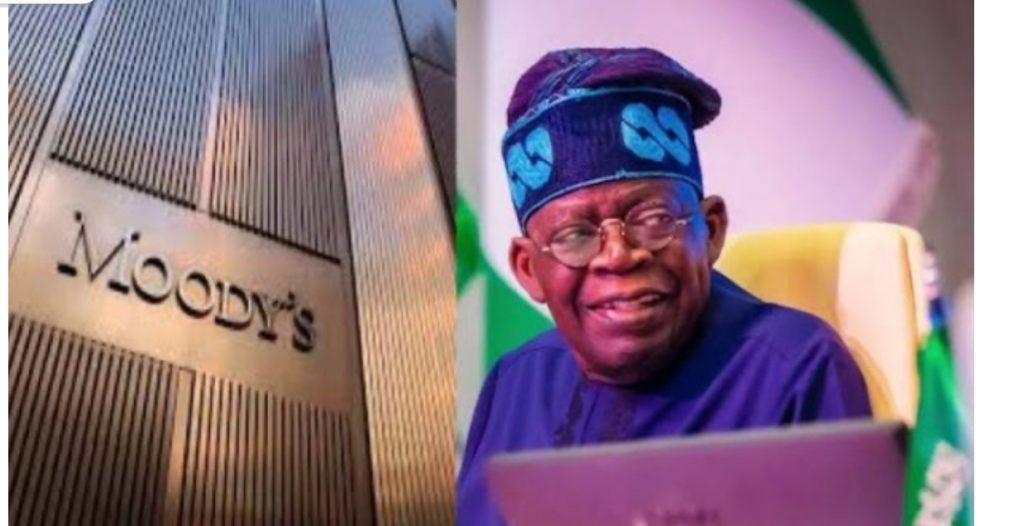

The Federal Government welcomed the development, describing it as further validation of ongoing efforts to strengthen macroeconomic stability and restore investor confidence under the administration of president Bola Tinubu.

Moody’s stated that its latest action reflects significant improvements in Nigeria’s fiscal and external positions, underpinned by policy measures adopted since President Tinubu assumed office in May 2023.

In December 2023, Moody’s had already revised Nigeria’s outlook from Caa1 Stable to Caa1 Positive, making the current upgrade to B3 the second positive action from the agency in less than a year.

Moody’s attributed its decision to the government’s commitment to correcting macroeconomic imbalances, deepening fiscal transparency, and pursuing structural reforms. Notable among these, according to the agency, are ongoing tax reforms and the adoption of a more flexible, market-driven foreign exchange regime, which has led to a more efficient allocation of resources and a bolstering of the country’s external reserves.

Responding to the development, the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, said the upgrade reflects the administration’s determination to achieve economic stability and sustainable growth.

“We are encouraged by Moody’s recognition of our reform agenda,” Edun said. “This positive outlook reflects our administration’s determination and the tremendous work being carried out across various Ministries, Departments, and Agencies (MDAs)—including our monetary policy authorities at the Central Bank of Nigeria—to stabilize the economy, attract investment, and ensure inclusive and sustainable growth for all Nigerians.”

The Tinubu administration has since its inception introduced what it describes as tough but necessary reforms aimed at reversing long-standing distortions in Nigeria’s macroeconomic framework. These include the removal of petrol subsidies, unification of exchange rates, broadening of the tax base, and measures to improve public financial management.

The Federal Ministry of Finance, in a statement, noted that the timing of the upgrade is significant, coming at a period when the government is focused on accelerating economic growth through increased private sector participation. According to the ministry, efforts are underway to improve infrastructure financing, deepen the financial sector, and expand access to capital for productive activities.

“The government will continue to collaborate with both domestic and international partners to boost investor confidence and enhance Nigeria’s global credit standing,” the ministry said.

Analyst, Dr. Wahab Balogun, Managing Director and Chief Executive Officer of Ambosit Capital Managers said that a better credit rating provides a foundation for Nigeria to re-engage international capital markets under more favourable terms, potentially reducing debt service costs and freeing up fiscal space for development spending.

“With the stable outlook assigned by Moody’s, Nigeria is not expected to face an imminent downgrade or upgrade. This indicates that the reforms currently in place are perceived as credible, with no immediate risks that could undermine the rating. It also reinforces the view that the government’s policy direction is yielding early positive results, though sustained implementation will be necessary to achieve long-term benefits” he said.

He added that “the dual upgrades by Fitch and Moody’s have been received in financial and investment circles as indicators of Nigeria’s return to a path of responsible economic management, capable of restoring the country’s standing in global finance.”

As Nigeria seeks to attract more private capital—both domestic and international—to power its development priorities, the improved ratings could become a useful lever in supporting long-term plans for economic diversification, infrastructure development, and inclusive growth

For the second time in as many months, Nigeria’s sovereign credit rating has been lifted into more favourable territory by a major international rating agency, with Moody’s Investors Service upgrading the country’s long-term issuer ratings from Caa1 to B3 and assigning a stable outlook.

For the second time in as many months, Nigeria’s sovereign credit rating has been lifted into more favourable territory by a major international rating agency, with Moody’s Investors Service upgrading the country’s long-term issuer ratings from Caa1 to B3 and assigning a stable outlook.

President Bola Tinubu says Nigeria and Türkiye have agreed to fast-track cooperation in trade, energy and defence to boost jobs, investment and shared prosperity.

President Bola Tinubu says Nigeria and Türkiye have agreed to fast-track cooperation in trade, energy and defence to boost jobs, investment and shared prosperity.