in to assume his ministerial duties.

The Finance Ministry, currently led by Wale Edun as substantive minister, oversees fiscal policy, revenue mobilisation, debt management, and economic planning.

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle6 years ago

lifestyle6 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health6 years ago

health6 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health6 years ago

health6 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment1 year ago

entertainment1 year agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news10 months ago

news10 months agoBREAKING: Tinubu swears in new NNPCL Board