brand

UBA Foundation’s National Essay Competition 2020 brings out the finest young creative writers in a challenging year

…. Ten out of the twelve winners are girls

…. Ten out of the twelve winners are girls

The UBA Foundation, the CSR arm of the United Bank for Africa, today, held its tenth annual National Essay Competition(NEC) in a virtual ceremony that was attended by high school students from across the nation. The UBA Foundation’s Education initiative has been changing lives for a decade as the tertiary education scholarship programme continues to impact the lives of many students and their communities.

For the fourth consecutive year, the females have been leading this competition with14 year-old Eshiet Abasiekeme of Bright Stars Model Secondary School from Akwa-Ibom state taking home this year’s winning prize. Eshiet received an educational grant of N2,500,000.00 to study in any African university of her choice. She will also be supported throughout her educational career and beyond with constant mentoring by the UBA Foundation.

Abasiekeme who had joined the virtual event from her base in Akwa Ibom state in Nigeria, could not contain her excitement as she heard the announcement that she had won the first prize of the NEC 2020. “I feel honoured to be the winner of this year’s NEC, and I want to appreciate UBA and UBA Foundation as this will help towards my dream of becoming a lawyer,” she said proudly, expressing that she would like to go to university in Uyo in her home state.

The second prize was awarded to 14 year old Mofoluwake Adesanya of Spring Forte-Lead College Lagos State, who won a N2,000,000 educational grant, whilst the third prize of N1,500,000 went to Abdulganiyy Habeebah, 16 years old. Abdulganiyy attends the International School, University of Lagos.

Eshiet and the 11 other finalists, took home their brand new lap top computers to enable them continue to work competitively in a world that is rapidly becoming fully digitalised.

Congratulating all the winners at the final event of the competition, the Managing Director/CEO of UBA Foundation, Bola Atta, applauded all the participants for their exceptional brilliance. She explained that the Foundation had taken into consideration the effect that the Covid-19 pandemic has had on lives and incomes across board and had increased the prize money by 33 per cent this year to help cushion any negative or inflationary effects.

Emphasising the driving force behind the annual competition, she said, “We are passionate about the annual NEC because it changes lives and helps to improve the quality of lives of students and their families. The NEC helps to improve the quality of writing and competitiveness amongst students. We have launched in more African countries this year and would have launched the initiative in 20 countries by the end of 2021. It is not just about writing essays, the ripple effect is really quite enormous, and we are glad that it is cascading to other countries where we operate.’ she said.

Also speaking at the opening of the event, the Group Managing Director/Chief Executive Officer of UBA Plc, Mr. Kennedy Uzoka, commended all 12 finalists, expressing that UBA was happy to be touching lives and making a solid impact through its National Essay Competition, which is now in its 10th edition. He was very pleased about the fact that more females again came out tops this year, adding that notwithstanding the constraints and challenges of 2020, the Foundation received the highest number of entries ever, at over 12,000 digital submissions’.

Uzoka who is also the Chairman, UBA Foundation said, “The NEC has been changing lives positively for 10 years, and we have awarded scholarships to students not just in Nigeria but in other parts of Africa like Ghana, Sierra Leone and Senegal. Some of these students are already graduates and contributing meaningfully to their communities’.

To all 12 of you that have emerged finalists, I would like to congratulate you. If out of 12,000 entries you were able to make it to the top 12, that represents about 0.12% of the entries. You are no doubt, already a winner,” he continued.

UBA Foundation’s National Essay Competition is an initiative under the Education pillar of the Foundation. Now in its tenth year, the aim of the NEC is to ensure that more African youths have access to education. The programme also highlights the good quality of education that exists on the continent as it stresses that the grant must be used in any university of the winners’ choice on the African continent.

2020 UBAF TOP 12 FINALISTS

| S/N | NAME | POSITION | |

| 1 | Eshiet Abasiekeme Eshiet | 1st | |

| 2 | Mofuluwake Adesanya | 2nd | |

| 3 | Abdulganiyu Habeeba | 3rd | |

| 4 | Emenugha Hannah Amarachi | 4th | |

| 5 | Ibem Marylyn Anya | 5th | |

| 6 | Ehibor Favour | 6th | |

| 7 | Nwabueze Regina Ugochi | 6th | |

| 8 | Dimaro Tamarapreye | 7th | |

| 9 | Ozoke Melvin Damian Uchenna | 8th | |

| 10 | Enobong Flourish David | 9th | |

| 11 | Chukwuma Light E. C. | 10th | |

| 12 | Stephen God’s Grant |

brand

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing 73790#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

brand

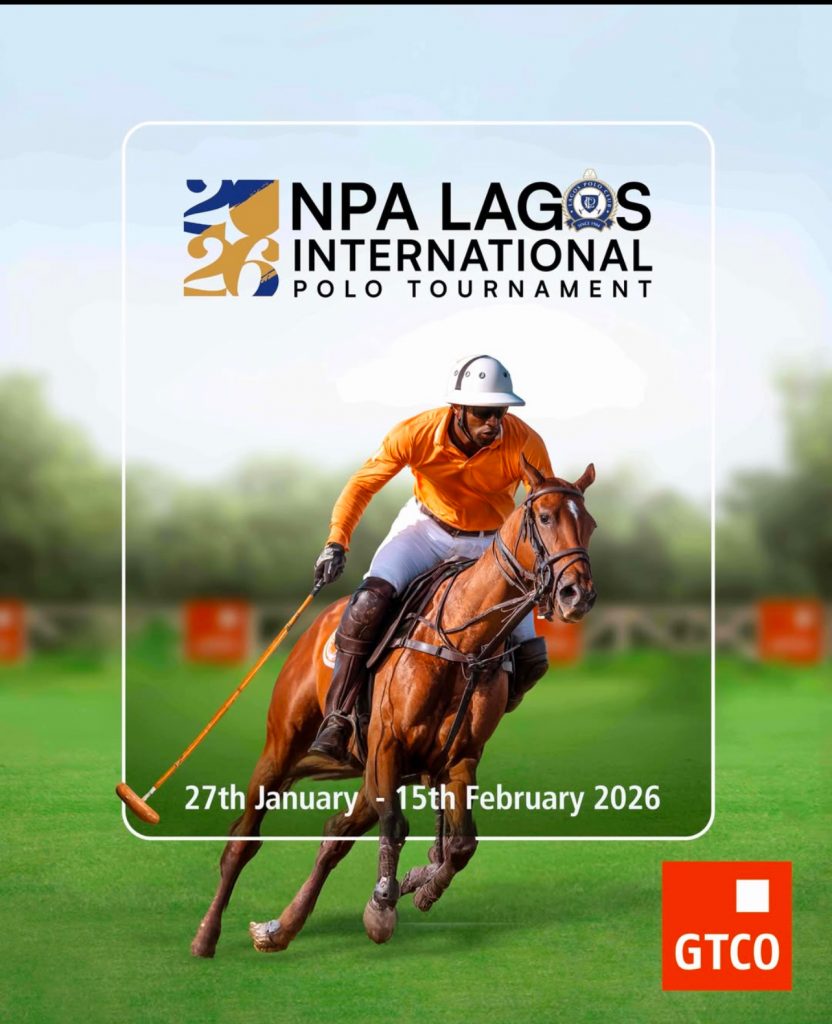

GTCO Proudly Headlines the NPA Lagos International Polo Tournament as Main Sponsor— Championing Great Experiences and Heritage

Guaranty Trust Holding Company Plc (GTCO Plc) (NGX: GTCO; LSE: GTCO), one of Africa’s leading financial services groups, is proud to announce its continued support as the main sponsor of the NPA Lagos International Polo Tournament, one of Africa’s oldest and most prestigious sporting events. The 2026 edition will be held at the Lagos Polo Club, Ikoyi, from Tuesday, January 27 to Sunday, February 15, bringing together top local and international polo teams and spectators from across the continent and beyond.

The 2026 NPA Lagos International Polo Tournament will feature top‑tier teams competing for major prizes, including the Majekodunmi Cup, Independence Cup, Open Cup, Silver Cup and Low Cup, among others. Guests can expect a fusion of thrilling equestrian action, polo-inspired lifestyle showcase, and curated hospitality experiences. The event will also be livestreamed, allowing audiences online to share in the excitement and spectacle.

Commenting on GTCO’s role as main sponsor of the Lagos International Polo Tournament, Segun Agbaje, Group Chief Executive Officer, said: “This tournament, one of the oldest in Africa, celebrates not only the noble sport of polo but the values we hold dear as a brand: teamwork, discipline, fair play, and a commitment to excellence. Beyond the field, it showcases Nigeria and Africa to a global audience, reinforcing the continent’s place on the world stage. Our longstanding sponsorship of the NPA Lagos International Polo Tournament reflects our conviction that sport can amplify opportunity, foster connections, and deliver world-class experiences for all.”

The NPA Lagos International Polo Tournament has long been celebrated not only for its thrilling competition and equestrian excellence but also for its rich heritage and cultural resonance within Africa’s sporting tradition. GTCO’s sponsorship embodies the Group’s commitment to creating platforms that unite communities and drive social impact across diverse audiences.

brand

Fidelity Bank appoints Onwughalu as Chairman following completion of Chike-Obi’s tenure

Tier one lender, Fidelity Bank Plc, has announced the completion of the tenure of Mr. Mustafa Chike-Obi as Chairman of its Board of Directors effective December 31, 2025, and the appointment of Mrs. Amaka Onwughalu as the new Chairman of the Board, effective January 1, 2026.

Tier one lender, Fidelity Bank Plc, has announced the completion of the tenure of Mr. Mustafa Chike-Obi as Chairman of its Board of Directors effective December 31, 2025, and the appointment of Mrs. Amaka Onwughalu as the new Chairman of the Board, effective January 1, 2026.

The board transitions are in alignment with the Bank’s policy and have been communicated to the Central Bank of Nigeria, the Nigerian Exchange Group, and other stakeholders.

Under Mr. Chike-Obi’s leadership, Fidelity Bank repaid its Eurobond, completed the first tranche of its public offer and rights issue that were oversubscribed by 237 percent and 137.73 percent respectively, expanded internationally to the United Kingdom, and received improved ratings from various agencies amongst a long list of achievements. His tenure also saw the Bank strengthen its capital position, record steady growth in customer deposits and total assets, deepen its digital banking capabilities, and enhance its corporate and investment banking proposition. The bank equally made notable progress in governance, risk management, and operational efficiency, all of which contributed to strengthened market confidence and the Bank’s sustained upward performance trajectory.

Reflecting on his tenure, Mr. Mustafa Chike-Obi said, “It has been a privilege to serve as Chairman of Fidelity Bank. The dedication of our Board, management, and staff has enabled us to reach significant milestones. I am confident that the Bank will continue to thrive and deliver value to all stakeholders.”

Mrs. Amaka Onwughalu’s appointment marks a new chapter for Fidelity Bank. She joined the Board in December 2020 and has chaired key committees. With over 30 years of banking experience, including executive roles at Mainstreet Bank Limited and Skye Bank Plc. She holds degrees in Economics, Corporate Governance, and Business Administration, and has attended executive programmes at global institutions. Mrs. Onwughalu is a Fellow of several professional bodies and has received awards for accountability and financial management

“I am honoured to lead the Board of Fidelity Bank at this exciting time. Our recent achievements have set a strong foundation for continued growth. I look forward to working with my colleagues to drive our strategy and deliver sustainable value,” commented Mrs. Onwughalu.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 9.1 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is a recipient of multiple local and international Awards, including the 2024 Excellence in Digital Transformation & MSME Banking Award by BusinessDay Banks and Financial Institutions (BAFI) Awards; the 2024 Most Innovative Mobile Banking Application award for its Fidelity Mobile App by Global Business Outlook, and the 2024 Most Innovative Investment Banking Service Provider award by Global Brands Magazine. Additionally, the Bank was recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence and as the Export Financing Bank of the Year by the BusinessDay Banks and Financial Institutions (BAFI) Awards.

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle6 years ago

lifestyle6 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health6 years ago

health6 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health6 years ago

health6 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment1 year ago

entertainment1 year agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news9 months ago

news9 months agoBREAKING: Tinubu swears in new NNPCL Board