….Investors inject N110bn in UBA, FBNH, Zenith, Access, other stocks in two days

….Investors inject N110bn in UBA, FBNH, Zenith, Access, other stocks in two days

Presidency on Tuesday expressed support for the banking sector consolidation initiative of the Central Bank of Nigeria, saying it would help the country to grow the economy to a new height.

This came barely five days after the CBN said it would ask banks to raise new capital.

According to the Presidency, it has become important to consider the capital adequacy of Nigerian banks in light of the projected $1tn economy in eight years.

Representing President Bola Tinubu at the 40th Anniversary Celebration of The Guardian Newspapers in Lagos on Tuesday, the President’s Special Adviser on Information and Strategy, Bayo Onanuga, said there would be a strong need to revisit the capital adequacy levels of banks

Onanuga said, “On the economy, that is facing all of us, our ambition to attain the $1tn appears daunting but we believe that it is achievable with God on our side and our collective determine. This explains the reason the VP and I have been on the road trying to attract huge investments into various phases of our economy; agriculture, oil and gas and others.

“To arrive at the $1tn economy, we must address the capital adequacy of our banks that will prepare the fuel for this journey.”

At the 58th annual Bankers’ Dinner last Friday, CBN Governor, Olayemi Cardoso, had said a stress test performed on Nigerian banks revealed that while they would withstand mild to moderate stress, they would be unable to service a $1tn economy projected by Tinubu in seven years, hence the need for recapitalisation.

Cardoso said, “Stress tests conducted on the banking industry also indicate its strength under mild-to-moderate scenarios of sustained economic and financial stress, although there is room for further strengthening and enhancing resilience to shocks. Therefore, there is still much work to be done in fortifying the industry for future challenges.”

He added, “Considering the policy imperatives and the projected economic growth, it is crucial for us to evaluate the adequacy of our banking industry to serve the envisioned larger economy. It is crucial to evaluate the adequacy of our banking industry to serve the envisioned larger economy. It is not just about its current stability. We need to ask ourselves, can Nigerian banks have sufficient capital relative to the finance system needs in servicing a $1tn economy shortly, in my opinion, the answer is no, unless we take action. As a first test, the central bank will be directing banks to increase their capital.”

Meanwhile,findings show investors have begun positioning themselves in the stocks of Tier-1 banks listed on the Nigerian Exchange Limited following the announcement of the proposed recapitalisation of the banks.

There are reports some big banks may be eyeing smaller and weaker ones in the event the proposed consolidation in the sector fuels possible acquisitions.

Meanwhile, findings showed that some listed financial institutions gained over N101.18bn on Monday and Tuesday, following the announcement of the proposed banking sector recapitalisation.

An analysis done by one of our correspondent at the close of trading on Tuesday revealed that at least six of the lenders added to their market capitalisation in the two trading sessions this week, while five banks shed their value and two remained unchanged.

The lenders who gained included United Bank for Africa Plc, whose market capitalisation rose to N731.87bn on Tuesday from N713.06bn on Friday, the market cap of Zenith Bank Plc appreciated by one per cent to N1.10tn and Access Holdings Plc’s market cap rose by four per cent to close Tuesday’s trading at N639.81bn.

FBN Holdings Plc has been the biggest gainer so far as its market cap stood at N800.47bn on Tuesday from N717.91bn on Friday, marking an 11 per cent appreciation. The market cap of Sterling Financial Holdings Plc rose by 4.51 per cent to N106.81bn and the value of FCMB Group’s share rose by one per cent to N137.63bn.

The five lenders who lost during the period under review include; Guaranty Trust Holding Company (-1 per cent), Jaiz Bank (-2 per cent), Unity Bank (-8.69 per cent), Wema Bank and Stanbic IBTC Holdings (-3.08 per cent) to close with their market capitalisation at N1.13tn, N55.27bn, N19.64bn, N66.61bn and N816.29bn respectively.

The market capitalisation of two lenders, Ecobank Transnational Incorporated Plc and Fidelity Bank remained unchanged over the two-day period at N293.59bn and N288.11bn respectively.

A bank CEO, who earlier spoke to The PUNCH, welcomed the CBN policy direction regarding the recapitalisation of the banks, saying his institution was ready to raise fresh capital though it had yet to conclude the modality.

“Even before the CBN governor made the pronouncement, our bank was already considering raising fresh capital to significantly increase the capital base. This should happen in the first quarter of 2024. So, we are in tune with the CBN governor,” the CEO of a Tier-1 lender told one of our correspondents on Saturday.

In the last few months, First Bank of Nigeria Holdings, Wema Bank and Jaiz Bank have proposed Rights Issues, while Fidelity Bank has announced plans to raise additional capital via the issuance of 13,200 billion ordinary shares via public offer and rights issue. It was gathered that Wema Bank would commence its Rights Issue on December 1.

Already, players in the capital market have expressed varied views as to the capability of the market to support the proposed recapitalisation drive.

While the doyen of the Nigerian Exchange Limited, Rasheed Yusuf, in his comments, believed the local bourse could support such a major capital raise, even without the presence of foreign investors, the Managing Director of Afrinvest Securities Limited, Ayodeji Ebo, expressed doubts the capital market could support the recapitalisation.

He said, “The Nigerian capital market may not be able to fully support the recapitalisation of the banks given the market is currently been driven by domestic investors. To also achieve this, the banks must adopt technology to drive the capital raise process as we saw during the MTN public offer.

Ebo added, “We believe if the foreign exchange policy is clear and consistent in the medium term, we expect to begin to attract FPIs to the capital market.”

Meanwhile, some minority shareholders community have expressed the conditions under which they will support the financial institutions. Mr Boniface Okezie of the Progressive Shareholders Association of Nigeria, said that minority investors must do their due diligence and invest in stocks with track records.

“What we will be looking out for include those who have been paying dividends in the past, those with good capital appreciation and a good track record from their management team. How have they been communicating with shareholders when the situation was rosy or not? I have my fears and some of those banks can’t convince me, not when my money has been trapped. In the past, they have been reckless. Even those who acquired the shares of those banks did not pay compensation to shareholders and are using the assets of the bank as leverage to build up their branches. They are not paying dividends to shareholders but have created an empire. For such banks, shareholders must be on the lookout for them and this is the time to pay them back in their coins, “he said.

Post Views: 447

“We are laying a foundation for a tax regime that is fair, transparent and fit for a modern, ambitious Nigeria. A tax regime that rewards enterprise, protects the vulnerable, and mobilises revenue without punishing productivity”, he said.

“We are laying a foundation for a tax regime that is fair, transparent and fit for a modern, ambitious Nigeria. A tax regime that rewards enterprise, protects the vulnerable, and mobilises revenue without punishing productivity”, he said.

….Investors inject N110bn in UBA, FBNH, Zenith, Access, other stocks in two days

….Investors inject N110bn in UBA, FBNH, Zenith, Access, other stocks in two days

President Bola Ahmed Tinubu has signed the four tax reform bills into law.

President Bola Ahmed Tinubu has signed the four tax reform bills into law.

Debris of a missile fired from Iran toward Israel leaves a trail in the night sky over Hebron in the occupies-West Bank after being intercepted on June 13, 2025.

Debris of a missile fired from Iran toward Israel leaves a trail in the night sky over Hebron in the occupies-West Bank after being intercepted on June 13, 2025.

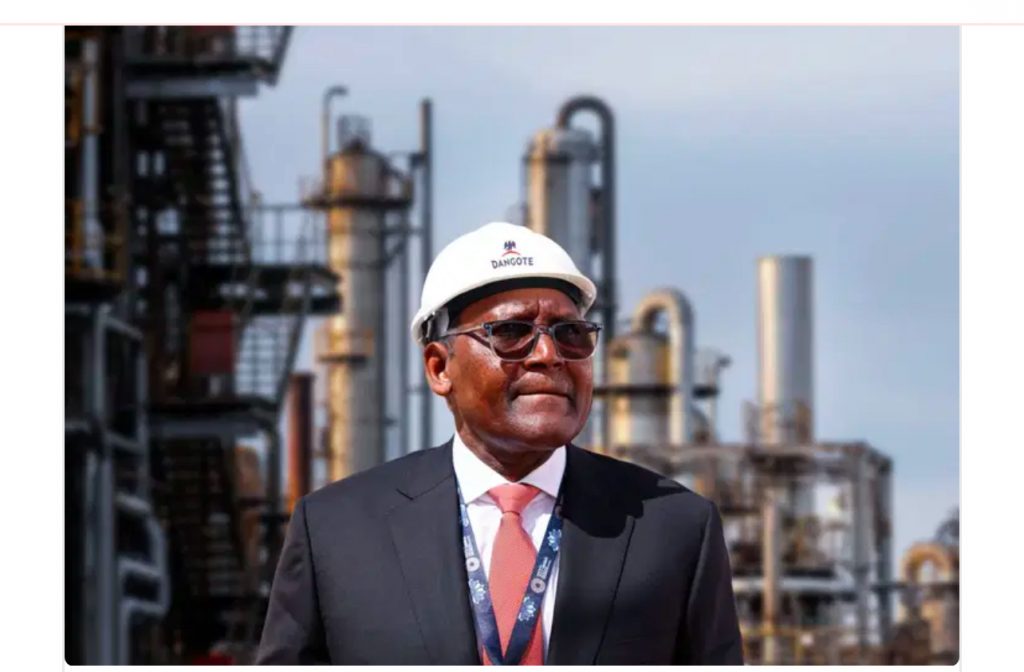

The Dangote Petroleum Refinery has announced that it will begin distribution of Premium Motor Spirit (PMS) and diesel nationwide.

The Dangote Petroleum Refinery has announced that it will begin distribution of Premium Motor Spirit (PMS) and diesel nationwide.