brand

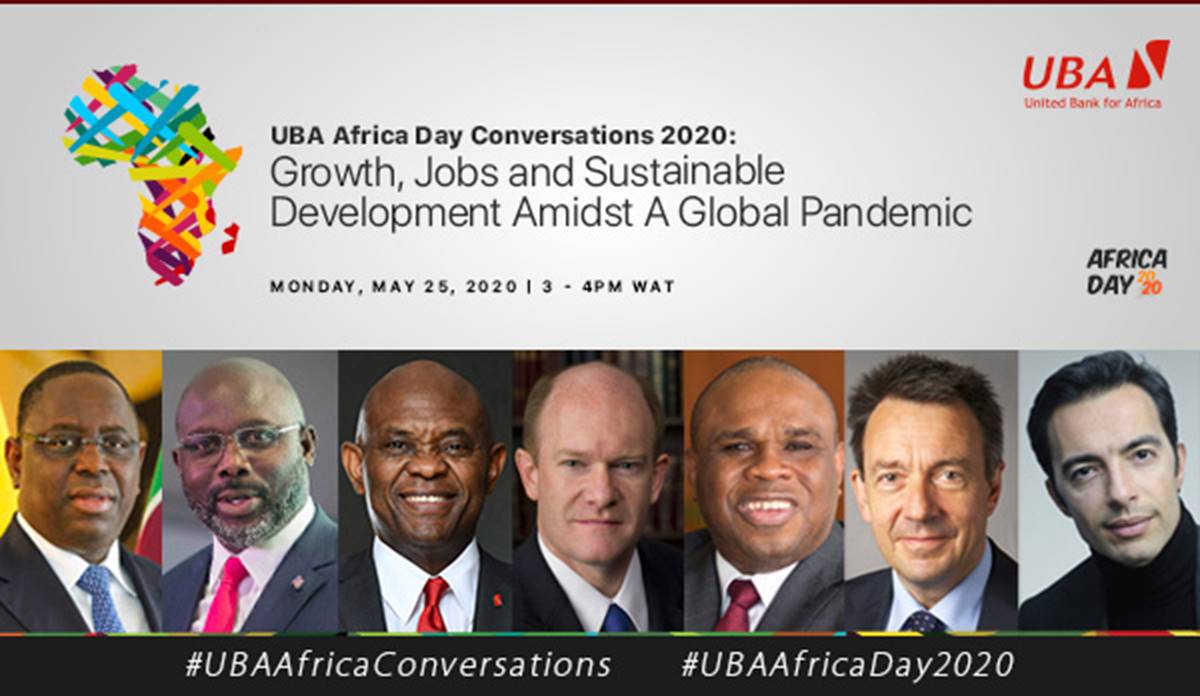

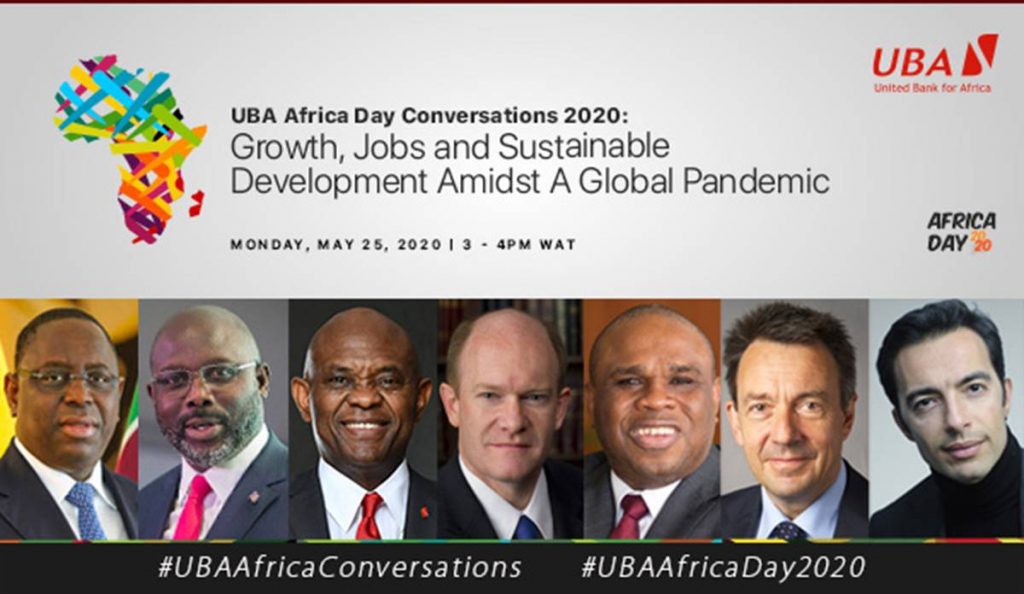

Post Covid19: Global Leaders at UBA Africa Day Conversations Seek Path To Economic Recovery

…Global co-operation needed to stem global depression

|

|

Global leaders at the second edition of United Bank for Africa (UBA) African Day Conversations, have emphasised the need for meaningful collaborations between governments and the private sector as a panacea for the quick recovery of the economy of the African continent post Covid-19.

The leaders which included the President of Liberia, H.E George Weah; United States Senator Chris Coons; the President & Chairman of the Board of Directors of the African Export–Import Bank (AFREXIMBANK), Professor Benedict Okey Oramah; President, International Committee of the Red Cross (ICRC), Peter Maurer; President spoke on Monday at the virtual Leadership Panel which was moderated by the Chairman, UBA Plc, Tony Elumelu.

Other leading voices who made up the panel were the Founder, Africa CEO Forum, Amir Ben Yahmed; the Secretary-General of the African Caribbean and Pacific Group of States (ACP), H.E George Chikoti; Administrator, United Nations Development Program (UNDP), Achim Steiner and Donald Kaberuka.

While moderating, Elumelu, who is also the Founder of the Tony Elumelu Foundation, spoke on the need to mobilise everyone and explained the necessity to discover a more fundamental solution to Africa’s challenges through collaborative efforts.

“This is the time for us to deal with the situation we have and also forge a better situation for everyone, acting again collectively,” he said. “This is not the time for finger pointing but for collaborative effort by governments and organizations to fight the pandemic globally.”

Continuing, Elumelu pointed out that all hands must be on deck if the African continent is to have a quick recovery from the pandemic, adding “There is need to flatten the curve, we need global co-operation to stem global depression. Africa requires a large stimulus package, and we need long-term solutions to prevent a cycle of debt.”

In his submission, the Liberian President, George Weah, established how collaborations worked in his government in an attempt to stem the sufferings brought about the coronavirus pandemic.

“In Liberia we have taken measures to ease the financial burden on vulnerable business in the informal sector by providing small loan assistance to SMEs and traders. In addition, we are working with commercial banks to manage the repayment of loans as well as to create stimulus packages for citizens.”

On his part, US, Senator Chris Coons, said, “It is important to take a moment to look at how African leaders have reacted to the pandemic. In order for us to recover from this pandemic, we must develop a vaccine that is free and affordable and freely distributed so that full economic activities can return. There are ways we can invest in debt relief, invest in infrastructure and human development. This is no time to be looking backwards. We recognise the power of collective collaboration on the continent.

While pointing out that the pandemic poses an opportunity for Africa to be independent and promote its growth and development as a people without external help; Prof. Benedict Okey Oramah, on his part, said COVID 19 has taught Africa that there comes a time when every group of people will fend for themselves.

He called for the swift implementation of the African Continental Free Trade Area (AfCFTA) agreement, adding, “The priority of government should be to make sure that the AfCFTA gets implemented without delay. If there was any doubt about the importance of that agreement, this pandemic has told us that this is the way to go.

Continuing, Oramah said, “The pandemic has shown so many weaknesses we have across our continent. We know that hunger is looming if we do not do anything. If we allow hunger to take over from the COVID 19 pandemic, we will begin to see political problems filling in. For Africa the problems go beyond health challenges to other areas such as food supply. Hunger is looming and if action is not taken, Africa will see political problem. Africa has become the epicenter of the economic devastation that this pandemic has unleashed upon us.”

While disclosing that Afrexim has made available $200million to supply fertilizers and grains amongst others across Africa, the Afrexim boss added that “If Africa allows hunger takeover the people, it will see an increase in insecurity, which will take a long time to overcome.”

George Chikoti of ACP, said that the huge task of economic recovery on the continent, rests on both the government and the private sector. “The responsibility of COVID-19 does not rest on the government alone, the private sector needs to play a big role in lifting the burden of the pandemic. African governments need to accept the support of the Private Sector in alleviating the impact of the COVID-19 pandemic in Africa,” he said.

“We have been able to release $25m to all member states. One of the major challenges is to make sure that in all countries, we have agricultural activity and high productivity. What we should learn from the impact of this pandemic is that the international community can look at how well they can fund all these initiatives that come from our countries, Chikoti added.

Achim Steiner of the UNDP noted that Digital connectivity is very essential as it is a crucial opportunity to connect all schools across the continent, adding that emphasis on Healthcare is also very important. “Digital connectivity is very crucial to connect schools to the internet. We need to address inequality; also, the virus has put a spotlight on Africa’s healthcare system. Africa needs to look at intermediate strategies like micro-insurance to ramp up this sector. Healthcare has the ability to make a large percentage of the occupation fall into extreme poverty.

“What we need to look at is to find a way for government as a regulator and also as an investor, to leverage private sector investment into these areas” Steiner said.

Peter Maurer, President, ICRC, said there is the need to look at pandemics as part of a broader health system which needs stabilisation; A lot of vulnerable populations in Africa have been heavily infected by the pandemic. “We must do more than life-saving. This pandemic has illustrated the weakness of health, water, sanitation and social systems, and we have to heavily invest into the stabilization of these systems.

Throwing more light on this, Maurer said, “Two things need to follow after live saving during the pandemic. First, the pandemic has illustrated the weak situation of health, water and food systems and we need to heavily invest both by the public and private sectors to stabilize the health sector. Secondly, investment has always gone into the more developed parts of Africa and not the fragile parts. We need Private Public Partnerships and investments by multi-corporate institutions to develop these areas’ he noted.

Amir Yahmed said the crisis is going to be a super accelerator of already existing trends. “We have to get away from the commodity driven model which has failed in creating prosperity. Secondly, self-reliance should be one of the major objectives. The pandemic is wake up call for Africa – Creating new streams of revenue and self-reliance by the African continent”

“We need to use this crisis to take Africa to the next level. This crisis is going to be a super accelerator of already existing trends. I think it has to be a wake-up call for us to attain goals we haven’t reached. Create new revenues for the economy. We also need to attain self-reliance. Self reliance is an important goal. Africa manufactures [only] 2% of what it produces. We need to use this crisis to take Africa to the next level. Invest in digital infrastructure, digital education, agriculture is another opportunity we need to grab. We need to get the AFCTA working,” Yamed said.

Donald Kaberuka on his part opined that “What we need (for this crisis) is something unusual, it is not business as usual. It is not marginal action, it is radical action.”

brand

JIM OVIA: FOUNDER/CHAIRMAN ZENITH BANK, REAFFIRMS STRONG COMMITMENT TO SHAREHOLDER VALUE AT THE NGX CLOSING GONG CEREMONY

L-R:GMD/CEO, Nigerian Exchange Group, Mr. Temi Popoola; Group Managing Director/CEO, Zenith Bank Plc, Dame Dr. Adaora Umeoji, OON; Chairman and Founder, Zenith Bank Plc, Jim Ovia, CFR; Group Chairman, Nigerian Exchange Group, Alhaji (Dr.) Umaru Kwairanga; Director General, Securities and Exchange Commission(SEC), Dr. Emomotimi Agama; CEO, Nigerian Exchange (NGX), Mr. Jude Chiemeka; and CEO, Central Securities Clearing System Plc, Mr. Haruna Jalo-Waziri at the Closing Gong Ceremony of the Nigerian Exchange Limited, yesterday.

Zenith Bank Plc’s Founder and Chairman, Dr. Jim Ovia, CFR, accompanied by the bank’s Group Managing Director/CEO, Dame Dr. Adaora Umeoji, OON, on Tuesday, October 14, 2025, carried out the prestigious closing gong ceremony at the Nigerian Exchange (NGX), marking a significant milestone in the bank’s continued partnership with the capital market and the official closing of the trading day. The ceremony highlights Zenith Bank’s strong relationship with the NGX and its commitment to transparency, accountability, and bolstering investor confidence. While speaking at the Nigerian Exchange, Dr. Umeoji expressed her delight in participating in the closing gong ceremony, acknowledging the NGX’s visionary leadership and innovative initiatives. “We are delighted to be here today to perform the closing gong ceremony – a symbol of shared progress and enduring partnership,” Dr. Umeoji said. “The NGX’s leadership has been very creative and innovative, and their electronic trading platform – X-stream played a pivotal role in the success of our recapitalization exercise, which achieved a 160% subscription. The bank’s stock price has doubled since the recapitalization exercise, from N36.50 per share to N68. Zenith Bank has also reported impressive financial results for the Half Year (H1) of 2025, becoming the most profitable bank in Nigeria and paying the highest dividend in the industry for the half year.””We are committed to creating value for our stakeholders and will continue to partner with the NGX to boost the Nigerian economy,” Dr. Umeoji added. “Our expansion strategy is focused on following our customers’ businesses and ensuring that we go to countries and economies where we can scale and provide more returns for our shareholders.”She stressed that the bank plans to make good on its promise of being investors’ delight by paying quantum dividends to its shareholders by year end. According to her “For us in Zenith, we are looking forward to paying more based on the confidence the market reposed on us. We are working assiduously to ensure that we do not disappoint the Market. We are going to continue to be the investors’ delight, and we assure the market that we would continue to pay enhanced dividends come end of the year.”Also commenting, the Director General of the Securities and Exchange Commission (SEC), Dr. Emomotimi Agama emphasised the role of the NGX in creating value in the Nigerian economic space. He said, “I want to thank you all for making the market what it is. Without you, the market wouldn’t have seen the leap that it has achieved in the last one-and-half year. I spoke earlier that at my assumption of office, market capitalization stood at N55 trillion, today it is hovering around 89 trillion and 93 trillion. That was not done by a spirit, it was done by you. Your ability, tenacity, courage, vision and transparency have moved the market where it is. Our vision is that by next year, we will have the market at 200trn.”

The Doyen of the NGX, Alhaji Rasheed Yusuf while giving his remarks, lauded the Founder & Chairman, Zenith Bank Plc, Jim Ovia, CFR for his vision and leadership. He ended by referring to him as the “Doyen of the Commercial banking sector”.Zenith Bank remains committed to creating long-term value for its stakeholders while driving economic development in Nigeria. As the bank continues on its growth trajectory, it has its sights set on global expansion. The bank intends to strategically leverage the capital raised from the Market to enhance its scalability and deliver enhanced services to its valued customers.The Bank’s track record of excellent performance has continued to earn the brand numerous awards, including being recognised as the Number One Bank in Nigeria by Tier-1 Capital for the sixteenth consecutive year in the 2025 Top 1000 World Banks Ranking, published by The Banker and “Nigeria’s Best Bank” at the Euromoney Awards for Excellence 2025. The Bank was also awarded Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards for 2020, 2022 and 2024; Best Bank in Nigeria from 2020 to 2022, 2024 and 2025, in the Global Finance World’s Best Banks Awards; Best Bank for Digital Solutions in Nigeria in the Euromoney Awards 2023; and was listed in the World Finance Top 100 Global Companies in 2023.Further recognitions include Best Commercial Bank, Nigeria for five consecutive years from 2021 to 2025 in the World Finance Banking Awards and Most Sustainable Bank, Nigeria in the International Banker 2023 and 2024 Banking Awards. Additionally, Zenith Bank has been acknowledged as the Best Corporate Governance Bank, Nigeria, in the World Finance Corporate Governance Awards for four consecutive years from 2022 to 2025 and ‘Best in Corporate Governance’ Financial Services’ Africa for four consecutive years from 2020 to 2023 by the Ethical Boardroom.The Bank’s commitment to excellence saw it being named the Most Valuable Banking Brand in Nigeria in The Banker’s Top 500 Banking Brands for 2020 and 2021, Bank of the Year 2023 to 2025 at the BusinessDay Banks and Other Financial Institutions (BAFI) Awards, and Retail Bank of the Year for three consecutive years from 2020 to 2022 and 2024 to 2025 at the BAFI Awards. The Bank also received the accolades of Best Commercial Bank, Nigeria and Best Innovation in Retail Banking, Nigeria, in the International Banker 2022 Banking Awards.Zenith Bank was also named Most Responsible Organisation in Africa, Best Company in Transparency and Reporting and Best Company in Gender Equality and Women Empowerment at the SERAS CSR Awards Africa 2024; Bank of the Year 2024. by New Telegraph Newspaper; and Best in MSME Trade Finance, 2023 by Nairametrics. The Bank’s Hybrid Offer was also adjudged ‘Rights Issue/ Public Offer of the Year at the Nairametrics Capital Market Choice Awards 2025.

brand

ZENITH BANK SIGNALS STRONG FULL-YEAR OUTLOOK WITH N51.3 BILLION INTERIM DIVIDEND PAYOUT

Zenith Bank Plc, on Friday, October 10, 2025, made good on its promise as it paid a total interim dividend of N51.3 billion to its shareholders for the Half Year (H1) 2025, at N1.25 per share. This significant payout represents over 60% increase from the N31.4 billion paid in H1 2024, demonstrating the bank’s commitment and enhanced capacity to continually generate value for its shareholders amidst a challenging macroeconomic environment.The dividend payment comes on the heels of the bank’s audited financial results for the half-year ended June 30, 2025, released to the Nigerian Exchange (NGX) in September 2025, which showcased a robust financial position and growth trajectory.Commenting on the dividend payout, the Group Managing Director/CEO, Dame Dr. Adaora Umeoji, OON, said, “We are pleased to have paid this significant interim dividend to our valued shareholders. Our half-year results underscore our resilience and commitment to our stakeholders. Based on the momentum achieved in H1, we are confident in our full-year outlook and expect to exceed shareholders’ expectations by year end.”The substantial dividend payout reflects exceptional underlying performance as the Bank recorded a robust 20% year-on-year increase in gross earnings, rising from N2.1 trillion to N2.5 trillion in H1 2025. Interest income drove this performance with an impressive 60% growth, climbing from N1.1 trillion to N1.8 trillion. The Bank achieved this impressive increase in interest income through strategic repricing of risk assets and effective treasury management.The Bank’s total assets also expanded to N31 trillion in June 2025, representing steady growth from N30 trillion in December 2024, underpinned by a robust and well-structured balance sheet. Customer confidence remained strong, with deposits growing by 7% from N22 trillion to N23 trillion in June 2025.Zenith Bank’s shareholders can be assured of the bank’s continued focus on delivering exceptional value and growth, driven by its strong financial fundamentals and strategic initiatives.The Bank’s track record of excellent performance has continued to earn the brand numerous awards, including being recognised as the Number One Bank in Nigeria by Tier-1 Capital for the sixteenth consecutive year in the 2025 Top 1000 World Banks Ranking, published by The Banker and “Nigeria’s Best Bank” at the Euromoney Awards for Excellence 2025. The Bank was also awarded Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards for 2020, 2022 and 2024; Best Bank in Nigeria from 2020 to 2022, 2024 and 2025, in the Global Finance World’s Best Banks Awards; Best Bank for Digital Solutions in Nigeria in the Euromoney Awards 2023; and was listed in the World Finance Top 100 Global Companies in 2023.

Further recognitions include Best Commercial Bank, Nigeria for five consecutive years from 2021 to 2025 in the World Finance Banking Awards and Most Sustainable Bank, Nigeria in the International Banker 2023 and 2024 Banking Awards. Additionally, Zenith Bank has been acknowledged as the Best Corporate Governance Bank, Nigeria, in the World Finance Corporate Governance Awards for four consecutive years from 2022 to 2025 and ‘Best in Corporate Governance’ Financial Services’ Africa for four consecutive years from 2020 to 2023 by the Ethical Boardroom.The Bank’s commitment to excellence saw it being named the Most Valuable Banking Brand in Nigeria in The Banker’s Top 500 Banking Brands for 2020 and 2021, Bank of the Year 2023 to 2025 at the BusinessDay Banks and Other Financial Institutions (BAFI) Awards, and Retail Bank of the Year for three consecutive years from 2020 to 2022 and 2024 to 2025 at the BAFI Awards. The Bank also received the accolades of Best Commercial Bank, Nigeria and Best Innovation in Retail Banking, Nigeria, in the International Banker 2022 Banking Awards.Zenith Bank was also named Most Responsible Organisation in Africa, Best Company in Transparency and Reporting and Best Company in Gender Equality and Women Empowerment at the SERAS CSR Awards Africa 2024; Bank of the Year 2024 by ThisDay Newspaper; Bank of the Year 2024 by New Telegraph Newspaper; and Best in MSME Trade Finance, 2023 by Nairametrics. The Bank’s Hybrid Offer was also adjudged ‘Rights Issue/ Public Offer of the Year’ at the Nairametrics Capital Market Choice Awards 2025

brand

Fidelity Bank Commences Disbursement of FGN MSME Intervention Funds

……Reaffirms Support for Women Entrepreneurs

……Reaffirms Support for Women Entrepreneurs

Tier One Lender, Fidelity Bank Plc, has commenced the disbursement of the Federal Government of Nigeria’s (FGN) MSME Intervention Funds, administered by the Bank of Industry (BOI), to qualified SMES with a strategic focus on empowering women-owned businesses across the country.

The FGN MSME Intervention Fund is designed to provide accessible financing to micro, small, and medium enterprises (MSMEs) across all 36 states of the federation.

The intervention aligns with Fidelity Bank’s commitment to inclusive economic growth and its long-standing support for Nigeria’s SME sector. In this phase of the disbursement, the bank is prioritizing women entrepreneurs, reinforcing its belief in the catalytic role of women-led enterprises in driving sustainable development and job creation.

Speaking on the development, Osita Ede, Divisional Head, Product Development at Fidelity Bank Plc, said, “As a bank deeply committed to the growth of SMEs, we are proud to partner with the Federal Government and the Bank of Industry on this critical intervention. For this phase, we are placing women at the forefront because we recognize their resilience, innovation, and pivotal contributions to wealth creation and employment generation in Nigeria.”

Fidelity Bank has also put in place a robust structure to ensure seamless onboarding and fund disbursement. Leveraging its nationwide branch network, digital banking platforms, and experienced relationship managers, the bank is poised to reach and support entrepreneurs across urban and rural communities.

The bank’s emergence as a critical player in the disbursement of the FGN MSME intervention Fund strongly aligns with its ongoing initiatives as the leading supporter of SMEs in Nigeria. Recently, the Fidelity SME Empowerment Programme (FSEP) was launched at its Gbagada SME Hub in Lagos.

This flagship initiative provided 100 growth-ready SMEs with ERPRev-enabled POS systems, business software, receipt printers, barcode scanners, inventory support, bookkeeping and branding training, three-day masterclasses, and six months of post-installation monitoring—all at no cost.

Earlier in May 2025, Fidelity Bank also signed an MoU with SMEDAN, Nigeria’s Small and Medium Enterprises Development Agency, to deliver SME-friendly low-interest financing, capacity-building support, and market access for SMEs referred under the agreement.

“Our vision goes beyond financing. We are building an ecosystem of support for SMEs by offering capacity-building programs, mentorship opportunities, and market access. Women entrepreneurs, in particular, will benefit from a larger share of the fund as part of our broader strategy to promote gender inclusion,”Ede added.

The FGN MSME Intervention Fund will further advance the bank’s commitment to empowering small and medium-sized enterprises by expanding access to affordable financing and strategic support. Through this fund, Fidelity Bank aims to deepen its impact on Nigeria’s MSME ecosystem, fostering sustainable growth, job creation, and economic resilience across the country.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 9.1 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is the recipient of multiple local and international Awards, including the 2024 Excellence in Digital Transformation & MSME Banking Award by BusinessDay Banks and Financial Institutions (BAFI) Awards; the 2024 Most Innovative Mobile Banking Application award for its Fidelity Mobile App by Global Business Outlook, and the 2024 Most Innovative Investment Banking Service Provider award by Global Brands Magazine.

Additionally, the Bank was recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence and as the Export Financing Bank of the Year by the BusinessDay Banks and Financial Institutions (BAFI) Awards.

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle5 years ago

lifestyle5 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health5 years ago

health5 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health5 years ago

health5 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment9 months ago

entertainment9 months agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news5 months ago

news5 months agoBREAKING: Tinubu swears in new NNPCL Board