brand

ENABLING DREAMS WITH FIRST BANK ‘DECEMBER IS A VYBE’

One of the most fascinating quotes of popular British business magnate and author, Sir Richard Brandson is that “A great business is simply an idea to make other people’s lives better.” This vital nugget aligns with a global view that a critical element of successful brands is the ability to beyond functional products benefits become a visible partner in customers lives, enabling them live better and happier, aim higher and achieve their dreams.

One of the most fascinating quotes of popular British business magnate and author, Sir Richard Brandson is that “A great business is simply an idea to make other people’s lives better.” This vital nugget aligns with a global view that a critical element of successful brands is the ability to beyond functional products benefits become a visible partner in customers lives, enabling them live better and happier, aim higher and achieve their dreams.

For businesses, this means seeing beyond financial gains into becoming a true ally and partner who make life worth living. This is a core hallmark of the few enduring global brands and FirstBank appears focused on towing the path.

Beyond business promotion and marketing engagements solely for commercial value, the premier bank in its 127th year is assisting Nigerians to live happier and create awesome memories of good time with cherished ones through some cool initiatives.

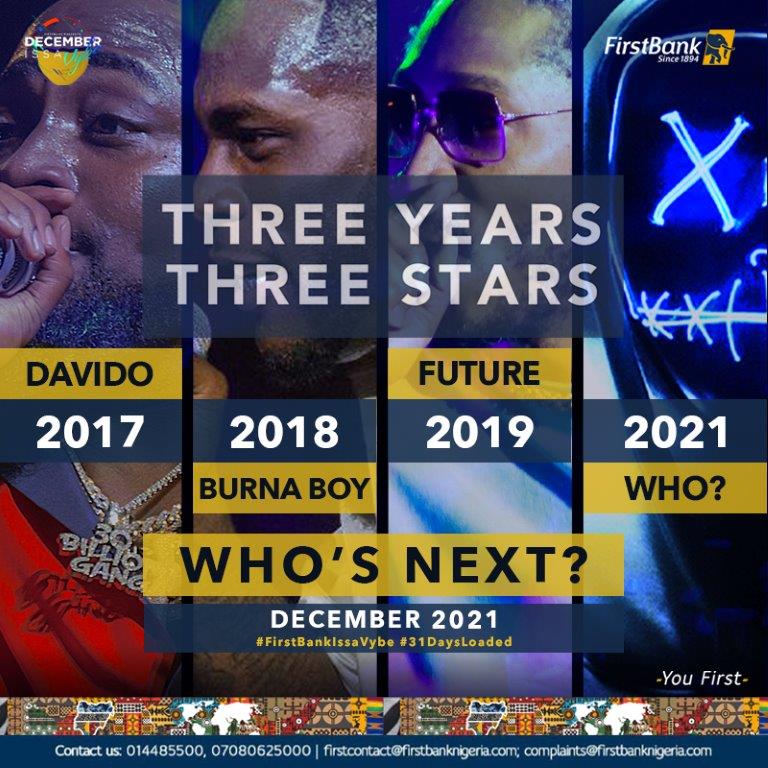

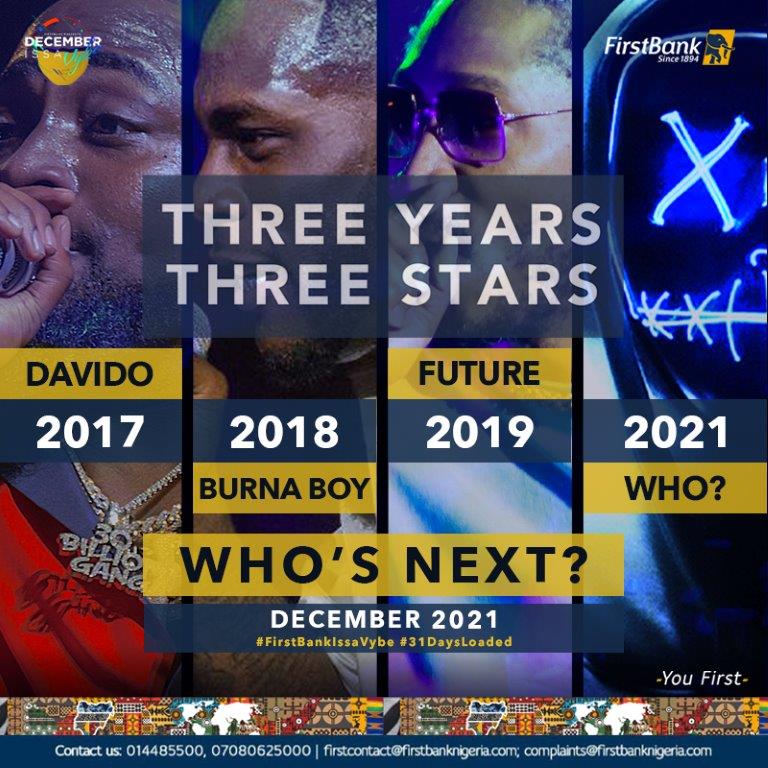

Globally, December heralds the holiday season during which people love to celebrate, unwind and relax with loved ones. Though checkered by Covid-19 disruptions in 2020, FirstBank is giving a new expression and meaning to ‘December in Nigeria’ with the high-octane and life enriching #FirstBankIssaVybe, #DecemberIssaVybe campaign.

The campaign which started in 2018 is already generating ripples across the cities with Nigerians across ages anticipating the new trick FirstBank will pull out from the hat this year.

Through the annual FirstBankIssaVybe campaign, FirstBank sponsors of an array of the hottest and coolest entertainment platforms across music, fashion and arts during the month of December, with massive ticket giveaways to premium events.

The goal is to create enthralling and memorable experience for customers in the Yuletide season as they bond with family and friends, whilst connecting with their favourite superstars.

Commenting with much enthusiasm on the year-end campaign, global head marketing and corporate communication of FirstBank, Folake Ani-Mumuney says it’s simply FirstBank creating a ‘Wow December to Remember’ experience for all as a bank for all generations.

For her, #FirstBankIssaVybe offers a variety performance; FirstBank is not just considering financial well-being but also the entire well-being for customers. That is why it is enabling opportunities for families to come together to celebrate and enjoy premium concerts, plays, fashion and food, and gave out over 500 mostly VIP tickets per campaign, which cost from N15,000 to N50,000.

“We are delighted with our achievements and consider the yuletide a good way of identifying with our customers and appreciating their support. We want them to have the best of fun through this period. Through different expressions, we strive to support our heritage; the value systems we believe in and create opportunities for families to bond across generations.

“The carefully curated experiences speak to our ethos, what we believe in and what Nigerians would appreciate. We do not just concentrate like some other brands on specific areas, or just one name; we are true enablers across the raft, and offered variety. We also use the opportunity to further deepen support for arts and job creation.

“We also spread the program across the nation with sponsorship of Igue Festival in Edo State, and Calabar Carnival in Cross River State. With our partners, #DecemberIssaVybe, we curate across the country as a whole. We supported Waka the Musical in 2017 which was also taken to Abuja in 2018,” she noted.

Meanwhile, the campaign has seen customers treated to fantastic experience in previous editions and many are looking forward to the 2021 edition. From the exciting Alternative Sound 4.0, held at Terra Culture on 5 December, 2019 to the memorable Cardi B live in Lagos by Livespot Concert on 7 December 2019 and the unforgettable “An Evening with FBNHoldings” held on 13 December, 2019 to the pleasure overload of Island Block Party at Oniru Lagos on 14 December, lucky customers and followers of the Bank’s social media handles were given free tickets to have loads of fun!

Also, in the bouquet of fun extravaganza was Teni – The Billionaire Experience musical concert held at Eko Hotel on Monday, 16 December 2019 which had many customers thrilled to the finest of tunes by the Billionaire crooner and other guest artistes present. The annual Nativeland music festival at Muri Okunola Park was another event for the yuletide which has since its inauguration in 2016, had top class performances by A-lists artistes.

Youth and teenage fashion lovers were not left out; as with Street Souk, they had a feel of current trends and creativity in the fashion industry. The event held on 18 December 2019. Keen on getting exposed to the best and latest designs, wears and fabrics in fashion, then the African Fashion Week Nigeria was another port of call. The event which held 20 – 21 December, 2019 attracted leading players in the fashion industry and deepened the fashion appetite and interest of participants.

Building into Christmas was Flytime Rhythm Unplugged, starting on 20 December at the Eko Hotel and Suites. The 5-day music festival event had performances of leading and top artistes in the country. Olamide, Burna Boy, Tiwa Savage, MI, Ycee, Patoranking, Mayorkun, Teni, Zlatan, Joeboy, Fireboy, B Red, Tolani, Jeff Akoh, Oluwadamilola thrilled fun lovers to the best of tunes topping charts not just in Nigeria but the continent. On the wheels of steel was DJ Neptune, DJ Consequence, DJ Obi, and DJ Cuppy.

Kizz Daniel’s Toro concert on 26 December 2019 and Tu Face’s musical show on 28 December built up to the wrap-up of the list of December events with Future, the American trap music sensation scheduled to perform live in Lagos. The Future Live in Concert held 29 December 2019 at the Eko hotel. The 80s boy band, New Edition performance at the FlyTime Music Festival in Lagos was also electrifying with Burna Boy Live, Davido Live and many more in action!

For plays, the campaign has featured sponsorships of Moremi and Oba Eshugbayi play which focused on highlighted history of Lagos: the struggle over water tax imposed by the British on the people of Lagos and the expulsion of Oba Esugbayi, who stood against the tax, to Abeokuta. The play was from the stable of Joseph Edgar of the iconic Duke of Shomolu Production.

Two lucky fans, Tina Ediale and Timilehin Anibaba, amongst others got to see their favourite star Davido Live in Concert; another winner, Azeez Animashaun couldn’t believe his luck when he got a VIP Rhythm Unplugged ticket while some got special treat watching ace actress Omotola Jalade Ekeinde as Esumirin in Moremi The Musical.

Some social media followers also scored invitation to parties including Island Block Party, All Black Everything; conferences Golas Grit Grind 2.0; festivals: Native Land, Plamwine Festival; and pop up sales: Mente de Moda.

The FirstBank #DecemberIssaVybe and #FirstBankIssaVybe giveaway fest is again set to reward old, new and potential customers with tickets to premium events around Lagos.

And Yes, we know you want to attend these events and yes you can. Just follow FirstBank on any of its social media pages – Facebook: First Bank of Nigeria Limited, Instagram: @firstbanknigeria, and Twitter: @firstbankngr – look out for the posts announcing the giveaway and follow instructions to experience maximum party #vybes this season.

brand

Access Holdings Reports 2.5 Trillion Gross Earnings in H1 2025

Access Holdings Plc (“the Group” or “the Company”) today announced its half-year audited financial results for the period ended June 30, 2025.The Group’s financial results for the half year ended June 30, 2025, reflect the resilience of our business model, the diversification of our revenue streams, and the steady progress to the execution of our five-year strategic plan. Gross earnings increased by 13.8% year-on-year to 2.5 trillion in H1 2025 from 2.2₦ ₦ trillion in H1 2024, driven by strong growth in interest income which increased by 38.9% year-on-year to 2.0 trillion from 1.5 billion in H1 2024. Net interest income also increased by 91.8% year-on-year to 984.6 billion in H1 2025 from 513.4 billion in H1 2024. Complementing this performance was a growth in net fees and commission income, which increased by 16.1% year-on-year to 237.7billion in H1 2025 from 204.7 billion in H1 2024. Profit before tax (PBT) and profit after tax (PAT) closed at 320.6 billion and 215.9 billion respectively underscoring the strength and resilience of our business model in the markets we operate in. Key balance sheet indicators remain strong with total assets, customer deposits, loans and advances, and shareholders’ equity closing at 42.4 trillion, 22.9 trillion, 13.2 trillion 3.8 trillion respectively. The Banking group demonstrated resilient performance in H1 2025. Interest income grew by 38.7% year-on-year to 2.0 trillion in H1 2025 from 1.5 trillion in H1 2024. Net interest income increased by 85%, from 536.7 billion in H1 2024 to 992.7 billion in H1 2025. Fee and commission income increased by 27% to 294.9 in H1 2025 from 232.5 billion in H1 2024 driven by increased transaction volumes. Profit before tax (PBT) and profit after tax (PAT) closed at 303.0 billion and 199.3 billion respectively. Banking group subsidiaries contributed 65% to the Banking group’s profit before tax (PBT) in H1 2025. This result highlights our journey towards sustainable performance and execution across our key African and international markets. The Group’s non-banking subsidiaries maintained a strong growth momentum. For Access – ARM Pensions, financial performance was robust, with revenue up 29.9% to 21.0 billion and profit before tax up 65.1% to 13.1 billion. The business delivered a₦ ₦

www.accessbankplc.com solid ROAE of 48.1%, a cost-to-income ratio of 35.1%, and a PBT margin of 62.5%, underscoring strong operational efficiency and profitability. Hydrogen Payments recorded a 40.5% growth in top-line revenue compared to H1 2024. Profit before tax (PBT) grew by 273% year-on-year. The total transaction value processed increased by 211%, reaching 41.1 trillion in H1 2025, up from 13.8 trillion in H1 2024. Access Insurance Brokers has sustained strong momentum, recording a 125% year-on-year increase in gross written premium, 146% growth in revenue, and a 161% improvement in profit before tax (PBT). Oxygen X, the Group’s digital lending arm, has sustained strong momentum since launch in Q3 2024, delivering 5.4 billion in revenue and 2.2 billion in profit before tax in H1 2025. Access Holdings’ businesses are well-positioned to deepen market penetration, expand product offerings, and leverage cross-sell opportunities across the Group to drive continued growth and profitability. The group’s focus remains on driving prudent growth and continued execution of its strategic priorities, scaling its digital and transaction-led income streams, increasing revenue diversification, embedding efficiency, innovation, and disciplined portfolio management across all areas of the business. It will also continue to uphold the highest standards of risk and governance discipline to ensure sustainable profitability.Access Holdings remains confident that it will continue to deliver sustainable value and returns to its shareholders. Its long-term objective is to build a stronger, more agile Group that consistently delivers superior returns, fosters innovation-driven growth, and optimises portfolio performance to create inclusive value across its markets while reaffirming investor confidence in the strength and future of Access Holdings. The Group appreciates the continued trust and support of its shareholders, customers, and employees. Together, the Group is building a stronger future.

brand

JIM OVIA: FOUNDER/CHAIRMAN ZENITH BANK, REAFFIRMS STRONG COMMITMENT TO SHAREHOLDER VALUE AT THE NGX CLOSING GONG CEREMONY

L-R:GMD/CEO, Nigerian Exchange Group, Mr. Temi Popoola; Group Managing Director/CEO, Zenith Bank Plc, Dame Dr. Adaora Umeoji, OON; Chairman and Founder, Zenith Bank Plc, Jim Ovia, CFR; Group Chairman, Nigerian Exchange Group, Alhaji (Dr.) Umaru Kwairanga; Director General, Securities and Exchange Commission(SEC), Dr. Emomotimi Agama; CEO, Nigerian Exchange (NGX), Mr. Jude Chiemeka; and CEO, Central Securities Clearing System Plc, Mr. Haruna Jalo-Waziri at the Closing Gong Ceremony of the Nigerian Exchange Limited, yesterday.

Zenith Bank Plc’s Founder and Chairman, Dr. Jim Ovia, CFR, accompanied by the bank’s Group Managing Director/CEO, Dame Dr. Adaora Umeoji, OON, on Tuesday, October 14, 2025, carried out the prestigious closing gong ceremony at the Nigerian Exchange (NGX), marking a significant milestone in the bank’s continued partnership with the capital market and the official closing of the trading day. The ceremony highlights Zenith Bank’s strong relationship with the NGX and its commitment to transparency, accountability, and bolstering investor confidence. While speaking at the Nigerian Exchange, Dr. Umeoji expressed her delight in participating in the closing gong ceremony, acknowledging the NGX’s visionary leadership and innovative initiatives. “We are delighted to be here today to perform the closing gong ceremony – a symbol of shared progress and enduring partnership,” Dr. Umeoji said. “The NGX’s leadership has been very creative and innovative, and their electronic trading platform – X-stream played a pivotal role in the success of our recapitalization exercise, which achieved a 160% subscription. The bank’s stock price has doubled since the recapitalization exercise, from N36.50 per share to N68. Zenith Bank has also reported impressive financial results for the Half Year (H1) of 2025, becoming the most profitable bank in Nigeria and paying the highest dividend in the industry for the half year.””We are committed to creating value for our stakeholders and will continue to partner with the NGX to boost the Nigerian economy,” Dr. Umeoji added. “Our expansion strategy is focused on following our customers’ businesses and ensuring that we go to countries and economies where we can scale and provide more returns for our shareholders.”She stressed that the bank plans to make good on its promise of being investors’ delight by paying quantum dividends to its shareholders by year end. According to her “For us in Zenith, we are looking forward to paying more based on the confidence the market reposed on us. We are working assiduously to ensure that we do not disappoint the Market. We are going to continue to be the investors’ delight, and we assure the market that we would continue to pay enhanced dividends come end of the year.”Also commenting, the Director General of the Securities and Exchange Commission (SEC), Dr. Emomotimi Agama emphasised the role of the NGX in creating value in the Nigerian economic space. He said, “I want to thank you all for making the market what it is. Without you, the market wouldn’t have seen the leap that it has achieved in the last one-and-half year. I spoke earlier that at my assumption of office, market capitalization stood at N55 trillion, today it is hovering around 89 trillion and 93 trillion. That was not done by a spirit, it was done by you. Your ability, tenacity, courage, vision and transparency have moved the market where it is. Our vision is that by next year, we will have the market at 200trn.”

The Doyen of the NGX, Alhaji Rasheed Yusuf while giving his remarks, lauded the Founder & Chairman, Zenith Bank Plc, Jim Ovia, CFR for his vision and leadership. He ended by referring to him as the “Doyen of the Commercial banking sector”.Zenith Bank remains committed to creating long-term value for its stakeholders while driving economic development in Nigeria. As the bank continues on its growth trajectory, it has its sights set on global expansion. The bank intends to strategically leverage the capital raised from the Market to enhance its scalability and deliver enhanced services to its valued customers.The Bank’s track record of excellent performance has continued to earn the brand numerous awards, including being recognised as the Number One Bank in Nigeria by Tier-1 Capital for the sixteenth consecutive year in the 2025 Top 1000 World Banks Ranking, published by The Banker and “Nigeria’s Best Bank” at the Euromoney Awards for Excellence 2025. The Bank was also awarded Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards for 2020, 2022 and 2024; Best Bank in Nigeria from 2020 to 2022, 2024 and 2025, in the Global Finance World’s Best Banks Awards; Best Bank for Digital Solutions in Nigeria in the Euromoney Awards 2023; and was listed in the World Finance Top 100 Global Companies in 2023.Further recognitions include Best Commercial Bank, Nigeria for five consecutive years from 2021 to 2025 in the World Finance Banking Awards and Most Sustainable Bank, Nigeria in the International Banker 2023 and 2024 Banking Awards. Additionally, Zenith Bank has been acknowledged as the Best Corporate Governance Bank, Nigeria, in the World Finance Corporate Governance Awards for four consecutive years from 2022 to 2025 and ‘Best in Corporate Governance’ Financial Services’ Africa for four consecutive years from 2020 to 2023 by the Ethical Boardroom.The Bank’s commitment to excellence saw it being named the Most Valuable Banking Brand in Nigeria in The Banker’s Top 500 Banking Brands for 2020 and 2021, Bank of the Year 2023 to 2025 at the BusinessDay Banks and Other Financial Institutions (BAFI) Awards, and Retail Bank of the Year for three consecutive years from 2020 to 2022 and 2024 to 2025 at the BAFI Awards. The Bank also received the accolades of Best Commercial Bank, Nigeria and Best Innovation in Retail Banking, Nigeria, in the International Banker 2022 Banking Awards.Zenith Bank was also named Most Responsible Organisation in Africa, Best Company in Transparency and Reporting and Best Company in Gender Equality and Women Empowerment at the SERAS CSR Awards Africa 2024; Bank of the Year 2024. by New Telegraph Newspaper; and Best in MSME Trade Finance, 2023 by Nairametrics. The Bank’s Hybrid Offer was also adjudged ‘Rights Issue/ Public Offer of the Year at the Nairametrics Capital Market Choice Awards 2025.

brand

ZENITH BANK SIGNALS STRONG FULL-YEAR OUTLOOK WITH N51.3 BILLION INTERIM DIVIDEND PAYOUT

Zenith Bank Plc, on Friday, October 10, 2025, made good on its promise as it paid a total interim dividend of N51.3 billion to its shareholders for the Half Year (H1) 2025, at N1.25 per share. This significant payout represents over 60% increase from the N31.4 billion paid in H1 2024, demonstrating the bank’s commitment and enhanced capacity to continually generate value for its shareholders amidst a challenging macroeconomic environment.The dividend payment comes on the heels of the bank’s audited financial results for the half-year ended June 30, 2025, released to the Nigerian Exchange (NGX) in September 2025, which showcased a robust financial position and growth trajectory.Commenting on the dividend payout, the Group Managing Director/CEO, Dame Dr. Adaora Umeoji, OON, said, “We are pleased to have paid this significant interim dividend to our valued shareholders. Our half-year results underscore our resilience and commitment to our stakeholders. Based on the momentum achieved in H1, we are confident in our full-year outlook and expect to exceed shareholders’ expectations by year end.”The substantial dividend payout reflects exceptional underlying performance as the Bank recorded a robust 20% year-on-year increase in gross earnings, rising from N2.1 trillion to N2.5 trillion in H1 2025. Interest income drove this performance with an impressive 60% growth, climbing from N1.1 trillion to N1.8 trillion. The Bank achieved this impressive increase in interest income through strategic repricing of risk assets and effective treasury management.The Bank’s total assets also expanded to N31 trillion in June 2025, representing steady growth from N30 trillion in December 2024, underpinned by a robust and well-structured balance sheet. Customer confidence remained strong, with deposits growing by 7% from N22 trillion to N23 trillion in June 2025.Zenith Bank’s shareholders can be assured of the bank’s continued focus on delivering exceptional value and growth, driven by its strong financial fundamentals and strategic initiatives.The Bank’s track record of excellent performance has continued to earn the brand numerous awards, including being recognised as the Number One Bank in Nigeria by Tier-1 Capital for the sixteenth consecutive year in the 2025 Top 1000 World Banks Ranking, published by The Banker and “Nigeria’s Best Bank” at the Euromoney Awards for Excellence 2025. The Bank was also awarded Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards for 2020, 2022 and 2024; Best Bank in Nigeria from 2020 to 2022, 2024 and 2025, in the Global Finance World’s Best Banks Awards; Best Bank for Digital Solutions in Nigeria in the Euromoney Awards 2023; and was listed in the World Finance Top 100 Global Companies in 2023.

Further recognitions include Best Commercial Bank, Nigeria for five consecutive years from 2021 to 2025 in the World Finance Banking Awards and Most Sustainable Bank, Nigeria in the International Banker 2023 and 2024 Banking Awards. Additionally, Zenith Bank has been acknowledged as the Best Corporate Governance Bank, Nigeria, in the World Finance Corporate Governance Awards for four consecutive years from 2022 to 2025 and ‘Best in Corporate Governance’ Financial Services’ Africa for four consecutive years from 2020 to 2023 by the Ethical Boardroom.The Bank’s commitment to excellence saw it being named the Most Valuable Banking Brand in Nigeria in The Banker’s Top 500 Banking Brands for 2020 and 2021, Bank of the Year 2023 to 2025 at the BusinessDay Banks and Other Financial Institutions (BAFI) Awards, and Retail Bank of the Year for three consecutive years from 2020 to 2022 and 2024 to 2025 at the BAFI Awards. The Bank also received the accolades of Best Commercial Bank, Nigeria and Best Innovation in Retail Banking, Nigeria, in the International Banker 2022 Banking Awards.Zenith Bank was also named Most Responsible Organisation in Africa, Best Company in Transparency and Reporting and Best Company in Gender Equality and Women Empowerment at the SERAS CSR Awards Africa 2024; Bank of the Year 2024 by ThisDay Newspaper; Bank of the Year 2024 by New Telegraph Newspaper; and Best in MSME Trade Finance, 2023 by Nairametrics. The Bank’s Hybrid Offer was also adjudged ‘Rights Issue/ Public Offer of the Year’ at the Nairametrics Capital Market Choice Awards 2025

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle5 years ago

lifestyle5 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health5 years ago

health5 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health5 years ago

health5 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment9 months ago

entertainment9 months agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news5 months ago

news5 months agoBREAKING: Tinubu swears in new NNPCL Board