brand

GTBank advises customers as it resumes operations

We hope that you and your loved ones are taking all the necessary precautions to stay safe and well during this Coronavirus (COVID-19) pandemic. We would also like to thank you very much for your understanding and patience during the period of skeletal banking operations.

For us, the COVID-19 Pandemic is first and foremost a humanitarian challenge, so our primary focus is to safeguard lives. As we go into the phased easing of lockdown protocols, we need to work with you to make our return to work safe.

One of the major places we have to work together to keep everyone safe is in our branches, some of which will reopen from May 4, 2020. We have put together some key areas of collaboration which, with your active participation, will enable us to greatly mitigate a potential spread of the Coronavirus.

Please see below the key areas of collaboration:

1. Personal Protection

The most effective way to curb the spread of the Coronavirus is by protecting ourselves at all times. That is why it is absolutely imperative that we work together to ensure adequate personal protection when our banking halls reopen. On our part, we will provide hand sanitizers, carry out individual temperature checks and ensure that there is adequate spacing between people. On your part, kindly ensure that you have your face mask on and also make use of the hand sanitisers at the entrance of all our branches.

2. Physical Distancing

Physically keeping away from others, for now, goes a long away in neutralising the ability of the Coronavirus to spread. Hence, we also have to work together in this area to ensure that we reduce physical contact to the barest minimum when you visit our branches. On our part, we are taking steps to ensure transactions at the banking halls are conducted at a safe distance from one another. On your part, we would strongly encourage you to cooperate with our Security Personnel at our branches in maintaining order at our branches.

3. Cash Handling

Studies suggest that the Coronavirus can survive on surfaces and physical materials, such as paper for several hours. Hence it is very important that we work together to prevent the spread of the virus through cash. On our part, we will pay extra diligence to cash handling and would only give out cash that has been adequately processed. On your part, please bear with us as cash deposits over a certain amount in the banking halls will take 48 hours, in order to allow our staff to take all necessary precautions in the processing of the cash. You can also take advantage of our cash deposit ATMs, which will continue to allow you to complete your deposits instantly.

4. Alternating Branch Opening:

As we recover from this pandemic, it is critical to have a Plan B, in the event that something goes wrong. That is why we have segmented our branches into sets, so that whilst we all make use of one set of branches, we could quickly switch to another set if we have to shut down a branch due to an outbreak. We will also be keeping you informed of which set of branches will be open on a weekly basis, so please look out for our communication via our corporate website, email and on social media.

5. Managing Footfalls

The need for social distancing cannot be overemphasised in these times, and the authorities have strongly discouraged mass gatherings of any form. You can effectively help reduce the chances of such mass gatherings at our branches by making use of our e-channels and self-service platforms. On our part, we have made sure that our digital banking platforms are running optimally so that you can continue to access our financial services seamlessly anywhere, anytime using Internet Banking, GTWorld, the GTBank Mobile App and our 737 USSD Service.

This is an evolving situation, and as such, we will provide you with regular updates on what we are doing to keep you safe. Ultimately, our hope as your bank is to emerge from this pandemic with all our customers healthy. Working together with you, we strongly believe that we will achieve this.

brand

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing 73790#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

brand

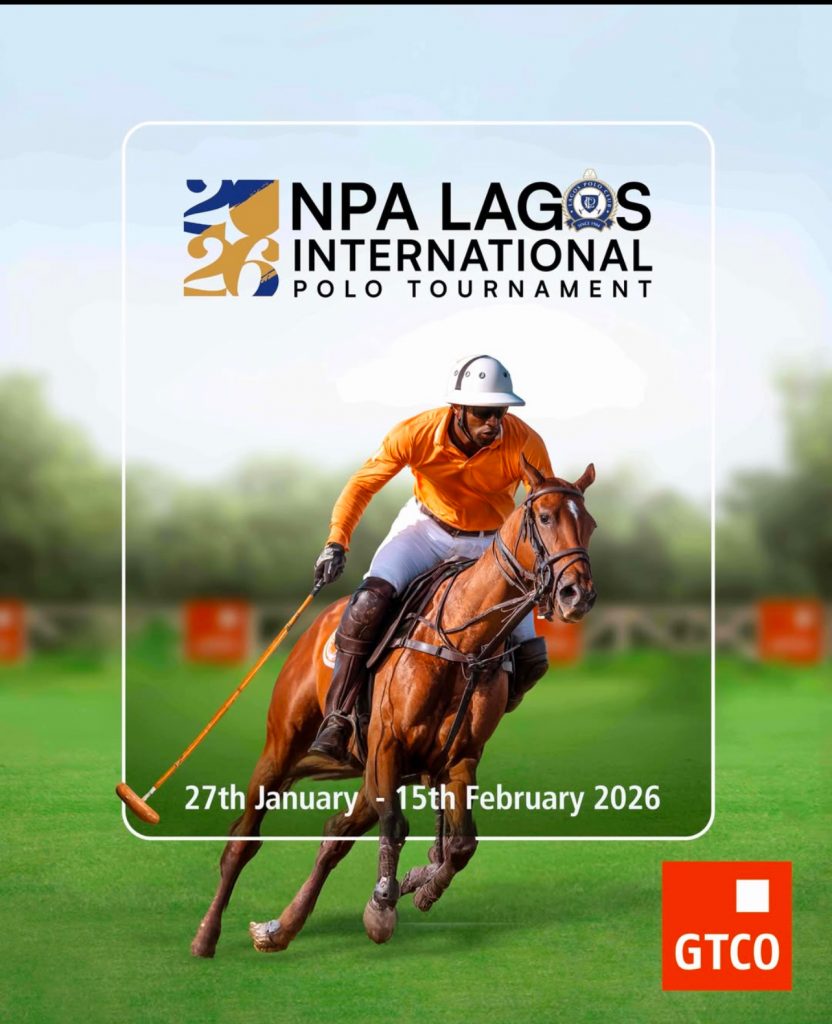

GTCO Proudly Headlines the NPA Lagos International Polo Tournament as Main Sponsor— Championing Great Experiences and Heritage

Guaranty Trust Holding Company Plc (GTCO Plc) (NGX: GTCO; LSE: GTCO), one of Africa’s leading financial services groups, is proud to announce its continued support as the main sponsor of the NPA Lagos International Polo Tournament, one of Africa’s oldest and most prestigious sporting events. The 2026 edition will be held at the Lagos Polo Club, Ikoyi, from Tuesday, January 27 to Sunday, February 15, bringing together top local and international polo teams and spectators from across the continent and beyond.

The 2026 NPA Lagos International Polo Tournament will feature top‑tier teams competing for major prizes, including the Majekodunmi Cup, Independence Cup, Open Cup, Silver Cup and Low Cup, among others. Guests can expect a fusion of thrilling equestrian action, polo-inspired lifestyle showcase, and curated hospitality experiences. The event will also be livestreamed, allowing audiences online to share in the excitement and spectacle.

Commenting on GTCO’s role as main sponsor of the Lagos International Polo Tournament, Segun Agbaje, Group Chief Executive Officer, said: “This tournament, one of the oldest in Africa, celebrates not only the noble sport of polo but the values we hold dear as a brand: teamwork, discipline, fair play, and a commitment to excellence. Beyond the field, it showcases Nigeria and Africa to a global audience, reinforcing the continent’s place on the world stage. Our longstanding sponsorship of the NPA Lagos International Polo Tournament reflects our conviction that sport can amplify opportunity, foster connections, and deliver world-class experiences for all.”

The NPA Lagos International Polo Tournament has long been celebrated not only for its thrilling competition and equestrian excellence but also for its rich heritage and cultural resonance within Africa’s sporting tradition. GTCO’s sponsorship embodies the Group’s commitment to creating platforms that unite communities and drive social impact across diverse audiences.

brand

Fidelity Bank appoints Onwughalu as Chairman following completion of Chike-Obi’s tenure

Tier one lender, Fidelity Bank Plc, has announced the completion of the tenure of Mr. Mustafa Chike-Obi as Chairman of its Board of Directors effective December 31, 2025, and the appointment of Mrs. Amaka Onwughalu as the new Chairman of the Board, effective January 1, 2026.

Tier one lender, Fidelity Bank Plc, has announced the completion of the tenure of Mr. Mustafa Chike-Obi as Chairman of its Board of Directors effective December 31, 2025, and the appointment of Mrs. Amaka Onwughalu as the new Chairman of the Board, effective January 1, 2026.

The board transitions are in alignment with the Bank’s policy and have been communicated to the Central Bank of Nigeria, the Nigerian Exchange Group, and other stakeholders.

Under Mr. Chike-Obi’s leadership, Fidelity Bank repaid its Eurobond, completed the first tranche of its public offer and rights issue that were oversubscribed by 237 percent and 137.73 percent respectively, expanded internationally to the United Kingdom, and received improved ratings from various agencies amongst a long list of achievements. His tenure also saw the Bank strengthen its capital position, record steady growth in customer deposits and total assets, deepen its digital banking capabilities, and enhance its corporate and investment banking proposition. The bank equally made notable progress in governance, risk management, and operational efficiency, all of which contributed to strengthened market confidence and the Bank’s sustained upward performance trajectory.

Reflecting on his tenure, Mr. Mustafa Chike-Obi said, “It has been a privilege to serve as Chairman of Fidelity Bank. The dedication of our Board, management, and staff has enabled us to reach significant milestones. I am confident that the Bank will continue to thrive and deliver value to all stakeholders.”

Mrs. Amaka Onwughalu’s appointment marks a new chapter for Fidelity Bank. She joined the Board in December 2020 and has chaired key committees. With over 30 years of banking experience, including executive roles at Mainstreet Bank Limited and Skye Bank Plc. She holds degrees in Economics, Corporate Governance, and Business Administration, and has attended executive programmes at global institutions. Mrs. Onwughalu is a Fellow of several professional bodies and has received awards for accountability and financial management

“I am honoured to lead the Board of Fidelity Bank at this exciting time. Our recent achievements have set a strong foundation for continued growth. I look forward to working with my colleagues to drive our strategy and deliver sustainable value,” commented Mrs. Onwughalu.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 9.1 million customers through digital banking channels, its 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

The Bank is a recipient of multiple local and international Awards, including the 2024 Excellence in Digital Transformation & MSME Banking Award by BusinessDay Banks and Financial Institutions (BAFI) Awards; the 2024 Most Innovative Mobile Banking Application award for its Fidelity Mobile App by Global Business Outlook, and the 2024 Most Innovative Investment Banking Service Provider award by Global Brands Magazine. Additionally, the Bank was recognized as the Best Bank for SMEs in Nigeria by the Euromoney Awards for Excellence and as the Export Financing Bank of the Year by the BusinessDay Banks and Financial Institutions (BAFI) Awards.

-

news5 years ago

news5 years agoUPDATE: #ENDSARS: CCTV footage of Lekki shootings intact – Says Sanwo – Olu

-

lifestyle6 years ago

lifestyle6 years agoFormer Miss World: Mixed reactions trail Agbani Darego’s looks

-

health5 years ago

health5 years agoChairman Agege LG, Ganiyu Egunjobi Receives Covid-19 Vaccines

-

lifestyle4 years ago

lifestyle4 years agoObateru: Celebrating a Quintessential PR Man at 60

-

health6 years ago

health6 years agoUPDATE : Nigeria Records 790 new cases of COVID-19

-

health6 years ago

health6 years agoBREAKING: Nigeria confirms 663 new cases of COVID-19

-

entertainment1 year ago

entertainment1 year agoAshny Set for Valentine Special and new Album ‘ Femme Fatale’

-

news9 months ago

news9 months agoBREAKING: Tinubu swears in new NNPCL Board