brand

8 CONTESTANTS SEEK VIEWERS VOTES, AS FIRSTBANK-SPONSORED THE VOICE NIGERIA SEASON 3 ENTERS LIVE SHOWS

By Bolaji Israel

By Bolaji Israel

With an electrifying mix of pulsating musical performances, music training, glamorous fashion and life enriching entertainment, the The Voice Nigeria 3 continues to dazzle to the very grand finale.The fate of eight amazing music talents now lies with the viewers votes for a chance to fight for the grand prize as the world acclaimed music talents reality series, the Voice Nigeria 3 sponsored by FirstBank, Baba Ijebu and Airtel entered the much awaited Live Shows stage in Nigeria. The music show is produced by UN1TY Limited and Livespot360.Out of the twelve talents that made it to the live shows, the four celebrity coaches cum judges only picked one each following spectacular performances, leaving eight badly in need of the voters life-lines.The lucky four were Eazzie, Naomi Mac, Esther and Kitay while the highly gifted and promising Dapo, Kpee, Inioluwa, Nuel Ayo, Jeremiah, Toeseen, Anu and Tamara can now only be saved by the viewers votes by dialing *894*7*talent’s code#. More details of the show can be gotten via this link https://www.firstbanknigeria.com/the-voice-nigeria/ Fifteen weeks into the FirstBank- powered world-class show, eight outstanding talents had earlier emerged from the pack while viewers saved Toeseen, Jeremiah, Nuel Ayo and Tamara offering them an opportunity to perform at the live shows and raising the tally to twelve.All four saved talents are now in need of a second chance as they are part of the eight that needs viewers votes again.Meanwhile, all twelve talents had given their best with the performances of various songs at the live shows witnessed for the first time by not only judges but also a small audience.It was team Waje that first opened the live show kicking off with a powerful singer, Eazzie in a vibrant performance of Omawumi’s “If You Ask Me” then Inioluwa with a soulful delivery of “Essence” by Wizkid featuring Tems followed by Nuel Ayo with an angelic delivery of Diamonds by Rihanna. Coach Waje chose Eazzie leaving Inioluwa and Nuel to the viewers vote.Team Darey then took over the stage first with Esther who wowed the audience with a superb delivery of another Omawumi classic, “In the Music” followed by Jeremiah with a princely delivery of Teni’s Billionaire and the flamboyant Kpee in a different mode singing Roju by a Voice Nigeria alumni, Chike. At the end, Darey chose Esther, leaving Kpee and Jeremiah.It was soon Team Yemi’s turn to dazzle with Toeseen performing “The Climb” by Miley Cyrus, then Kitay delivering an emotional Luther Vandross classic, “Dance with My father” followed by Anu’s rendition of “Feeling Good” by Nino Simone. Expectedly, Yemi saved Kitay.Tamara’s rendition of Beyonce’s “Halo” ushered in Team Falz, followed by Dapo’s performance of John Legend ‘s classic, Ordinary People, and Naomi Mac’s delivery of John Legend’s revolutionary song, Glory. At the end, Naomi was saved by Falz, leaving Dapo and returnee Tamara to the viewers votes.With an electrifying mix of pulsating musical performances, music training, glamorous fashion and life enriching entertainment, the The Voice Nigeria 3 continues to dazzle to the very grand finale.Lead show sponsor, FirstBank in a statement by its Group Head, Marketing and Corporate Communications, Folake Ani-Mumuney, reiterated that The Voice Nigeria 3 is a Reality TV show designed to discover and promote talented singers to actualise their dreams of becoming international stars which aligns with FirstBank’s commitment to providing a platform for nurturing and showcasing talents and driving social cohesion.The Financial giant added that its support for The Voice Nigeria 3 is a demonstration of FirstBank’s commitment to contributing to the projected revenue of US$86m by 2021 from Nigeria’s music industry aimed at promoting a diversified economy in line with the Federal Government’s diversification policy.

brand

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing 73790#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

brand

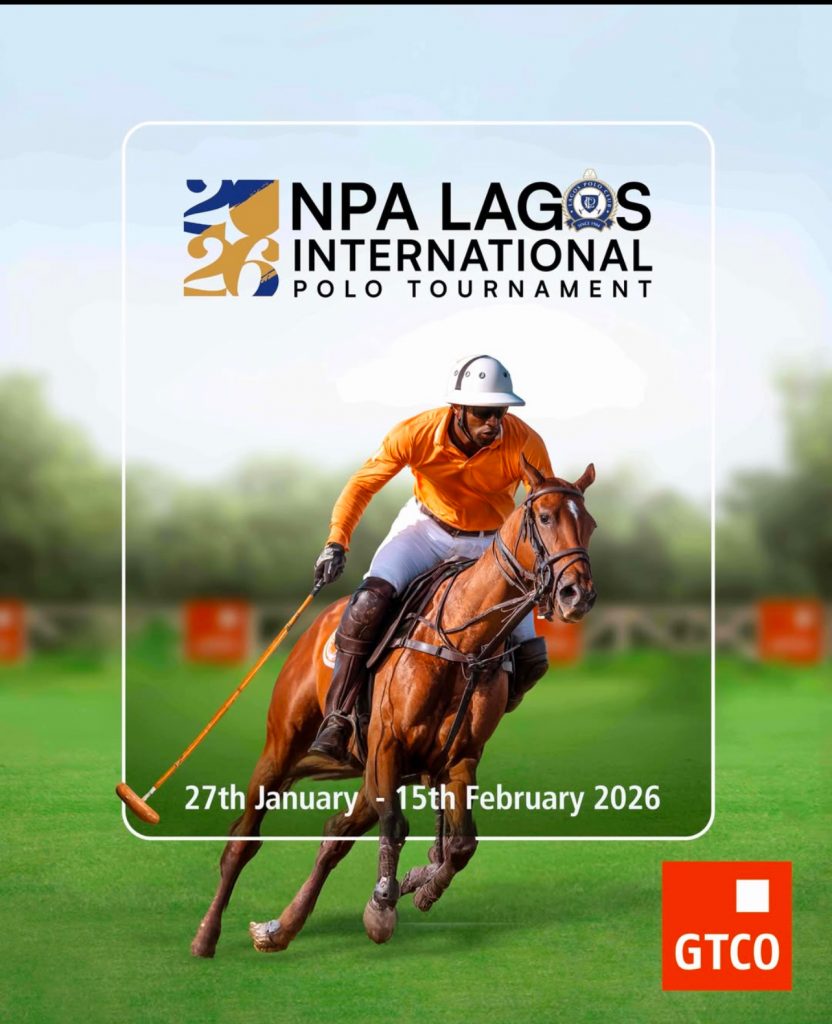

GTCO Proudly Headlines the NPA Lagos International Polo Tournament as Main Sponsor— Championing Great Experiences and Heritage

Guaranty Trust Holding Company Plc (GTCO Plc) (NGX: GTCO; LSE: GTCO), one of Africa’s leading financial services groups, is proud to announce its continued support as the main sponsor of the NPA Lagos International Polo Tournament, one of Africa’s oldest and most prestigious sporting events. The 2026 edition will be held at the Lagos Polo Club, Ikoyi, from Tuesday, January 27 to Sunday, February 15, bringing together top local and international polo teams and spectators from across the continent and beyond.

The 2026 NPA Lagos International Polo Tournament will feature top‑tier teams competing for major prizes, including the Majekodunmi Cup, Independence Cup, Open Cup, Silver Cup and Low Cup, among others. Guests can expect a fusion of thrilling equestrian action, polo-inspired lifestyle showcase, and curated hospitality experiences. The event will also be livestreamed, allowing audiences online to share in the excitement and spectacle.

Commenting on GTCO’s role as main sponsor of the Lagos International Polo Tournament, Segun Agbaje, Group Chief Executive Officer, said: “This tournament, one of the oldest in Africa, celebrates not only the noble sport of polo but the values we hold dear as a brand: teamwork, discipline, fair play, and a commitment to excellence. Beyond the field, it showcases Nigeria and Africa to a global audience, reinforcing the continent’s place on the world stage. Our longstanding sponsorship of the NPA Lagos International Polo Tournament reflects our conviction that sport can amplify opportunity, foster connections, and deliver world-class experiences for all.”

The NPA Lagos International Polo Tournament has long been celebrated not only for its thrilling competition and equestrian excellence but also for its rich heritage and cultural resonance within Africa’s sporting tradition. GTCO’s sponsorship embodies the Group’s commitment to creating platforms that unite communities and drive social impact across diverse audiences.

brand

Fidelity Bank appoints Onwughalu as Chairman following completion of Chike-Obi’s tenure

Tier one lender, Fidelity Bank Plc, has announced the completion of the tenure of Mr. Mustafa Chike-Obi as Chairman of its Board of Directors effective December 31, 2025, and the appointment of Mrs. Amaka Onwughalu as the new Chairman of the Board, effective January 1, 2026.

Tier one lender, Fidelity Bank Plc, has announced the completion of the tenure of Mr. Mustafa Chike-Obi as Chairman of its Board of Directors effective December 31, 2025, and the appointment of Mrs. Amaka Onwughalu as the new Chairman of the Board, effective January 1, 2026.

The board transitions are in alignment with the Bank’s policy and have been communicated to the Central Bank of Nigeria, the Nigerian Exchange Group, and other stakeholders.

Under Mr. Chike-Obi’s leadership, Fidelity Bank repaid its Eurobond, completed the first tranche of its public offer and rights issue that were oversubscribed by 237 percent and 137.73 percent respectively, expanded internationally to the United Kingdom, and received improved ratings from various agencies amongst a long list of achievements. His tenure also saw the Bank strengthen its capital position, record steady growth in customer deposits and total assets, deepen its digital banking capabilities, and enhance its corporate and investment banking proposition. The bank equally made notable progress in governance, risk management, and operational efficiency, all of which contributed to strengthened market confidence and the Bank’s sustained upward performance trajectory.

Reflecting on his tenure, Mr. Mustafa Chike-Obi said, “It has been a privilege to serve as Chairman of Fidelity Bank. The dedication of our Board, management, and staff has enabled us to reach significant milestones. I am confident that the Bank will continue to thrive and deliver value to all stakeholders.”

Mrs. Amaka Onwughalu’s appointment marks a new chapter for Fidelity Bank. She joined the Board in December 2020 and has chaired key committees. With over 30 years of banking experience, including executive roles at Mainstreet Bank Limited and Skye Bank Plc. She holds degrees in Economics, Corporate Governance, and Business Administration, and has attended executive programmes at global institutions. Mrs. Onwughalu is a Fellow of several professional bodies and has received awards for accountability and financial management

“I am honoured to lead the Board of Fidelity Bank at this exciting time. Our recent achievements have set a strong foundation for continued growth. I look forward to working with my colleagues to drive our strategy and deliver sustainable value,” commented Mrs. Onwughalu.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 9.1 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is a recipient of multiple local and international Awards, including the 2024 Excellence in Digital Transformation & MSME Banking Award by BusinessDay Banks and Financial Institutions (BAFI) Awards; the 2024 Most Innovative Mobile Banking Application award for its Fidelity Mobile App by Global Business Outlook, and the 2024 Most Innovative Investment Banking Service Provider award by Global Brands Magazine. Additionally, the Bank was recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence and as the Export Financing Bank of the Year by the BusinessDay Banks and Financial Institutions (BAFI) Awards.

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle6 years ago

lifestyle6 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health6 years ago

health6 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health6 years ago

health6 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment1 year ago

entertainment1 year agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news9 months ago

news9 months agoBREAKING: Tinubu swears in new NNPCL Board