brand

UBA Strengthens Brand Affiliation on Nigerian Campuses, Unveils 30 Ambassadors

The United Bank for Africa (UBA) Plc has launched the second edition of its Campus Ambassador Programme with the induction of 30 new brand ambassadors.

The UBA Campus Ambassador Programme is an initiative to identify young emerging leaders among students of tertiary institutions and give them a unique and highly rewarding learning experience.

The 30 successful candidates were selected from over 300 students across tertiary institutions in Nigeria through a rigorous screening exercise in line with set criteria.

The colourful inauguration ceremony was held at the UBA house in Lagos on Friday, with Chuks Nweke, Executive Director, Group Chief Operating Officer, and other senior management staff in attendance.

“UBA is pleased to have you all on board as valuable Ambassadors who will help us propagate our goodwill messages, ethos, values and what we stand for as a bank, across your institutions,” Nweke said.

He further noted that the goal is intended to give students a platform to demonstrate leadership as well as build and instill the brand philosophy into the consciousness of youths.

According to Nweke, our bank is a bank with strong affiliation to youths, evident in the Bank’s scholarship and grants schemes through the UBA Foundation National Essay Competition amongst other educational initiatives.

He continued “We at UBA take youth development and engagement seriously, because we believe they are the future of Nigeria. For this reason, we decided to collaborate for the purpose of building their creative skills, leadership skills. It is the abilities that the students exhibited that influenced their selection. No doubt, they have the core values of Enterprise, Excellence and Execution that are dear to us. Starting from now, they are expected to try to exhibit the core values of UBA”.

He further said, this days, Life is tough. “We need people in who can exhibit those qualities, beyond what we’ve done, these are people we have seen leadership traits in. We will work with them to develop their leadership traits, creativity for the good of everyone”.

Also speaking, Mr. Tomiwa Sotiloye, Group Head, Retail & Consumer Banking, explained that, the 30 students selected are from 10 universities. The new ones among them are 25. We have five returning ambassadors from the pioneer set. He noted that among the 15 the bank decided to retain a few outstanding students.

He also stated that the programme is for six months – between now and September. “Starting from next session it will be one year because we have now aligned the programme to the academic calendar – not from January- December which gave us a lot of problems last year”.

“As part of our plans to bring them on board, from now we will take them on an intensive training. They will have specific projects which they will execute after which We will discuss the projects tomorrow. Also worthy of note is that they will get an opportunity for a one month paid internship at any of our branches. They will also get paid for this programme. And for them, a pathway has opened for employment in UBA”, he said.

He also charged them to be good leaders and positive influencers who should stand out by ensuring the bank’s reputation soars high in their respective campuses.

The 30 ambassadors, who are A-list students in their various institutions, include: Hassan Mahmud Balarabe, Ahmadu Bello University, Muftau Monishola Barakat, Ahmadu Bello University, Ibrahim Kamilu Muhammad, Ahmadu Bello University; Okara Daniel, Babcock University; Olujobi Adebayo, Babcock University , Romi Oghoghome, Obafemi Awolowo University; Ajisafe Mojolaadura, Obafemi Awolowo University; Barakat Tiamiyu, Obafemi Awolowo University, Ike Nathaniel C., Obafemi Awolowo University; Fadaini Asalewa Boluwatife , Obafemi Awolowo University; Jaja Queen Oko, Rivers State University; Wuche Jeremiah Chris, Rivers State University; Umeh Justice Frank, University of Abuja; Victor Isah Efekpo University of Abuja, Stanley Nnamdi Alieke, University of Benin; Rita Nkemdilim Okonkwo, University of Benin; Isaiah Confidence O, University of Benin, Ihechi Opara, University of Ibadan, Egbodofo Temitope Sunday, University of Ibadan.

Others are Chiamaka Uzokwe, University of Lagos; Olatunbosun Yetunde Anuoluwapo, University of Lagos, Fatogun Ayomiposi Oluwatoyin; University of Lagos, Nwajiaku, Vivian Nneka, University of Lagos, Winifred C. Mbanugo ,University of Nigeria, Nsukka, Ezeonu Tochukwu Edward, University of Nigeria, Nsukka, Charles-Onah Orlando C., University of Nigeria, Nsukka, Asimiea Ibioku, University of Port Harcourt, Manuel Dateim Ibikebobo, University of Port Harcourt; Beth-karibo Owen Tamunoibi, University of Port Harcourt, Benson Queen Chidinma, University of Port Harcourt

l-r: Group Head, Cards, Digital Banking; Dr. Yinka Adedeji, United Bank for Africa, (UBA Plc), Executive Director, Risk Management & Compliance, Mr. Ike Uche; Group Executive, Digital & Consumer Banking; Executive Director, Group Chief Operating Officer, Operations; Mr. Chukwuma Nweke; Group Head, Retail & Consumer Banking, Mr. Tomiwa Sotiloye; Head UBA Academy, Human Capital Management, Mr. Ayo Orungbe, flanked by the 2nd set of UBA Campus Ambassadors during their Inauguration ceremony at the UBA house in Lagos on Friday

brand

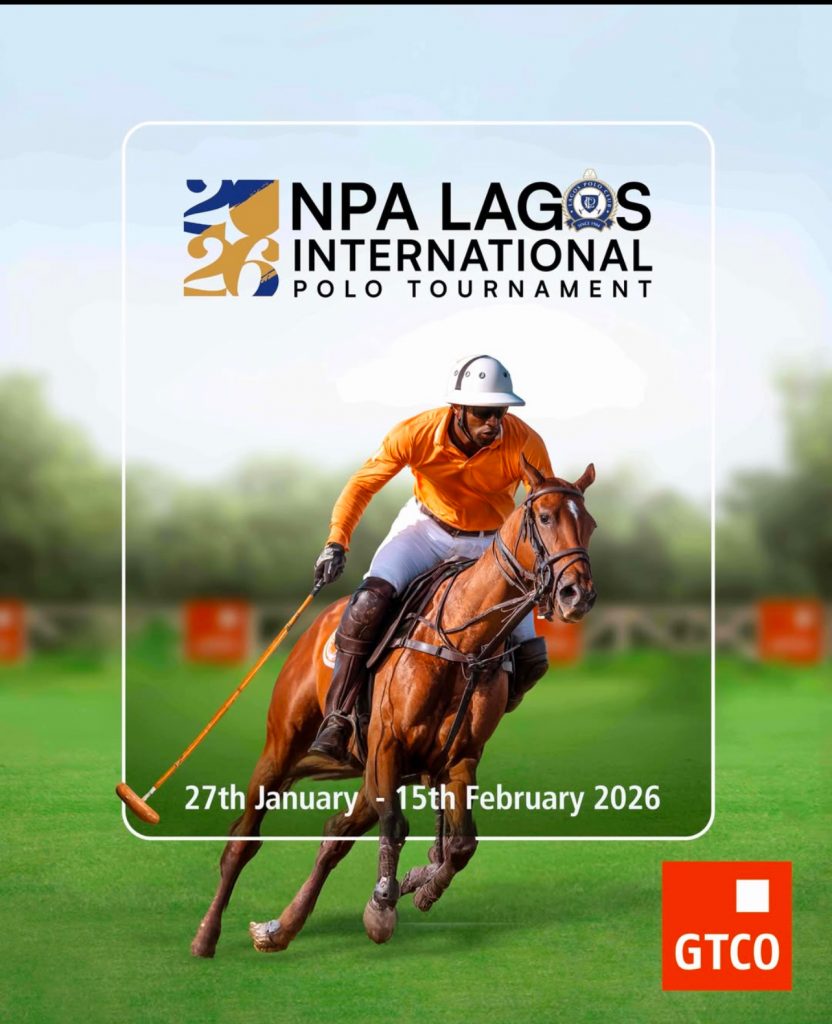

GTCO Proudly Headlines the NPA Lagos International Polo Tournament as Main Sponsor— Championing Great Experiences and Heritage

Guaranty Trust Holding Company Plc (GTCO Plc) (NGX: GTCO; LSE: GTCO), one of Africa’s leading financial services groups, is proud to announce its continued support as the main sponsor of the NPA Lagos International Polo Tournament, one of Africa’s oldest and most prestigious sporting events. The 2026 edition will be held at the Lagos Polo Club, Ikoyi, from Tuesday, January 27 to Sunday, February 15, bringing together top local and international polo teams and spectators from across the continent and beyond.

The 2026 NPA Lagos International Polo Tournament will feature top‑tier teams competing for major prizes, including the Majekodunmi Cup, Independence Cup, Open Cup, Silver Cup and Low Cup, among others. Guests can expect a fusion of thrilling equestrian action, polo-inspired lifestyle showcase, and curated hospitality experiences. The event will also be livestreamed, allowing audiences online to share in the excitement and spectacle.

Commenting on GTCO’s role as main sponsor of the Lagos International Polo Tournament, Segun Agbaje, Group Chief Executive Officer, said: “This tournament, one of the oldest in Africa, celebrates not only the noble sport of polo but the values we hold dear as a brand: teamwork, discipline, fair play, and a commitment to excellence. Beyond the field, it showcases Nigeria and Africa to a global audience, reinforcing the continent’s place on the world stage. Our longstanding sponsorship of the NPA Lagos International Polo Tournament reflects our conviction that sport can amplify opportunity, foster connections, and deliver world-class experiences for all.”

The NPA Lagos International Polo Tournament has long been celebrated not only for its thrilling competition and equestrian excellence but also for its rich heritage and cultural resonance within Africa’s sporting tradition. GTCO’s sponsorship embodies the Group’s commitment to creating platforms that unite communities and drive social impact across diverse audiences.

brand

Fidelity Bank appoints Onwughalu as Chairman following completion of Chike-Obi’s tenure

Tier one lender, Fidelity Bank Plc, has announced the completion of the tenure of Mr. Mustafa Chike-Obi as Chairman of its Board of Directors effective December 31, 2025, and the appointment of Mrs. Amaka Onwughalu as the new Chairman of the Board, effective January 1, 2026.

Tier one lender, Fidelity Bank Plc, has announced the completion of the tenure of Mr. Mustafa Chike-Obi as Chairman of its Board of Directors effective December 31, 2025, and the appointment of Mrs. Amaka Onwughalu as the new Chairman of the Board, effective January 1, 2026.

The board transitions are in alignment with the Bank’s policy and have been communicated to the Central Bank of Nigeria, the Nigerian Exchange Group, and other stakeholders.

Under Mr. Chike-Obi’s leadership, Fidelity Bank repaid its Eurobond, completed the first tranche of its public offer and rights issue that were oversubscribed by 237 percent and 137.73 percent respectively, expanded internationally to the United Kingdom, and received improved ratings from various agencies amongst a long list of achievements. His tenure also saw the Bank strengthen its capital position, record steady growth in customer deposits and total assets, deepen its digital banking capabilities, and enhance its corporate and investment banking proposition. The bank equally made notable progress in governance, risk management, and operational efficiency, all of which contributed to strengthened market confidence and the Bank’s sustained upward performance trajectory.

Reflecting on his tenure, Mr. Mustafa Chike-Obi said, “It has been a privilege to serve as Chairman of Fidelity Bank. The dedication of our Board, management, and staff has enabled us to reach significant milestones. I am confident that the Bank will continue to thrive and deliver value to all stakeholders.”

Mrs. Amaka Onwughalu’s appointment marks a new chapter for Fidelity Bank. She joined the Board in December 2020 and has chaired key committees. With over 30 years of banking experience, including executive roles at Mainstreet Bank Limited and Skye Bank Plc. She holds degrees in Economics, Corporate Governance, and Business Administration, and has attended executive programmes at global institutions. Mrs. Onwughalu is a Fellow of several professional bodies and has received awards for accountability and financial management

“I am honoured to lead the Board of Fidelity Bank at this exciting time. Our recent achievements have set a strong foundation for continued growth. I look forward to working with my colleagues to drive our strategy and deliver sustainable value,” commented Mrs. Onwughalu.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 9.1 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is a recipient of multiple local and international Awards, including the 2024 Excellence in Digital Transformation & MSME Banking Award by BusinessDay Banks and Financial Institutions (BAFI) Awards; the 2024 Most Innovative Mobile Banking Application award for its Fidelity Mobile App by Global Business Outlook, and the 2024 Most Innovative Investment Banking Service Provider award by Global Brands Magazine. Additionally, the Bank was recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence and as the Export Financing Bank of the Year by the BusinessDay Banks and Financial Institutions (BAFI) Awards.

brand

UBA Group Dominates 2025, Banker Awards, Emerges Africa’s Bank of the Year, For Third Time in Five Years

….Wins Best Bank in Nine out of 20 African Subsidiaries

….Wins Best Bank in Nine out of 20 African Subsidiaries

Africa’s Global Bank, United Bank for Africa (UBA) Plc, has once again, reaffirmed its leadership as one of the continent’s most innovative and resilient financial institutions, as the bank has, for the third time in five years, been named the African Bank of the year 2025 by the Banker.com.

UBA also won the Best Bank of the Year awards in nine of its 20 African subsidiaries, bringing its total awards this year to ten as UBA Benin, UBA Chad, UBA Republic of Congo (Congo-Brazzaville), UBA Liberia, UBA Mali, UBA Mozambique, UBA Senegal, UBA Sierra Leone, and UBA Zambia, all came out tops as the best banks in their respective countries, underscoring the bank’s strength across West, Central and Southern Africa and highlighting the depth of its Pan-African franchise.

The Banker.com, a leading global finance news publication published by the Financial Times of London, organises the annual Bank of the Year Awards, and this year’s edition was held at a grand ceremony at the Peninsula, London, on Wednesday.

The Chief Executive Officer, UBA UK, Deji Adeyelure, received the awards on behalf of the bank, representing the Group Managing Director/CEO, Oliver Alawuba, and was accompanied by the bank’s Head Business Development, Mark Ifashe, and Head, Financial Institutions, Shilpam Jha.

The Banker’s awards are widely regarded as the most respected and rigorous in the global banking industry, celebrating institutions that demonstrate outstanding performance, innovation and strategic execution.

In its remarks on UBA’s winnings, the banker.com said, “For the third time in five years, UBA Group has won the coveted Bank of the Year award for Africa. UBA Group time after time punches above its weight against its larger African rivals. The bank this year also takes home nine separate country awards (one more than it gained for its last continental win in 2024), equivalent to around a quarter of the awards for the continent, and more than any of its continent-wide rivals.”

Continuing, it said, “Perhaps even more impressive is the fact that the awards were won across a broad geographic spread, going to lenders based in the Economic Community of West African States (Benin, Liberia, Senegal, Sierra Leone, and former member Mali), the Central African Economic and Monetary Community (Chad, Republic of Congo) and the Southern African Development Community (Mozambique, Zambia). Its award wins were particularly notable in the highly competitive categories for Benin and Mozambique.”

The Banker also highlighted UBA’s strong financial performance and commitment to future growth. In 2024, the Group recorded a 46.8 per cent increase in assets and a 6.1 per cent rise in pre-tax profits in local currency terms, while continuing to invest significantly in talent and technology. West Africa remains UBA’s heartland, with operating revenue and profit increasing by 87 per cent and 89 per cent respectively in H1 2025.

The bank’s digital and innovation leadership was equally recognised. During the year under review, and launched its Advance Top-Up buy-now-pay-later feature on the *919# USSD platform, expanding financial access for customers, while the bank’s chatbot Leo continued its strong growth trajectory, with transaction volumes rising by 29 per cent year-on-year in H1 2025. Notably, in August, Leo became the first African banking chatbot to enable cross-border payments via the Pan-African Payment and Settlement System (PAPSS).

UBA’s Group Managing Director/Chief Executive Officer, Oliver Alawuba, while reacting to the achievement, said the recognition affirms the bank’s long-term strategy and customer-first philosophy.

“This honour reflects the strength of our Pan-African network, the trust of our customers, and the dedication of our people. Winning Africa’s Bank of the Year for the third time in five years is not by chance; it is a testament to disciplined execution, innovation, and a deep understanding of the markets we serve,” Alawuba said.

“Our nine country awards across diverse regions of Africa show that UBA is not just growing, but growing with impact. We remain committed to driving financial inclusion, supporting economic development, and deploying technology that makes banking simpler, faster, and more accessible to Africans everywhere,” he added.

United Bank for Africa is one of the largest employers in the financial sector on the African continent, with 25,000 employees group-wide and serving over 45 million customers globally. Operating in twenty African countries, the United Kingdom, the United States of America, France and the United Arab Emirates, UBA provides retail, commercial and institutional banking services, leading financial inclusion and implementing cutting-edge technology.

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle6 years ago

lifestyle6 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health6 years ago

health6 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health6 years ago

health6 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment1 year ago

entertainment1 year agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news9 months ago

news9 months agoBREAKING: Tinubu swears in new NNPCL Board