news

How I Stopped Kingibe, Abba Kyari, Rufai Abubakar From Stealing $44m-Former Acting D-G, NIA

Immediate past Acting Director-General (D-G) of the National Intelligence Agency (NIA), Mr Mohammed Dauda, has disclosed that he fought off attempts by Messrs. Babagana Kingibe, former Secretary to the Government of the Federation and his protégé and incumbent D-G of the NIA, Mr. Rufai Abubakar and Abba Kyari, President Muhammadu Buhari’s Chief of Staff to steal $44million NIA intervention fund. The disclosure was made in a brief to the House of Representatives Committee on National Security and Intelligence.

In the brief, exclusively obtained by SaharaReporters, Mr. Dauda said he assumed office as Acting D-G on November 6 2017, following a brief meeting with Mr. Kyari at the Presidential Villa. The Chief of Staff, he said, conveyed the President’s directive to him that he should function in an acting capacity while waiting for further directives.

On leaving the Presidential Villa, Mr. Dauda said he headed straight to have a meeting with Mr. Arab Yadam who was D-G in an acting capacity but was retiring. The meeting, he said, dwelt on what the retiring Acting D-G did in the seven months during which he ran the agency. The briefing, said Mr. Dauda, comprised his administrative, operational and technical duties, all of which were highly confidential. Mr. Yadam also gave his successor the picture of the agency’s financial position, which included $44million he informed was part of the intervention fund that brought the Ikoyi apartment cash scandal.

After the briefing, Mr. Yadam introduced Mr. Dauda to Brigadier-General Mohammed Ja’afaru, the Acting Director of Finance and Administration (DFA) who briefed him on the nature of the agency’s assignments. Among these are the daily operations of the accounts for both domestic and foreign management. The Acting DFA also told Mr. Dauda that the $44million in his custody, which was not part of the agency’s budgetary allocation, should not be touched because it had become an exhibit in an ongoing case. The purpose of the disclosure, Mr. Dauda said, was for his information.

Not long after Mr. Dauda assumed office, the Presidential Review Panel (PRP) headed by Mr. Kingibe started its assignment within NIA. The agency provided the members of the panel with office space, accommodation, food and other logistics. Aside from Mr. Kingibe, other members include Mr. Albert K. Horsfall, a former D-G of the State Security Service; Mr. Olaniyi Oladeji, Mr. ZY Ibrahim both former DGs of the NIA and the current DG of NIA, Mr. Abubakar, who was PRP Secretary.

After the maiden meeting with the panel, said Mr. Dauda, Mr. Kingibe called him to advise that in his own interest, he should cooperate with them fully and avoid being close with Buhari’s National Security Adviser, Babagana Monguno, Mr. Kingibe also disclosed that they had presidential powers to overrule previous instructions or directives issued by the NSA.

“I was instructed to channel all our activities, contacts, concerns and complaints through the Office of the Chief of Staff Abba Kyari only,” said Mr. Dauda.

He said the instructions left him in discomfort, as they contradict all the provisions of the agency’s instruments. Not wanting to start on a confrontational note, he kept away from the NSA as instructed.

According to him, things went on smoothly untilKingibe and Abubakar kept pressuring him for money. Mr. Dauda said he explained that the agency’s dollar account was low because of the difficulty in sourcing dollars from the Central Bank of Nigeria following the crises that arose from the Ikoyi money scandal. However, the replied that the $44m in the custody of the Acting DFA belongs to the agency and that the DFA had no power to stop Mr. Dauda from spending the money. They added that since the crisis had blown over, Mr. Dauda should go and tell Brigadier-General Jafa’aru to return to his job in the army. He was advised to write to the National Security Adviser to withdraw him or ask the NIA security department to stop him from entering the premises of the agency.

Mr. Dauda said the pressure was huge, but he felt if Brigadier-General Jafa’aru left, he might not be able to resist further pressure from the desperate Kingibe led gang.

“They kept insisting that they had the mandate of the President and that the President had directed the Economic and Financial Crimes Commission (EFCC) to hands off the money and that it was legitimately ours. They verbally queried me on the logic of keeping the money as an exhibit since there was no case pending in court. Ambassador Kingibe told me that he was the one who, through the Chief of Staff drafted the memo that the President assented to, instructing the EFCC to hands off our case (Ikoyi cash . scandal) just to convince me that there are no more encumbrances on the money,” stated Mr. Dauda.

Still, no dice. He claimed that Kingibe and others kept pressuring and threatening that if he did not get rid of the Brigadier-General, he would have regrets. Mr. Dauda said he had no reason to get the man out and he actually enjoyed working with him. His refusal to do as they wished, he said, this prompted Messrs. Kingibe and Abubakar to tell him at a meeting that he was refusing presidential orders to bar the Brigadier-General from the NIA premises. They warned him that there might be consequences if he remained adamant. At one of the meetings, explained Mr. Dauda, Mr. Horsfall advised him to ignore any suggestion that could cause confrontation between him and the NSA and advised his colleagues on the panel to put it as part of their recommendations to the President since they had his mandate, so he could order the NSA to remove the Acting DFA from the NSA.

The pressure on him for money, the former Acting D-G said, intensified.

“They wanted money for medical treatment or holidays abroad for their families and girlfriends. I met and gave a lady Ambassador Kingibe simply introduced to me as “Angela” money twice at the car park of the Hilton Hotel. Once $50,000 and the second time $20,000, which apparently did not impress him. Even the current DG NIA once called me on WhatsApp, just like Amb. Kingibe always does and said that his Oga was traveling to London for medical check-up and he suggested that I should find something for him as a sign of good will. So, I reluctantly gave him $50,000 against my will, a decision that made me sad throughout the day,” he said. He added that Mr. Kingibe collected over $200,000 from him during the time he headed the PRP. Mr. Dauda said he was always using the President’s name to squeeze cash out of the NIA. They also undermined the Office of the National Security Adviser.

On December 20 2017, said the former Acting DG, Mr. Kingibe asked the current DG NIA to tell him to meet them at home located at 59 Nelson Mandela Street, Asokoro, Abuja. He was asked to come alone. At the meeting, he was told of his refusal to cooperate with them and they had brought him there to warn that the Acting DFA was conspiring with some people to steal the $44million in their safe. He was warned that he would be held liable if he did not stop their plan.

“They told me that their Committee had completed their assignment and that their recommendations were so generous to the DG NIA. They said they recommended the appointment of two Deputy Directors-General and watered down their powers enough so that they will not be in a position to pose any threat to him as the DG,” wrote Mr. Dauda.

They then suggested that it was his turn to do something in return as he was likely to get the President’s nod as the substantive DG only if he could immediately make $2million available.

“I told them it was not going to be possible as the only money available was the $44million and I didn’t know how to approach the Acting DFA. They also told me at the meeting that if I can’t sack the DFA, they would send someone to do it soon. That was my last communication with them until I heard of my removal from office on Wednesday 11 January on Channels Television around 8 pm,’ said Mr. Dauda.

The next day, he advised the NSA to look at the possibility of evacuating the money from the NIA, an advice the NSA heeded. The money was moved and taken to the Office of the NSA.

Later that night, Mr. Dauda said he received a call from the Mr. Abubakar, who requested for a meeting with him and the staff who worked with him at 10pm. Mr. Abubakar said the meeting was ordered by Mr. Kyari. The meeting was eventually moved to the next day after Mr. Dauda protested that it was too late. At the meeting the next day, an enraged Mr. Abubakar said the Presidency blamed him for not taking over immediately thereby giving room for the money to be taken away and warned that Mr. Dauda would be held responsible.

When he finished, Mr. Dauda said he told him no money was missing and that he approved the transfer so the money could be safe.

“I told him that if there was no ulterior motive, the apprehension was unfounded. I also warned him to mind his language as I have always been his senior in this service,” Mr. Dauda stated.

He equally stated that his life is being threatened by the Kingibe gang and requested immediate protection for him and his family. Mr. Abubakar, he said, has already shown his hand with a letter requesting Mr. Dauda to return official vehicles in his possession. He has also received another letter restricting his movement on the claim that the agency was investigating leakage of sensitive information.

“These are acts meant to cow and intimidate me into submission and there are also attempts to bundle me out of my official quarters through extra-legal means and also to withdraw my security details, thereby impacting my security,” he said.

He called on the House Committee not to allow the Kingibe gang to subvert the rule of law by bullying him into submission.

news

BREAKING: Tinubu Names Tunji Disu Acting Inspector General After Egbetokun’s Exit

President Bola Tinubu has accepted the resignation of the Inspector-General of Police, Kayode Egbetokun, and approved the appointment of Tunji Disu as Acting Inspector-General of Police with immediate effect.

Our correspondent had earlier reported that Egbetokun tendered his resignation letter on Tuesday, citing pressing family considerations.

Appointed in June 2023, Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

In a statement issued on Tuesday by his Special Adviser on Information and Strategy, Bayo Onanuga, the President received the letter earlier on Tuesday and expressed appreciation for his service to the nation.

He also commended Egbetokun’s “decades of distinguished service to the Nigeria Police Force and the nation,” acknowledging his “dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.”

“In view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance, President Tinubu has approved the appointment of Assistant Inspector-General of Police Tunji Disu to serve as Acting Inspector-General of Police with immediate effect.

“The President is confident that AIG Disu’s experience, operational depth, and demonstrated leadership capacity will provide steady and focused direction for the Nigeria Police Force during this critical period,” the statement read.

It added that in compliance with the provisions of the Police Act 2020, the President will soon convene a meeting of the Nigeria Police Council to formally consider Disu’s appointment as substantive Inspector-General of Police, after which his name will be forwarded to the Senate for confirmation.

The President reaffirmed his administration’s commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

news

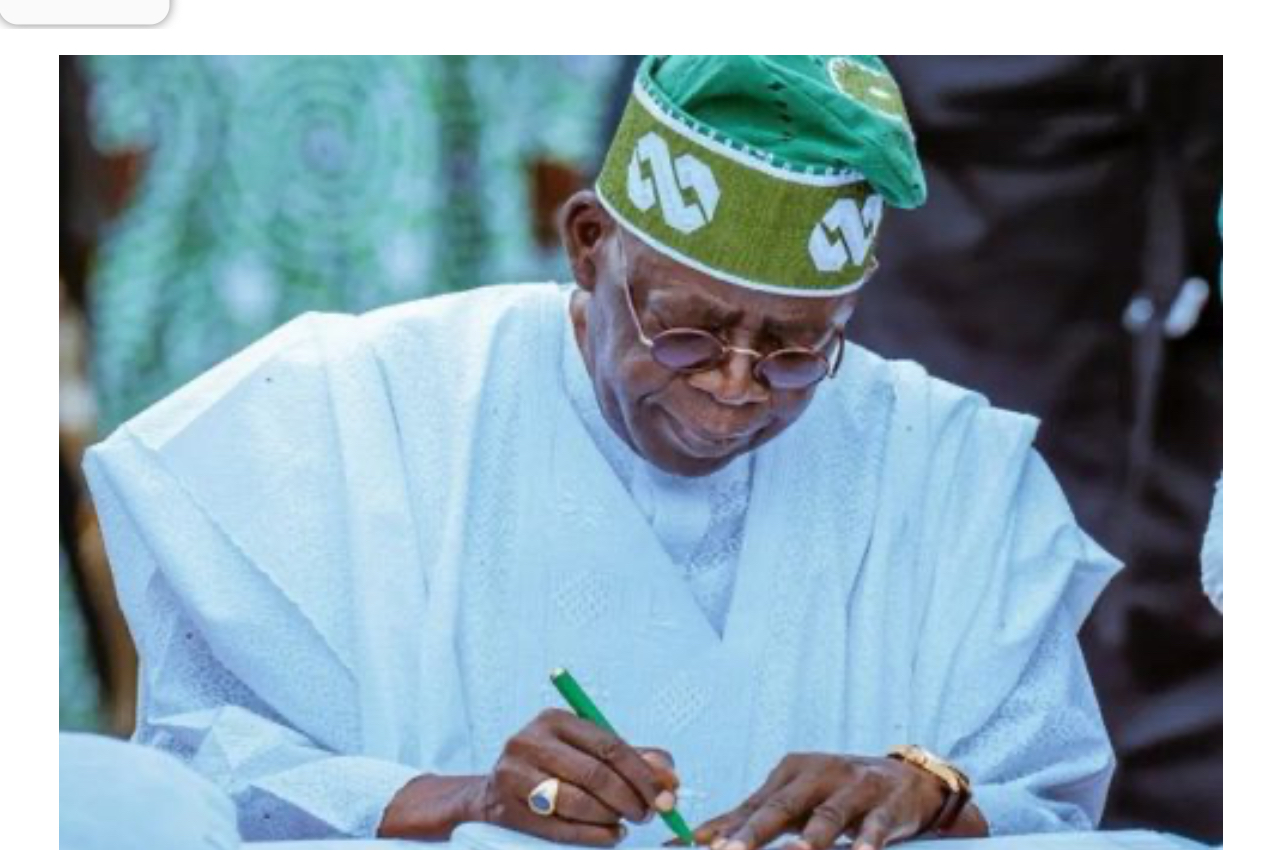

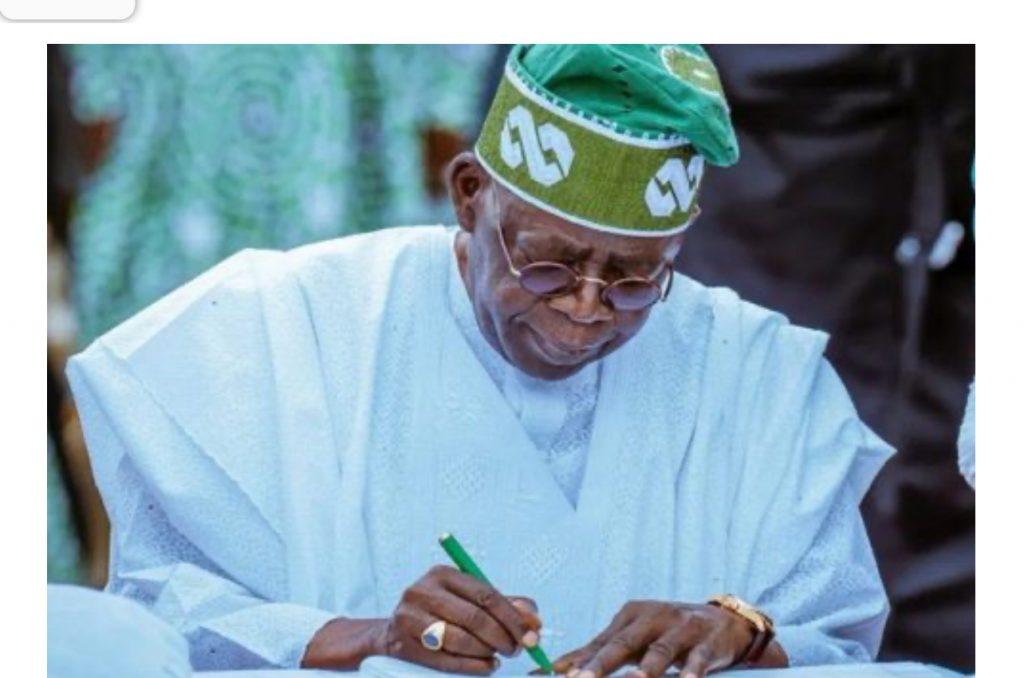

Breaking : Nigeria Gets New Electoral Act as Tinubu Signs 2026 Reform Bill

President Bola Tinubu has signed the Electoral Act 2026 (Amendment) into law, days after the Independent National Electoral Commission (INEC) released the timetable for the 2027 general elections.

The signing ceremony took place at the State House, Abuja, at about 5:00pm on Wednesday, with principal officers of the National Assembly in attendance.

The National Assembly had on Tuesday passed the Electoral Act 2026 (Amendment) Bill.

The latest amendment comes amid intense public debate over the electronic transmission of election results in real time.

Last week, protests erupted at the National Assembly complex as civil society organisations and opposition figures mounted pressure on lawmakers to mandate live transmission of results from polling units directly to INEC’s central server.

The protesters argued that real-time transmission would reduce result manipulation and strengthen public confidence in the electoral process.

However, the ruling All Progressives Congress (APC) and some stakeholders have raised concerns about the technical feasibility of live transmission, particularly in communities with weak telecommunications infrastructure. They have argued for a phased or hybrid approach that would allow manual collation where electronic systems fail.

news

EFCC Extends El-Rufai’s Stay in Custody Amid ₦432bn Probe

Former Kaduna State Governor, Nasir El-Rufai, on Tuesday spent the second night in the custody of the Economic and Financial Crimes Commission, as his lawyer, A.U Mustapha (SAN), pushes for his release on bail.

There are, however, indications that the commission may seek a remand order to extend his stay in custody to enable him to respond to questions posed by investigators handling his matter.

The former governor arrived at the EFCC headquarters in Abuja on Monday around 10 a.m. for questioning in connection with an alleged N432bn corruption probe. He was, however, detained at the commission, where investigators continued to grill him.

An official of the commission who pleaded anonymity said the anti-graft agency was considering obtaining a remand order after the expiration of the hours allowed by law to enable investigators conclude questioning him.

“Forget the speculations being peddled on social media that he has been released. He has not. El-Rufai is still with us and will be spending another night in custody.

“He is very much with us and will remain so because the investigators are considering getting a remand order after the expiration of the 48 hours allowed by law.

“The investigators need some time with him to answer questions arising from his eight years as governor in Kaduna State,” the source said.

Speaking in a telephone conversation with The PUNCH on Tuesday, El-Rufai’s counsel, Mustapha, confirmed that the former governor remained with the anti-graft agency, while insisting that his client had fully cooperated with investigators.

He described his client as a responsible citizen who is not a flight risk if granted bail.

Mustapha said, “Well, as a responsible citizen, he was invited and, true to his word, he honoured the invitation.

“As we speak, he is still with the EFCC. He is cooperating to the best of his capacity, and we hope that the EFCC, given its integrity, will be kind enough to admit him to bail because he is presumed innocent, and I am sure if he is granted bail, he will not jump bail.

“He is a responsible citizen, and everybody knows him. He came to Nigeria on his own volition. He wrote a letter that he was going to honour the EFCC invitation, and he kept his word as a man of integrity. We’re hopeful that very soon he will be granted bail.”

When asked about the specific allegations against his client, Mustapha declined to offer details.

“You’re asking the right question from the wrong person. That question can only be answered by the EFCC and not by me. I would just be speculating, and lawyers don’t do that.”

Pressed further on whether he witnessed parts of the interrogation and what it was about, Mustapha responded, “That would be prejudicial. It’s a confidential matter and not meant for public consumption.”

The EFCC’s interrogation is linked to the report of an ad hoc committee of the Kaduna State House of Assembly set up in 2024 to probe finances, loans, and contracts awarded between 2015 and 2023 during El-Rufai’s administration.

EFCC extends El-Rufai detention, Plateau indigenes killed, other top stories

Rep backs real-time electronic transmission of election results

The committee, chaired by Henry Zacharia, had alleged that several loans obtained during the period were not utilised for their intended purposes.

While presenting the report, the Speaker, Yusuf Dahiru Leman, claimed that about N423bn was allegedly siphoned under the former governor’s administration.

The committee recommended the investigation and prosecution of El-Rufai and some former cabinet members over alleged abuse of office, diversion of public funds, money laundering, contract awards without due process, and reckless borrowing.

The Assembly subsequently forwarded petitions to the EFCC and the Independent Corrupt Practices and Other Related Offences Commission.

El-Rufai has denied the allegations, describing the probe as politically motivated, and insisted that loans obtained during his tenure were properly appropriated and used for infrastructure, education, healthcare, and security.

On Monday, an EFCC source said the commission had been investigating the matter for about a year, noting that suspects are usually invited after investigations have reached an advanced stage.

“The commission has been investigating him for about a year now. As a commission, we don’t just rush to invite suspects. Persons accused are always the last; that is, after we might have done our investigation to an advanced stage.

“We are investigating him on the allegations against him by the Kaduna State Assembly,” the source said.

Meanwhile, in a separate development, the Department of State Services has filed criminal charges against El-Rufai before the Federal High Court in Abuja over alleged unlawful interception of the phone communications of the National Security Adviser, Nuhu Ribadu.

The three-count charge, marked FHC/ABJ/CR/99/2026, was filed under the Cybercrimes (Prohibition, Prevention, etc.) Amendment Act, 2024, and the Nigerian Communications Act, 2003.

According to the charge sheet, El-Rufai allegedly admitted during a February 13, 2026, appearance on Arise TV’s Prime Time Programme that he and unnamed associates unlawfully intercepted Ribadu’s communications.

Count One alleged that El-Rufai “did admit during the interview that you and your cohorts unlawfully intercepted the phone communications of the National Security Adviser, Nuhu Ribadu,” an offence said to be punishable under Section 12(1) of the Cybercrimes Amendment Act.

Count Two accused him of acknowledging knowledge of an individual involved in the alleged interception without reporting it to security agencies, while Count Three alleged that he and others still at large used technical equipment that compromised public safety and national security.

The prosecution further claimed that the alleged act, reportedly admitted during the television interview, caused “reasonable apprehension of insecurity among Nigerians.”

He is yet to be arraigned.

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle6 years ago

lifestyle6 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health6 years ago

health6 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health6 years ago

health6 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment1 year ago

entertainment1 year agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news9 months ago

news9 months agoBREAKING: Tinubu swears in new NNPCL Board