brand

COVID 19: Decision Necessary to Sustain Business-Wigwe

He started out his career at the Coopers and Lybrand Associates, Lagos, as a management consultant. He soon got to be a Chartered Accountant and subsequently went to work at GTBank. In his time at the bank, spanning over a decade, Herbert rose through the ranks to become the Executive Director Corporate and Investment Banking.

By his admission, he had seen some ups and downs, had some fears, experienced some turbulence and has equally tasted some very good side to the bargain. “There have also been very trying times. There have been days when we’ve had to roll on the floor and pray, and just beg God that certain things shouldn’t happen, when there’s been big changes in the macro.

“There was some information about an exposure which we had. The communication was that it was not a performing loan, and it was not true. Because of the size of the loan, it could have triggered an issue. We were a much smaller institution. And our reputation, particularly in banking, could affect the overall franchise. It could affect our stakeholders, our customers, most importantly our people, because they were going to be concerned about our professional future.”

He was quite concerned, he admitted at a point in time. I was absolutely petrified of failure and would do everything possible not to find myself in certain circumstances, he said. “People ask us why we spend so much time working. Apart from the fact that we truly enjoy what we are doing, I enjoy every second of what I do, but the thought of failure is something I don’t want to dream of. So, we are perpetually seeking ways to better prepare ourselves for those difficult moments in life.

‘’There were people who thought, ‘how are these guys going to pull it together?’ There were those who thought, ‘young people don’t work together very well, they are likely to quarrel.’ Several people thought like that, some also said: ‘It’s just a matter of time, something will happen.’

‘’In fact, there were some consulting firms that said they were not going to take on our mandate because these guys are just a bit too young for what they want to do. So that was the kind of vibe that we got, adding however that there were “more days of celebration with each passing thing, each success makes us so much more confident. So, it’s been mixed feelings, on the whole, there’s so much thanksgiving to God.’’ ”

That is largely the trajectory of the corporate world. Some prepare for it, while for some others, it is thrust upon them. What one makes of it is made manifest in space of time.

Within the period that he began to toil in the banking space, Wigwe had weathered some storms no doubt. In the period he rose to become an Executive Director in GTBank, to when he and his co-traveller, Aig-Imoukhuede bought ‘little’ Access Bank, and then went on to acquire Intercontinental Bank and very lately, Diamond Bank and Transnational Bank of Kenya, Wigwe in the course of these transactions, would have taken some hard decisions, rightly so, in the line of duty. Having therefore been acquainted with these developments over time in addition to other boardroom challenges, it has become a matter of routine, doubtless, that the challenges thrown-up by the outbreak of the COVID-19, serious as they are (make no mistake about that for no sector is spared), were not expected to sweep Wigwe of his feet. He has been prepared for a time like this.

Implications of COVID-19

As pervading and dangerous the COVID-19 pandemic impacts are, they bear repetition so that no one is left in doubt as to the danger the world faces.The pandemic, not being a financial issues per se, yet its impact has consumed and crippled all businesses, the banking industry not being an exception. The global business community, be it in the developed world, developing, countries, or emerging markets have been brought to their knees. Job loses every where are numerous. In the US where data is readily available, over 30 million people have filed for unemployment benefits, while in April alone, over 20.5 million were reported to be out of jobs and still counting. Spiralling death tolls have become the new normal, medicament and health care facilities have been stretched to their limits, even at that, no one knows when this shall come to an end. Uncertainty is now the new normal.

In situations like this, corporate chiefs and political leaders are taking proactive steps and making moves in the expectation that per chance, they may strike the cord that would mitigate the devastating impact of this ravaging scourge. To do nothing is to wait for a certain death, or imminent disaster. In Britain for instance, it was announced a few weeks ago that the government has offered to stand in for workers who were asked to stay at home with a promise to underwrite their salaries for a period of three months in the first instance. Some other developed countries have also offered similar, or other alternatives. Also in the US, Congress approved a $6 billion package that entitled households to about $2,000 monthly, with a proviso that it will consider a review upward as events unfold. So far, none of these measures put forward by the developed countries is available at home, or in most third world countries, save for pronouncements of palliatives being provided here and there with no specific modus operandi of how the service is administered.

‘We’ll not sack workers’

While some have taken to laying off employees, others have put a cut on the monthly payroll, Access Bank has taken the empathetic route of trimming operating costs instead of outright workforce downsising.

Wigwe, in statement, assured that Access Bank has put in place a robust business continuity process that is enough to sustain the bank’s performance going forward, saying the bank “was well prepared for COVID-19 early enough and created ways of working from home and working with our customers. We set up links with our customers and devised ways of reaching out to them three or four times a day. This happened even before we started working with the larger society and it enabled us to start fighting this pandemic”.

He said to remain accountable to shareholders and keep the business running, it has become necessary to rationalise cost structure, including salary and even service providers. In stating the obvious, Wigwe said no business was having it easy at this time. He said top global enterprises have taken various measures to ensure that they stay afloat of the situation, pointing out that this is a time when we all need to be more understanding and work towards eradicating the virus so that we can continue living our normal lives. Sometimes, everyone has to endure some discomfort in order to ensure that no one is left behind, and this sums up the rationale behind Access Bank’s decision, because in his words, “all shareholders, including employees, deserve empathy and consideration”.

Wigwe also took the exceptional step of leading by example. He offered to cut his pay by 40 per cent over the period that the pandemic is in force, saying the measure will be graduated down the line, with the assurance that no staff member would lose their jobs because of COVID-19.

He said: “To keep to this commitment, we have made a decision at the management level to restructure salaries. This will start with me, who will have a salary restructure of 40 per cent, while other employees will have their salaries slightly reduced as well. It has become essential to take this decision in the interim, considering the economic realities and hope to reverse it as soon as economic activities become stable.

“As an employer of over 30,000 employees, our employees are our greatest assets. We understand how difficult these times are and we are determined to ensure that our staff remain in employment,” Wigwe said in the statement.

Corporate social responsibility

Access Bank has been ranked as the overall best company in Corporate Social Responsibility and Sustainability in Nigeria for the year 2019 based on a result drawn from impact assessments of 910 organizations operating in Nigeria over the last 13 years. The ranking took into cognizance Access Bank’s participation in impactful national projects, its recognitions and ratings from international award bodies, investment in CSR and sustainability.

The bank has in place a corporate strategy and philosophy which places sustainability at its core, ensuring that projects and initiatives undertaken by the bank are impactful and strategically linked with the United Nations Sustainable Development Goals. Under Wigwe’s leadership, the bank has also recorded outstanding results by undertaking several initiatives across the country.

Having launched the Nigerian Green Bond Market Development Programme in June 2018, Access Bank’s determination to promote sustainable growth through funding of projects at a lower cost of capital, led to the issuance of a N15 billion (USD41 million) corporate green bond in 2019. The issue is the first-ever Climate Bonds Initiative certified corporate green bond in Africa.

He certainly knows what it takes to be a leader. His work attitude, ethics and transparency and strategies in navigating uncharted terrain and circumstances in the global economy, have attested to him being a proven, tested and pragmatic leader. His approach to amicably resolving the challenges thrown up by the coronavirus scourge in marrying the corporate interest with those of the workforce, and leaving all interests well protected, should be commended. He rose to the challenge of the moment and proactively adopted measures to keep the financial institution going, not only that, but strong and competitive.Transparency is a strong virtue of leadership.

Clearly, one thing the ravaging pandemic has revealed, according to Barclays Bank boss, Jes Staley, is that having thousands of bank workers in big, expensive city offices, “may be a thing of the past”.

Staley pointed out that about 70,000 of Barclays’ staff members worldwide are working from home due to coronavirus lockdown measures, leading the bank to rethink its long-term strategy. So, it is not just Wigwe taking proactive and pragmatic steps to remain competitive, he is sure having a head start here by his bold and pragmatic approach.

brand

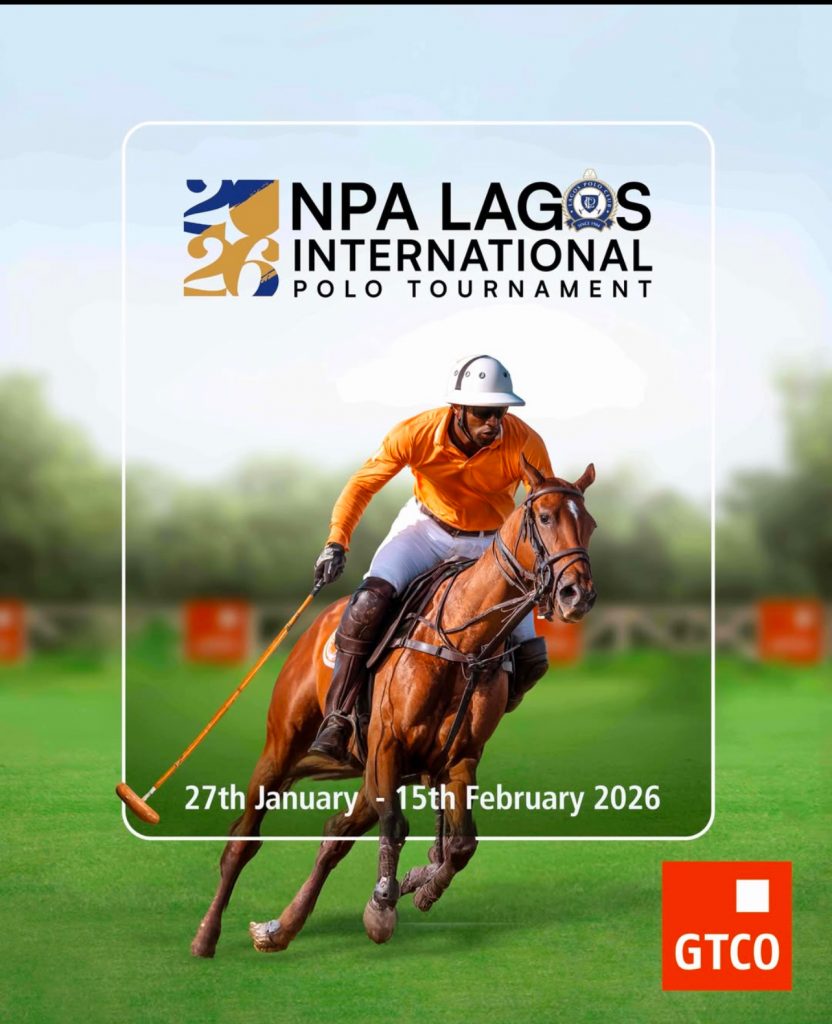

GTCO Proudly Headlines the NPA Lagos International Polo Tournament as Main Sponsor— Championing Great Experiences and Heritage

Guaranty Trust Holding Company Plc (GTCO Plc) (NGX: GTCO; LSE: GTCO), one of Africa’s leading financial services groups, is proud to announce its continued support as the main sponsor of the NPA Lagos International Polo Tournament, one of Africa’s oldest and most prestigious sporting events. The 2026 edition will be held at the Lagos Polo Club, Ikoyi, from Tuesday, January 27 to Sunday, February 15, bringing together top local and international polo teams and spectators from across the continent and beyond.

The 2026 NPA Lagos International Polo Tournament will feature top‑tier teams competing for major prizes, including the Majekodunmi Cup, Independence Cup, Open Cup, Silver Cup and Low Cup, among others. Guests can expect a fusion of thrilling equestrian action, polo-inspired lifestyle showcase, and curated hospitality experiences. The event will also be livestreamed, allowing audiences online to share in the excitement and spectacle.

Commenting on GTCO’s role as main sponsor of the Lagos International Polo Tournament, Segun Agbaje, Group Chief Executive Officer, said: “This tournament, one of the oldest in Africa, celebrates not only the noble sport of polo but the values we hold dear as a brand: teamwork, discipline, fair play, and a commitment to excellence. Beyond the field, it showcases Nigeria and Africa to a global audience, reinforcing the continent’s place on the world stage. Our longstanding sponsorship of the NPA Lagos International Polo Tournament reflects our conviction that sport can amplify opportunity, foster connections, and deliver world-class experiences for all.”

The NPA Lagos International Polo Tournament has long been celebrated not only for its thrilling competition and equestrian excellence but also for its rich heritage and cultural resonance within Africa’s sporting tradition. GTCO’s sponsorship embodies the Group’s commitment to creating platforms that unite communities and drive social impact across diverse audiences.

brand

Fidelity Bank appoints Onwughalu as Chairman following completion of Chike-Obi’s tenure

Tier one lender, Fidelity Bank Plc, has announced the completion of the tenure of Mr. Mustafa Chike-Obi as Chairman of its Board of Directors effective December 31, 2025, and the appointment of Mrs. Amaka Onwughalu as the new Chairman of the Board, effective January 1, 2026.

Tier one lender, Fidelity Bank Plc, has announced the completion of the tenure of Mr. Mustafa Chike-Obi as Chairman of its Board of Directors effective December 31, 2025, and the appointment of Mrs. Amaka Onwughalu as the new Chairman of the Board, effective January 1, 2026.

The board transitions are in alignment with the Bank’s policy and have been communicated to the Central Bank of Nigeria, the Nigerian Exchange Group, and other stakeholders.

Under Mr. Chike-Obi’s leadership, Fidelity Bank repaid its Eurobond, completed the first tranche of its public offer and rights issue that were oversubscribed by 237 percent and 137.73 percent respectively, expanded internationally to the United Kingdom, and received improved ratings from various agencies amongst a long list of achievements. His tenure also saw the Bank strengthen its capital position, record steady growth in customer deposits and total assets, deepen its digital banking capabilities, and enhance its corporate and investment banking proposition. The bank equally made notable progress in governance, risk management, and operational efficiency, all of which contributed to strengthened market confidence and the Bank’s sustained upward performance trajectory.

Reflecting on his tenure, Mr. Mustafa Chike-Obi said, “It has been a privilege to serve as Chairman of Fidelity Bank. The dedication of our Board, management, and staff has enabled us to reach significant milestones. I am confident that the Bank will continue to thrive and deliver value to all stakeholders.”

Mrs. Amaka Onwughalu’s appointment marks a new chapter for Fidelity Bank. She joined the Board in December 2020 and has chaired key committees. With over 30 years of banking experience, including executive roles at Mainstreet Bank Limited and Skye Bank Plc. She holds degrees in Economics, Corporate Governance, and Business Administration, and has attended executive programmes at global institutions. Mrs. Onwughalu is a Fellow of several professional bodies and has received awards for accountability and financial management

“I am honoured to lead the Board of Fidelity Bank at this exciting time. Our recent achievements have set a strong foundation for continued growth. I look forward to working with my colleagues to drive our strategy and deliver sustainable value,” commented Mrs. Onwughalu.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 9.1 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is a recipient of multiple local and international Awards, including the 2024 Excellence in Digital Transformation & MSME Banking Award by BusinessDay Banks and Financial Institutions (BAFI) Awards; the 2024 Most Innovative Mobile Banking Application award for its Fidelity Mobile App by Global Business Outlook, and the 2024 Most Innovative Investment Banking Service Provider award by Global Brands Magazine. Additionally, the Bank was recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence and as the Export Financing Bank of the Year by the BusinessDay Banks and Financial Institutions (BAFI) Awards.

brand

UBA Group Dominates 2025, Banker Awards, Emerges Africa’s Bank of the Year, For Third Time in Five Years

….Wins Best Bank in Nine out of 20 African Subsidiaries

….Wins Best Bank in Nine out of 20 African Subsidiaries

Africa’s Global Bank, United Bank for Africa (UBA) Plc, has once again, reaffirmed its leadership as one of the continent’s most innovative and resilient financial institutions, as the bank has, for the third time in five years, been named the African Bank of the year 2025 by the Banker.com.

UBA also won the Best Bank of the Year awards in nine of its 20 African subsidiaries, bringing its total awards this year to ten as UBA Benin, UBA Chad, UBA Republic of Congo (Congo-Brazzaville), UBA Liberia, UBA Mali, UBA Mozambique, UBA Senegal, UBA Sierra Leone, and UBA Zambia, all came out tops as the best banks in their respective countries, underscoring the bank’s strength across West, Central and Southern Africa and highlighting the depth of its Pan-African franchise.

The Banker.com, a leading global finance news publication published by the Financial Times of London, organises the annual Bank of the Year Awards, and this year’s edition was held at a grand ceremony at the Peninsula, London, on Wednesday.

The Chief Executive Officer, UBA UK, Deji Adeyelure, received the awards on behalf of the bank, representing the Group Managing Director/CEO, Oliver Alawuba, and was accompanied by the bank’s Head Business Development, Mark Ifashe, and Head, Financial Institutions, Shilpam Jha.

The Banker’s awards are widely regarded as the most respected and rigorous in the global banking industry, celebrating institutions that demonstrate outstanding performance, innovation and strategic execution.

In its remarks on UBA’s winnings, the banker.com said, “For the third time in five years, UBA Group has won the coveted Bank of the Year award for Africa. UBA Group time after time punches above its weight against its larger African rivals. The bank this year also takes home nine separate country awards (one more than it gained for its last continental win in 2024), equivalent to around a quarter of the awards for the continent, and more than any of its continent-wide rivals.”

Continuing, it said, “Perhaps even more impressive is the fact that the awards were won across a broad geographic spread, going to lenders based in the Economic Community of West African States (Benin, Liberia, Senegal, Sierra Leone, and former member Mali), the Central African Economic and Monetary Community (Chad, Republic of Congo) and the Southern African Development Community (Mozambique, Zambia). Its award wins were particularly notable in the highly competitive categories for Benin and Mozambique.”

The Banker also highlighted UBA’s strong financial performance and commitment to future growth. In 2024, the Group recorded a 46.8 per cent increase in assets and a 6.1 per cent rise in pre-tax profits in local currency terms, while continuing to invest significantly in talent and technology. West Africa remains UBA’s heartland, with operating revenue and profit increasing by 87 per cent and 89 per cent respectively in H1 2025.

The bank’s digital and innovation leadership was equally recognised. During the year under review, and launched its Advance Top-Up buy-now-pay-later feature on the *919# USSD platform, expanding financial access for customers, while the bank’s chatbot Leo continued its strong growth trajectory, with transaction volumes rising by 29 per cent year-on-year in H1 2025. Notably, in August, Leo became the first African banking chatbot to enable cross-border payments via the Pan-African Payment and Settlement System (PAPSS).

UBA’s Group Managing Director/Chief Executive Officer, Oliver Alawuba, while reacting to the achievement, said the recognition affirms the bank’s long-term strategy and customer-first philosophy.

“This honour reflects the strength of our Pan-African network, the trust of our customers, and the dedication of our people. Winning Africa’s Bank of the Year for the third time in five years is not by chance; it is a testament to disciplined execution, innovation, and a deep understanding of the markets we serve,” Alawuba said.

“Our nine country awards across diverse regions of Africa show that UBA is not just growing, but growing with impact. We remain committed to driving financial inclusion, supporting economic development, and deploying technology that makes banking simpler, faster, and more accessible to Africans everywhere,” he added.

United Bank for Africa is one of the largest employers in the financial sector on the African continent, with 25,000 employees group-wide and serving over 45 million customers globally. Operating in twenty African countries, the United Kingdom, the United States of America, France and the United Arab Emirates, UBA provides retail, commercial and institutional banking services, leading financial inclusion and implementing cutting-edge technology.

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle6 years ago

lifestyle6 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health6 years ago

health6 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health6 years ago

health6 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment1 year ago

entertainment1 year agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news9 months ago

news9 months agoBREAKING: Tinubu swears in new NNPCL Board