news

The Messy Scandal Sheet of City Lawyer, Boardroom Guru and Business Mogul, TUNDE AYENI

-How he got enmeshed in serial multi-billion Naira mess.The truth about the former Skye Bank Chairman’s N150b fraud!

.How he milked Skye Bank dry!

+How his lawyers are fighting hard with their legalese for his release

Undisputedly astute businessman but now viciously embattled Tunde Ayeni, is a lawyer, investor and astute business magnate who sits atop the boards of a handful of successful and multinational companies in Nigeria and abroad as the Chairman. Little wonder, in the year 2011, mercurial and very business-minded Ayeni, was elected the Chairman of Skye Bank,[which was formed in 2005, when five commercial banks including Tunde Ayeni’s-owned and now moribund Bond Bank, merged to create a new entity with a balance sheet in excess of ₦1 trillion. Additionally, Ayeni was also the Vice Chairman of Aso Savings & Loans after emerging the majority shareholder in 2007. He also co-founded Ocean Marinse Security (OMS), a company that provides logistical support to the Nigerian Navy. Out of his deep knack for business, Tunde Ayeni became the Vice Chairman of Integrated Energy Distribution and Marketing Ltd (IEDM) in 2013, where he led a successful bid to take control of the Ibadan and Yola Electricity Distribution Companies. This marked the first privatization of a national energy asset in Nigerian history. He is also chairman of JKK (Nigeria) Plc and Temple Resources Ltd, and sits on the boards of PPP Fluid Mechanics Limited and Hightech Procurement Limited. On July 2016, Tunde Ayeni’s many dirty financial deals were exposed. It became a veritable and ugly news item for many, as the hitherto prudent businessman was exposed and tagged a controversial personality who can no more be trusted with people’s monies. Tunde Ayeni, who had his fingers burnt when the Economic and Financial Crimes Commission arrested and detained him for alleged financial fraud running into N8 billion which he allegedly committed as the Chairman of Skye Bank now Polaris Bank. Immediately men of the EFCC got hold of Ayeni and remanded him in their custody, several allegations were rolled out against this Iyah-Gbede, Ijumu, Kogi State-born boardroom guru, Tunde Ayeni. These ranged from his free-spending and massive attitudes at parties and events, to lavishing huge amount of money on frivolities like fleet of automobiles of different makes and brands, flamboyantly spending and using his position as a bank Chairman to grant loans for close family members, cronies, friends and aides which later resulted into un-serviced loans and many other financial misappropriations. We also gathered that other companies chaired by Tunde Ayeni were not left out of this financial turmoil and flagrant abuse of office by Ayeni. The companies were also reported to have felt the heat then. For example, his then fledgling ntel, a telecoms outfit, could not meet up with the information and communication needs of Nigerians, due to scarcity of funds for its smooth take-off and rewarding operations. But the worst hit by Tunde Ayeni’s financial carelessness, recklessness and ruthlessness, was the Skye Bank. Realizing how dangerous Ayeni’s financial modus operandi could be to the well-being of the bank, the EFCC stepped briskly into the issue and pronto, Ayeni was whisked away by the anti-graft agency. Furthermore, the EFCC later filed very damning charges against Tunde Ayeni before a Federal High Court in Maitama, Abuja in the Federal Capital Territory. Ayeni was variously charged by the EFCC for mismanaging the funds of Skye Bank which thereafter, ultimately led to its collapse. Back then, the Managing Director and Chief Executive of the Nigeria Deposit Insurance Corporation, Alhaji Umaru Ibrahim, had disclosed that Ayeni and a former Skye Bank Managing Director, Timothy Oguntayo, are being investigated for their shady roles in the financial fraud that rocked the bank. While Tunde Ayeni’s investigations and cross-examinations were on-going, the Central Bank of Nigeria, NDIC and AMCON revoked the operating license of Skye Bank. This was due to the bank’s financial instability, thus necessitating the regulators to rename it Polaris Bank with a capital injection of about $2bn. 51-year-old Ayeni chaired the board of Skye Bank between the years 2010 to 2016 before his removal by the Central Bank of Nigeria (CBN). Moreover, Ayeni was also investigated for illegally injecting a whopping N3 billion (three billion naira) into the re-election campaign of former President Goodluck Jonathan. Controversial Tunde Ayeni was also accused to have used his position to obtain loans to purchase ntel, take up power distribution with the establishment of Ibadan Electricity Distribution Company and Yola Electricity Distribution Company. All these allegations were all put up against Tunde Ayeni at the Court of Law then and the Kogi-born businessman found himself in huge financial quagmire. The then AMCON Managing Director, Ahmed Kuru was said to have included Tunde Ayeni as one of the debtors of a whopping N906 billion naira. When Skye Bank was founded in 2005, the financial institution has been serially plundered by its key management figures. However, the coming on board of former Inspector General of Police, Musiliu Smith as the bank’s chairman brought a new dimension into the operation of the bank affording the financial institution to be able to plod along impressively keeping its nose as clean as whistle. But, like a twist of fate, the successor to Musiliu Smith, Tunde Ayeni a parvenu oil and gas magnate as the Chairman of the bank ushered in an era of derring-do, dodgy financial gymnastics and kamikaze deposit plundering. In a letter written then to the Acting President the new Central Bank of Nigeria- appointed Board the bank has alleged that Ayeni was indebted to the bank by a staggering and largely unrecoverable N150 billion.

In a letter written to the then Acting President the Central Bank of Nigeria- appointed Board the bank alleged that Ayeni was indebted to the bank by a staggering and largely unrecoverable N150 billion. If any Nigerian bank in contemporary times had ever been thoroughly ravaged and assaulted by its board Skye takes the lead. Two of the larger banks in the 2005 merger were EIB bank and Prudent bank run by Sola Akinfemiwa. The Central Bank of Nigeria-inspired banking sector consolidation of the time afforded these bank executives to consolidate their interests in a bigger, and what they hoped to be a more stable institution.

The consolidated banks were Prudent Bank Plc, EIB International Plc, Bond Bank Limited, Reliance Bank Limited and Co-operative Bank Plc. Ironically, Ayeni was instrumental to the evolution of the bank, as he was said to have used various bank loans to buy Mainstreet Bank for N135 billion from AMCON and merged it with Skye Bank to form a bigger franchise.

Ayeni, a constant, but highly influential figure in former President Goodluck Jonathan’s government, had spiritedly leveraged on his closeness to Jonathan, the now late former governor of Bayelsa State Deprieye Alamaesiagha and Diezane Alison-Madueke, former petroleum minister to make significant economic gains for himself through ruthless takeovers and deals, either as a proxy for the alleged triumvirate or as the main deal maker.For instance, he allegedly purchased Nitel/Mtel at $252 million, a cost well below the actual value of the moribund parastatal. According to reports, he owns the consortium that bought over Ibadan Electricity Distribution Company as well as the Yola Distribution Company, at also prices well below their intrinsic valuation. In 2012, he became the chairman of Skye Bank and significantly leveraged on his position on the board to pillage the bank to fund a bohemian lifestyle, often using the bank’s funds to make oil sector investments with uncertain prospects; a situation which a source that preferred not to be mentioned in print confided had depleted the Bank’s general reserves by a whopping N48bn. Little wonder his speculated N3 billion donation to the President Goodluck Jonathan reelection campaign caused so much anxiety among Skye Bank customers who, for fear of safety of their savings, went on panic withdrawals when the news broke.

Recently, the Management of Skye Bank Plc has reportedly written to Acting President Yemi Osinbajo, detailing how Tunde Ayeni, Chairman of the bank between 2010 and 2016, wrecked havoc on the institution. In a deluge of letters and documents, the Management listed details of how Ayeni allegedly used his office to perpetrate illegality and fraud that nearly brought the bank to its knees. The apex bank had watched the Skye Bank saga with bated breath, but after several warnings, the Central Bank of Nigeria (CBN) took over Skye Bank on July 4, 2016. Godwin Emefiele, governor of CBN, said at the time that the action followed the failure of the lender to meet the regulator’s minimum key liquidity and capital adequacy ratios.

Ayeni had resigned following the development, and CBN announced the appointment of Muhammad Ahmad as the new chairman, while Adetokunbo Abiru took over from Timothy Oguntayo as group managing director (GMD.) In a letter signed by Abiru and Ahmad, the bank presented in graphic details how Ayeni allegedly used loans from the bank to acquire major government companies. The letter was unsparing of the debauchery committed at the bank under Ayeni’s controversial chairmanship. “Upon the assumption of duty by the new board, one of the immediate concerns that needed to be addressed was to ascertain the true state of the affairs and financial position of the bank and the credibility of the IT and information systems of the bank,” the letter read. To this end, the following were undertaken: engagement of PWC does to half-year audit as of June 30, 2016. This was later extended to cover the full year to December 31, 2016.

“The engagement of KPMG to do a forensic audit of the bank’s IT platform and management information systems; and The forensic audit revealed that the bank operated two sets of financial books and this was responsible for the regulators/auditors inability to detect the massive losses and infractions, particularly the balance of N280bn in suspense accounts. The bank’s total exposure to Ayeni as of the date is about N70bn. It is clear that he used his position as the chairman of the bank to obtain inside loans well above the regulatory thresholds for the acquisition of the following government enterprises: Ibadan Electricity Distribution Company, Yola Ibadan Electricity Distribution Company and Nitel/Mtel. All the facilities are presently seriously challenged. As of today, Ayeni’s total industry indebtedness, covering both Nitel and the Electricity Distribution Companies (Discos) is estimated at about N150bn, and little, if any, of these obligations are being adequately serviced, it is doubtful that he will ever be in a position to service these loans satisfactorily.” The expository letter also hinted at another N33billion traced to Ayeni, with strong suspicion that out of this amount, N7 billion was spent on the re-election campaign of former President Goodluck Jonathan.

The sum of N7bn was disbursed without due process to various individuals and corporate organizations on the request of Godknows Igali, a former permanent secretary of the federal ministry of power,” it read. “The monies appear to have been spent essentially on the Jonathan-Sambo electoral campaign in 2015. That sum remains outstanding as at today. “There is ample evidence that he (Ayeni), among others, received large amounts of cash, totaling N29.5bn, from the bank, which appears to be connected to the purchase of Mainstreet Bank Limited, but which has not been accounted for. In the face of this monumental rape, the Management has appealed to the government to assist it to seize Ayeni’s assets. “The former chairman should be brought to account for his central role in many of the identified infractions,” it read. “We have been able to perfect the debenture on the fixed and floating assets of Natcom, the vehicle that was used for the acquisition of Nitel and Mtel with asset estimated at N282bn (Open market value) and N183bn (forced sale value) by Knight Frank in 2014. This will put us in a position to place the company into receivership for recovery. However, in order to come to fruition, this approach will require strong and unyielding support from the regulatory and political authorities in the country.” The management also indicted Akinsola Akinfewa, Kehinde Durosinmi-Etti and Timothy Oguntayo, all former GMDs of the bank. Other individuals listed in the petition for various acts of infraction are Femi Otedola, chairman Forte Oil Plc, Festus Fadeyi and Jide Omokore. Recall that agents of the Economic and Financial Crimes Commission (EFCC) had in the past arrested and detained Tunde Ayeni, Skye Bank’s erstwhile Chairman, over allegations that he allegedly bribed a former minister of the Federal Capital Territory (FCT), Bala Mohammed, to acquire 54 plots of land in Abuja, the Nigerian federal capital city. Two EFCC sources informed some media guys at the time, that at his arrest, he was initially reluctant to co-operate. He had earlier been investigated for playing various roles in different business deals involving former First Lady Patience Jonathan and a former head of state, Abubakar Abdulsalam, who co-owns a telecommunications company with the former bank Chairman. Already, the Management of Skye bank is reportedly seeking to take over some oil wells belonging to Jide Omokore, a businessman involved in a number of corruption cases within and outside Nigeria. The bank said Omokore is indebted to it to the tune of N110bn at an exchange rate of $1/N315. The loans in question were said to have been obtained through three companies namely: Atlantic Energy Drilling Concepts (N56 billion), Cedar Oil and Gas Ltd (N22.4 billion) and Real Bank Ltd (N31 billion.) The new management of Skye bank has claimed that the repayment of two major obligations of the oil companies is tied to the controversial strategic alliance agreements (SAAs) with the Nigerian National Petroleum Corporation (NNPC.) Atlantic Energy was awarded SAAs by the Nigerian Petroleum Development Company (NPDC) Ltd, a subsidiary of NNPC, to develop and finance production from OMLs 26, 42, 30 and 34 – four oil blocks in all – in 2011.NPDC valued its stake in the oil wells at $1.8 billion then. The Economic and Financial Crimes Commission (EFCC) has frozen the assets of Omokore over suspicion of money laundering and procurement fraud.

In the letter to the Acting President, Skye bank has appealed that the federal government grant it access to the assets that were funded with loans from the bank.

“We will require assistance for the extrication of the real estate assets that were fully funded with loans from the bank from the assets of Omokore presently under the forfeiture order from the court,” the letter read. “This will enable us have access and rights over these assets and put the bank in a position to realize the assets that form the collateral for the loans granted to Real Bank limited.” The bank also sought assistance to take control of the oil assets of Omokore.

“We will require some political intervention working with the NNPC to be able to bring this matter relating to Atlantic Energy to a quick resolution,” the letter read

Skye Bank is struggling to survive, but analysts doubt its capacity to stay afloat given deep depositor suspicion of its solvency, its high and rising interest expenses relative to interest income and its evidently narrowing net interest margin. Victor Ukpai, a Research Analyst at Focus Bank, points out that a critical problem at Skye Bank was the apparent weakness of corporate governance, ‘those that should have given oversight integrity and corporate direction were the wolves at the gate’, he notes. According to Ukpai, ‘the regulatory bodies need to be a lot more thorough and circumspect in approving board positions of banks, detailed security checks and other ancillary means of intelligence gathering should be conducted before the approval of board members, only recently two prospective members of the board of an anti corruption agency were found to be under investigation by that very same agency!’. Skye Bank may not topple over but the outlook appears bleak as the two Kogi state indigenes of Tunde Ayeni and Jide Omokore, have dealt severe blows to the banks underlying liquidity and its supporting business capital. After the whole scenario then, an FCT High Court in Maitama ordered the Economic and Financial Crimes Commission (EFCC) to immediately release the Tunde Ayeni. The then trial judge, Justice Yusuf Halilu held that the anti-graft agency had suppressed facts which misled the court into earlier granting the application, thereby, making the detention illegal. The decision of the court followed an enforcement of fundamental rights suit filed by Ayeni, through his counsel, Ahmed Raji (SAN) seeking his release from the EFCC custody. At that period, Raji told the court that there was a pending suit before the Federal High Court against Tunde Ayeni on the same subject matter and that the trial judge at the Federal High Court then, Justice Nnamdi Dimgba had in the particular case admitted his client to bail. He added that the bail condition had since been perfected. Raji added that the detention of the applicant was a breach of his fundamental human right as he went to the commission by himself on invitation. When Ayeni’s case was on at the court, several revelations were made which included that Ayeni as the then Chairman of Skye Bank in connivance with the then Managing Director and Chief Executive Officer, Timothy Oguntayo conspired at different times to steal huge cash amounting to a whopping N4,750,000:00 (Four Billion, Seven Hundred and Fifty Million Naira) and USD5,000,000 (Five Million United States Dollars) belonging to Skye Bank Plc. According to information made known to the press by the court then, this sinful act of Tunde Ayeni and Oguntayo was contrary to the provisions of Section 1(a) of the Money Laundering (Prohibition) Act 2011 (as amended) read together with Section 18 (a) of the Money Laundering (Prohibition) Act 2011 (as amended) and punishable under Section 16(2) (b) of the Money Laundering (Prohibition) Act 2011 (as amended.)” However, seeing that the issue may land him in jail and destroy his ‘hard earned’ image, Ayeni involved the services of highly respected legal practitioners like Wole Olanipekun, Dele Adesina etc. to battle for his soul. These lawyers fought tooth and nail with the EFCC and Tunde Ayeni was given a controversial bail in the sum of N50 million with two sureties in like sum then. Oguntayo, through his own counsel, Oyetola Oshobi was also given the same bail condition. This was how Tunde Ayeni’s lawyers ensure he continue to breathe free air till date even though he has lost his credibility in the comity of businessmen and boardroom tycoons both in Nigeria and the international business community. How Tunde Ayeni will escape the gulag given the monumental and ground-swelling allegations and fraudulent charges against him, will take the courts of law to do the needful legally and appropriately.

news

Opeifa Defends Rail Reforms, Unveils Nationwide Expansion Roadmap

Opeifa maintained that derailments are not peculiar to Nigeria, noting that such incidents occur across advanced rail systems globally.

Opeifa maintained that derailments are not peculiar to Nigeria, noting that such incidents occur across advanced rail systems globally.

“Derailments are regular occurrences in the rail sector worldwide. In February alone, there were incidents in countries like Britain and others. Around the same time we experienced one, there were multiple derailments across the world,” he said.

He disclosed that in 2025, Nigeria recorded three major derailments:

• August 26 at Asham in Kaduna State

• November 1 at Abraka on the Warri–Itakpe line

• November 8 at Agbor on the same corridor

He said the NRC responded swiftly, restoring services within 24 hours in one case, while others were resolved within 21 and 28 days respectively.

Opeifa stressed that derailments can result from factors such as weather conditions, signal glitches, human error, speeding, or aging infrastructure, but noted that in Nigeria’s recent cases, there were no fatalities.

“These incidents are preventable and efforts are ongoing to minimize them. However, they should not be seen as major setbacks to the overall progress of the railway system,” he said.

On Allegations of Mismanagement

Addressing allegations of financial mismanagement within the corporation, Opeifa declined detailed comments, citing ongoing legal processes.

“When a matter is in court, it is sub judice. Allegations of corruption or mismanagement should be handled by the appropriate authorities,” he stated.

He reiterated that his priority is to reposition the NRC in line with global best practices and ensure efficient rail services for Nigerians.

Expansion, Upgrades and National Connectivity

The NRC boss said efforts are underway to restore damaged coaches and upgrade infrastructure using local engineers and technicians.

“We are bringing back the lines and retrofitting coaches. The Warri–Itakpe line is operational. The Abuja–Kaduna line is running, and we are increasing trips from two to three,” he said.

On long-term plans, Opeifa disclosed that the NRC roadmap envisions rail connectivity across major cities nationwide, subject to funding and phased execution.

He dismissed claims of abandoned projects, explaining that rail developments are capital-intensive and implemented in phases based on available resources.

He cited progress on the Lagos–Ibadan corridor—part of the larger Lagos–Kano project—as well as ongoing work on the Kano–Maradi line linking key northern cities.

Lagos–South-East, Port Connections in View

Opeifa also highlighted plans to expand connectivity between southern ports and inland cities. These include proposed links from Warri to Abuja and from Lekki Deep Sea Port to Kajola, Benin, Onitsha, and Aba, enabling both passenger and cargo movement.

Toward Modern Signaling and Faster Trains

On modernization, he said Nigeria is gradually upgrading from older narrow-gauge systems to standard-gauge infrastructure with improved signaling technology.

He noted that metro rail projects in Kaduna, Kano, and Lagos are being developed with higher signaling standards, positioning the country for faster and more efficient train services in the coming years.

“We are not yet at the highest global level, but we are moving steadily upward,” Opeifa said.

news

Ticket Reform Boosts Confidence in Lagos–Ibadan Rail Service, Says Opeifa

A quiet transformation is reshaping the daily commute between Nigeria’s commercial hub and the historic city of Ibadan. Passengers on the Lagos–Ibadan standard gauge corridor say services have become more efficient and predictable following a clampdown on ticket racketeering led by Kayode Opeifa

A quiet transformation is reshaping the daily commute between Nigeria’s commercial hub and the historic city of Ibadan. Passengers on the Lagos–Ibadan standard gauge corridor say services have become more efficient and predictable following a clampdown on ticket racketeering led by Kayode Opeifa

The renewed confidence in the rail line linking Lagos and is influencing residential and employment decisions among middle-income earners who once considered daily intercity commuting unrealistic.

“It is now possible to live in Ibadan and work in Lagos without the daily anxiety of securing a ticket,” said Adewale Bamidele, a financial analyst who travels three times a week. “Before, you needed connections. Now, you book, you board, you arrive.”

A Line Once Hindered by Middlemen

The Lagos–Ibadan railway, inaugurated as a flagship infrastructure project under the administration of former President Buhari was designed to ease pressure on the congested Lagos–Ibadan Expressway and deepen economic integration across the South-West.

However, in its early phases, passengers frequently complained of informal ticket rackets. Allegations included bulk-buying by intermediaries and artificial scarcity that forced travellers to pay inflated prices for seats on high-demand trains.

Industry observers say such practices undermined the railway’s credibility as a mass transit solution. “Transport systems thrive on predictability and fairness,” said a transport economist “Once access is perceived as compromised, commuters revert to road transport despite the risks and delays.”

Enforcement and Digitisation

Since assuming oversight responsibilities within the sector, Opeifa has reportedly intensified internal monitoring and strengthened digital ticketing protocols. Railway officials, speaking on condition of anonymity, said stricter verification processes and disciplinary measures against errant staff have curtailed unauthorised ticket sales.

Although the Nigerian Railway Corporation has not released detailed enforcement data, anecdotal evidence from regular commuters points to shorter queues, smoother boarding procedures and fewer last-minute cancellations.

For professionals with flexible work schedules, the improvement has been significant. The average journey time of about two to three hours—depending on the service type—now compares favourably with unpredictable road travel, which can take considerably longer during peak traffic.

Changing Urban Dynamics

Property agents in Ibadan report a modest rise in enquiries from Lagos-based workers seeking more affordable housing. Rents in many parts of Ibadan remain significantly lower than comparable neighbourhoods in Lagos, offering relief to households grappling with inflationary pressures.

“Rail reliability changes everything,” said Funke Adebayo, a real estate consultant in Ibadan. “When people trust the timetable, they are more willing to relocate.”

Economists caution, however, that long-term success will depend on consistent maintenance, adequate security along the corridor and transparent ticketing systems. Any return to informal practices could quickly erode recent gains.

The Lagos–Ibadan corridor is widely regarded as a litmus test for Nigeria’s broader rail ambitions. With additional standard gauge projects planned or underway nationwide, policymakers face mounting pressure to ensure that infrastructure investments translate into reliable public service delivery.

For now, passengers remain cautiously optimistic.

“It feels more organised,” Bamidele said while disembarking at Mobolaji Johnson Station in Lagos. “If this standard is sustained, rail can genuinely compete with road transport.”

Nigeria agree, the real challenge lies not just in laying tracks, but in sustaining public trust.

news

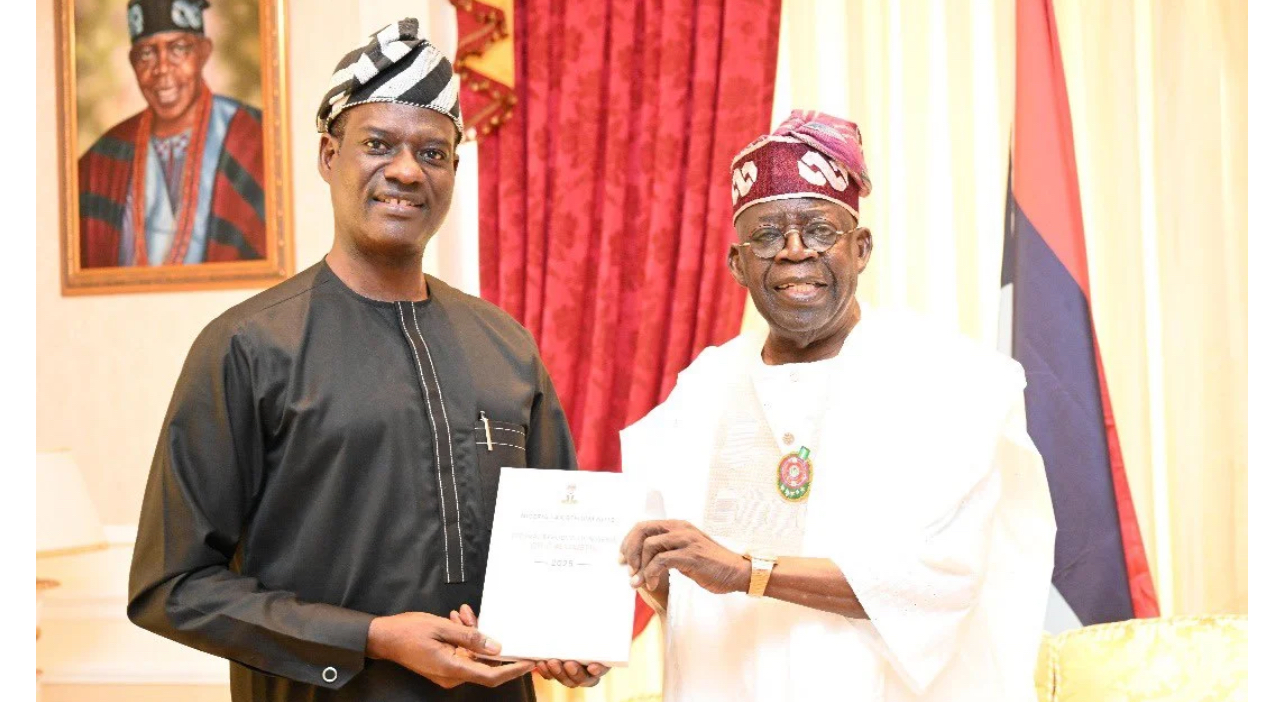

Breaking : Finance Ministry Shake-Up: Tinubu Nominates Oyedele, Says Onanuga

President Bola Tinubu has nominated the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Dr. Taiwo Oyedele, as the Minister of State for Finance.

Oyedele replaces Dr. Doris Anite-Uzoka, who has been redeployed to the Ministry of Budget and National Planning as Minister of State, her third portfolio in the administration.

The President on Tuesday conveyed Oyedele’s nomination to the Senate for confirmation in a letter to the Senate President, Godswill Akpabio, according to a statement by his Special Adviser on Information and Strategy, Bayo Onanuga, on Tuesday.

Until Tinubu nominated him as a minister, Oyedele from Ikaram, Akoko, Ondo State, was the chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, which overhauled Nigeria’s tax system.

The 50-year-old is an economist, accountant, and public policy expert who led the comprehensive overhaul of Nigeria’s tax system through the Presidential Committee on Fiscal Policy and Tax Reforms.

The committee, inaugurated in August 2023, delivered four executive bills that consolidated over 60 taxes into fewer than 10 statutes and introduced significant reforms, including zero income tax for Nigerians earning N800,000 annually or less.

The Tax Reform Acts, which became effective on January 1, 2026, also exempted small businesses with turnover below N50m from company income tax, capital gains tax, and development levy.

Other provisions include a 50 per cent tax deduction for companies hiring new workers for three years, a 50 per cent deduction for wage increases to the lowest-paid employees, and a five-year corporate tax holiday for agricultural enterprises.

Oyedele attended Yaba College of Technology, where he obtained a Higher National Diploma in Accountancy and Finance, before proceeding to Oxford Brookes University for a BSc in Applied Accounting.

He also completed executive education programmes at the London School of Economics, Yale University, the Gordon Institute of Business Science, and the Harvard Kennedy School.

Oyedele spent 22 years at PricewaterhouseCoopers, joining in 2001 and rising to become the Fiscal Policy Partner and Africa Tax Leader before his appointment to head the tax reform committee.

He is currently a professor at Babcock University in Ogun State and a visiting scholar at the Lagos Business School.

As Minister of State for Finance, Oyedele is expected to oversee the implementation of the tax reforms he championed, particularly as the government seeks to improve revenue generation and deepen economic reforms.

Anite-Uzoka, who is being redeployed to the Ministry of Budget and National Planning, previously served as Minister of State for Industry, Trade and Investment before her appointment as Minister of State for Finance.

The Senate is expected to screen and confirm Oyedele’s nomination in the coming weeks, following which he will be sworn in to assume his ministerial duties.

The Finance Ministry, currently led by Wale Edun as substantive minister, oversees fiscal policy, revenue mobilisation, debt management, and economic planning.

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle6 years ago

lifestyle6 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health6 years ago

health6 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health6 years ago

health6 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment1 year ago

entertainment1 year agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news10 months ago

news10 months agoBREAKING: Tinubu swears in new NNPCL Board